Cincinnati Bell 2004 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.additional minutes for fixed number of minute plans being charged at a per-minute-of-use rate. Prepaid

i-wireless

SM

subscribers generated 15% of revenue and subscribers of other wireless carriers roaming on

CBW’s network generated 5% of total 2004 revenue.

Sales of handsets and accessories generated the remaining 8% of segment revenue. These sales occur

primarily at CBW’s retail locations, which consist of stores and kiosks in high-traffic shopping malls and

commercial buildings in the Greater Cincinnati and Dayton, Ohio areas. Sales also take place in the retail

stores of major electronic and other retailers pursuant to agency agreements. CBW sells handsets and

accessories from a variety of vendors, maintains a supply of equipment and does not envision any shortages

that would compromise its ability to service existing or to add new customers. Unlike service revenue (which

is a function of wireless handset usage), equipment sales are seasonal in nature, as customers often purchase

handsets and accessories as gifts during the holiday season in the Company’s fourth quarter. In order to attract

customers, CBW typically sells handsets for less than direct cost, a common practice in the wireless industry.

In response to Cingular’s acquisition of AWE (the “Merger”), which Cingular announced on February 17,

2004 and then consummated on October 26, 2004, the Company entered into an agreement (the “Agreement”)

with Cingular on August 4, 2004 and subsequently amended it on February 14, 2005. The Agreement modifies

CBW’s operating agreement between the Company and AWE, whereby the Company has agreed to waive

AWE’s prohibition against competing with CBW and Cingular has agreed to forego certain minority rights

including membership on CBW’s governing member committee. In the Agreement, both parties have agreed to

new reciprocal roaming agreements, to the disposition of certain TDMA assets which CBW and AWE had

jointly used, and put/call obligations for the sale/purchase of CBW.

The Company has a right to purchase Cingular’s 19.9% interest in CBW at a price of $85.0 million if

purchased at any time prior to January 31, 2006, plus interest at an annual rate of 5%, compounded monthly,

from the date of the Agreement. Thereafter, the Company may purchase the minority interest for $83.0

million, beginning on January 31, 2006 plus interest at an annual rate of 5%, compounded monthly, thereafter.

In addition, at any time beginning on January 31, 2006 (or earlier, if the member committee calls for

additional capital contributions not previously approved by AWE or Cingular), Cingular has a right to require

the Company to purchase its interest in CBW at the purchase price of $83.0 million, plus interest at an annual

rate of 5%, compounded monthly, from January 31, 2006.

As the wireless venture is jointly owned with Cingular, income or losses generated by the Wireless

segment are shared between the Company and Cingular in accordance with respective ownership percentages

of 80.1% and 19.9%. As a result, 19.9% of the net income or loss of the Wireless segment is reflected as

minority interest expense or income in the Company’s Consolidated Statements of Operations and

Comprehensive Income (Loss). Refer to Note 9 of the Notes to Consolidated Financial Statements for a

detailed discussion of Cingular’s minority interest in this venture.

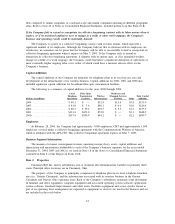

Hardware and Managed Services

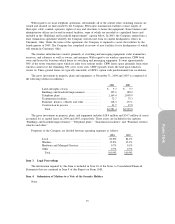

The Hardware and Managed Services segment provides data center collocation, IT consulting services,

telecommunications and computer equipment in addition to their related installation and maintenance. The

Hardware and Managed Services is comprised of the operations within Cincinnati Bell Technology Solutions

(“CBTS”). The segment produced revenue of $134.7 million, $162.8 million and $215.4 million in 2004, 2003

and 2002, respectively. The Hardware and Managed Services segment revenue constituted approximately 11%

of consolidated revenue in 2004 and 2003, and 10% of consolidated revenue in 2002. The Hardware and

Managed Services segment produced operating income of $12.7 million and $17.5 million in 2004 and 2003,

respectively, and an operating loss of $9.4 million in 2002.

In March 2004, CBTS sold certain operating assets, which were generally residing outside of the

Company’s operating area for approximately $3.2 million in cash. During the second quarter of 2004, CBTS

paid $1.3 million to the buyer of the assets in working capital adjustments related to the sale.

Other

The Other segment combines the operations of CBAD, CBCP and Public. CBAD and CBCP market and

sell voice long distance service and surveillance hardware and monitoring services to residential and business

customers in the Company’s operating area, while Public provides public payphone services in a four state area

6