Cincinnati Bell 2004 Annual Report Download - page 161

Download and view the complete annual report

Please find page 161 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

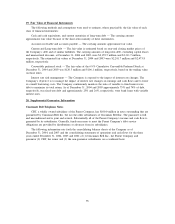

costs ranging between $250 and $5,000. On May 19, 2004, the Financial Accounting Standards Board issued

Staff Position No. 106-2, “Accounting and Disclosure Requirements Related to the Medicare Prescription

Drug, Improvement and Modernization Act of 2003” (“FSP No. 106-2”). FSP No. 106-2 clarified that the

federal subsidy provided under the Act should be accounted for as an actuarial gain in calculating the

postretirement benefit obligation and annual postretirement expense. Based on its current understanding of the

Act, the Company determined that a substantial portion of the prescription drug benefits provided under its

postretirement benefit plan would be deemed actuarially equivalent to the benefits provided under Medicare

Part D. Effective July 1, 2004, the Company prospectively adopted FSP No. 106-2 and remeasured its

postretirement benefit obligation as of that date to account for the federal subsidy, the effects of which

resulted in a $10.3 million reduction in the Company’s postretirement benefit obligation and a $1.1 million

reduction in the Company’s 2004 postretirement expense. The reduction in postretirement expense for 2004

was comprised of a $0.6 million benefit related to interest cost and a $0.5 million benefit in the amortization

of the actuarial loss. On January 21, 2005, the Department of Health and Human Services issued final federal

regulations on the determination of actuarial equivalence of the federal subsidy. The Company is currently

evaluating the effects, if any, that these final rules may have on its future benefit costs and postretirement

benefit obligation, but does not believe the effects will be material.

During 2004, special termination benefits of $10.5 million were included in the benefit obligation. These

special termination benefits related to the 2004 restructuring plan discussed in Note 5.

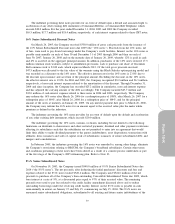

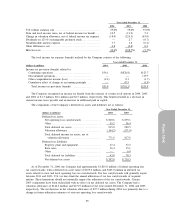

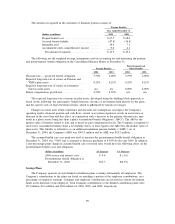

The following information relates to all Company noncontributory defined benefit pension plans,

postretirement health care, and life insurance benefit plans. Pension and postretirement benefit costs are as follows:

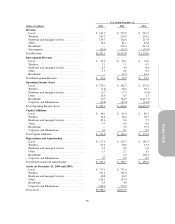

Pension Benefits

Postretirement and

Other Benefits

(dollars in millions) Year ended December 31 2004 2003 2002 2004 2003 2002

Service cost (benefits earned during the period) ..... $ 8.1 $ 9.6 $ 11.4 $ 2.1 $ 1.7 $ 1.4

Interest cost on projected benefit obligation ......... 27.3 28.8 31.2 16.2 15.7 15.2

Expected return on plan assets ...................... (41.4) (39.2) (45.7) (6.3) (6.6) (8.8)

Curtailment loss .................................... — 2.7 0.2———

Special termination benefit .......................... 10.5 — ————

Amortization of:

Transition (asset)/obligation ...................... (1.8) (2.5) (2.4) 4.2 4.2 4.2

Prior service cost ................................. 3.1 3.2 3.2 3.8 1.4 0.6

Net (gain) loss .................................... (0.9) (0.1) (5.9) 1.5 1.5 —

Actuarial (income) expense .......................... $ 4.9 $ 2.5 $ (8.0) $21.5 $17.9 $12.6

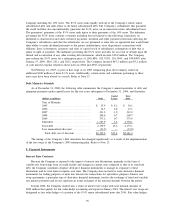

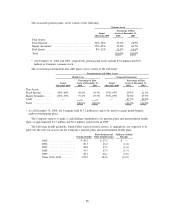

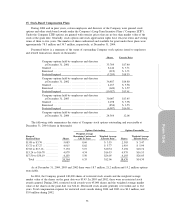

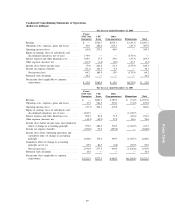

The following are the weighted average assumptions used in accounting for the pension and

postretirement benefit cost in the Statements of Operations and Comprehensive Income (Loss) for the years

ended December 31:

Pension Benefits

Postretirement and

Other Benefits

2004 2003 2002 2004 2003 2002

Discount rate — net periodic benefit expense ....... 6.00% 6.50% 7.25% 6.00% 6.50% 7.25%

Expected long-term rate of return on Pension and

VEBA plan assets ................................ 8.25% 8.25% 8.25% 8.25% 8.25% 8.25%

Expected long-term rate of return on retirement

fund account assets ............................... n/a n/a n/a 8.00% 8.00% 8.00%

Future compensation growth rate ................... 4.50% 4.50% 4.50% n/a n/a n/a

87

Form 10-K