Cincinnati Bell 2004 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

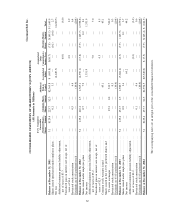

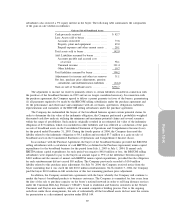

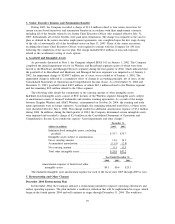

The adoption of SFAS 143 had an immaterial pro forma impact on net income for the year ended

December 31, 2002. The following table illustrates the activity for the asset retirement obligation during 2004:

(dollars in millions)

Initial

Liability Additions

Accreted

Interest Adjustments

Balance

December 31,

2003 Additions Settlements

Accreted

Interest Adjustments

Balance

December 31,

2004

Wireless ........... $1.8 $ — $0.2 $1.9 $3.9 $0.5 $ — $0.2 $0.3 $4.9

Other ............. 0.8 0.1 — — 0.9 0.1 (0.4) — — 0.6

Total ............ $2.6 $0.1 $0.2 $1.9 $4.8 $0.6 $(0.4) $0.2 $0.3 $5.5

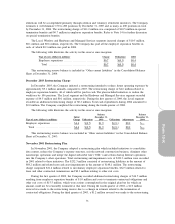

Investments — The Company invests in certain equity investments, which do not have readily

determinable fair market values. These investments are recorded at cost based on specific identification.

Investments are periodically reviewed for impairment. If the carrying value of the investment exceeds its fair

value and the decline in value is determined to be other-than-temporary, an impairment loss would be

recognized for the difference.

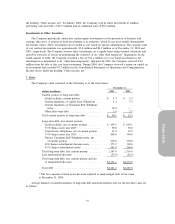

Revenue Recognition — The Company recognizes revenue as services are provided. Local access fees

are billed monthly, in advance, while revenue is recognized as the services are provided. Postpaid wireless,

long distance, switched access, reciprocal compensation and data and Internet product services are billed

monthly in arrears, while the revenue is recognized as the services are provided. The Company bills service

revenue in regular monthly cycles, which are dispersed throughout the days of the month. Because the day of

each billing cycle rarely coincides with the end of the Company’s reporting period for usage-based services

such as postpaid wireless, long distance and switched access, the Company must estimate service revenues

earned but not yet billed. The Company bases its estimates upon historical usage and adjusts these estimates

during the period in which the Company can determine actual usage, typically in the following reporting

period. These adjustments may have a material impact upon operating results of the Company during the

period of the adjustment.

CBT upfront fees for customer connection and activation are deferred and amortized into revenue on a

straight-line basis over the average customer life. The related connection and activation costs, to the extent of

the upfront fees, are deferred and amortized on a straight-line basis over the average customer life. Subsequent

to July 1, 2003 and in accordance with the Emerging Issues Task Force Issue 00-21, “Accounting for Revenue

Arrangements with Multiple Deliverables” (“EITF 00-21”), Cincinnati Bell Wireless LLC (“CBW”) ceased

deferral of revenue and cost related to customer connections and activations. As CBW does not require

customer contracts and sells its services at fair market value, the activation revenue is allocated to and

recorded upon the sale of the wireless handset. This change did not have a material impact on the Company’s

financial position, results of operations, or cash flows.

The Company recognizes equipment revenue generally upon the performance of contractual obligations,

such as shipment, delivery, installation or customer acceptance.

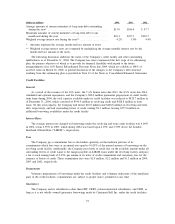

Prior to the sale of the broadband assets in the second and third quarters of 2003, broadband transport

services were billed monthly, in advance, while revenue was recognized as the services were provided. In

addition, the Company had entered into indefeasible right-of-use (“IRU”) agreements, which represent the

lease of network capacity or dark fiber, recording unearned revenue at the earlier of the acceptance of the

applicable portion of the network by the customer or the receipt of cash. The buyer of IRU services typically

paid cash or other consideration upon execution of the contract, and the associated IRU revenue was

recognized over the life of the agreement as services were provided, beginning on the date of customer

acceptance. In the event the buyer of an IRU terminated a contract prior to the contract expiration and

released the Company from the obligation to provide future services, the remaining unamortized unearned

revenue was recognized in the period in which the contract was terminated. The Company generated $59.4

million and $204.8 million in non-cash IRU revenue in 2003 and 2002, respectively. Concurrent with the

broadband asset sale, substantially all of the remaining IRU obligations were assumed by the buyer of the

broadband assets.

Pricing of local services is generally subject to oversight by both state and federal regulatory

commissions. Such regulation also covers services, competition and other public policy issues. Various

66