Cincinnati Bell 2004 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

amounts are not exchanged, the notional amounts of these agreements are not indicative of the Company’s

exposure resulting from these derivatives. The amounts to be exchanged between the parties are primarily the

net result of the fixed and floating rate percentages to be charged on the swap’s notional amount.

In June 2004, the Company entered into a series of interest rate swaps with total notional amounts of $100

million that qualify for fair value hedge accounting and expire in January 2014. The interest rate swaps are

designated as fair value hedges of a portion of the 8

3

⁄

8

% Senior subordinated notes due 2014. Fair value hedges

are hedges that eliminate the risk of changes in the fair value of underlying assets and liabilities. The interest

rate swaps are recorded at their fair value and the carrying value of the 8

3

⁄

8

% Senior subordinated notes due

2014 is adjusted by the same corresponding value in accordance with the shortcut method of Statement of

Financial Accounting Standard No. 133, “Accounting for Derivative Instruments and Hedging Activities”

(“SFAS 133”). As of December 31, 2004, the fair value of interest rate swap contracts was $3.9 million.

Pursuant to a series of transactions in late February and early March 2005, the Company executed

additional fixed-to-floating interest rate swaps with notional amounts of $350 million in order to: (a) hedge the

fair value risk associated with additional fixed coupon debt and (b) re-balance the fixed-to-floating rate mix

with regard to the Company’s capital structure. On February 16, 2005, as part of the refinancing plan, the

Company concurrently sold $250 million aggregate principal amount of new 7% Senior Notes due 2015 and

an additional $100 million aggregate principal amount of the Company’s previously issued 8

3

⁄

8

% Notes due

2014 (collectively, the “New Bonds”). The net proceeds from the offering of the New Bonds, together with

amounts under the Company’s new credit facility, were used to repay all outstanding borrowings of $438.8

million and terminate the Company’s prior credit facility. The New Bonds are fixed rate bonds to maturity and

are not callable until February 15, 2010 and January 15, 2009, respectively. The interest rate swaps essentially

change the fixed rate nature of the New Bonds to mimic the floating rates paid on the prior credit facility. The

desired effect of the interest rate swaps are to largely offset the increase in interest expense resulting from the

issuance of the new bonds in the short-term, but are subject to, and will be affected by, future changes in

interest rates.

Potential nonperformance by counterparties to the swap agreements exposes the Company to a

certain amount of credit risk due to the possibility of counterparty default. Because the Company’s only

counterparties in these transactions are financial institutions that are at least investment grade, it believes

the risk of counterparty default is minimal. The Company also seeks to minimize risk associated with

a concentration of credit risk by placing these interest rate swaps with a variety of investment grade

financial institutions.

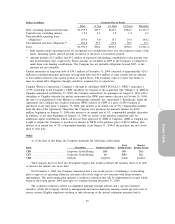

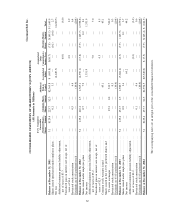

The following table sets forth the face amounts, maturity dates and average interest rates for the fixed- and

floating-rate debt held by the Company at December 31, 2004 (excluding capital leases and unamortized discount):

(dollars in millions) 2005 2006 2007 2008 2009 Thereafter Total Fair Value

Fixed-rate debt .............. $21.6 — — — $375.2 $1,323.9 $1,720.7 $1,799.8

Average interest rate on

fixed-rate debt ............ 6.3% — — — 16.0% 7.6% 9.4% —

Floating-rate debt ........... $ 4.3 $14.3 $211.2 $209.0 — — $ 438.8 $ 441.9

Average interest rate on

floating-rate debt ......... 5.1% 6.3% 5.1% 5.1% — — 5.1% —

54