Cincinnati Bell 2004 Annual Report Download - page 162

Download and view the complete annual report

Please find page 162 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200

|

|

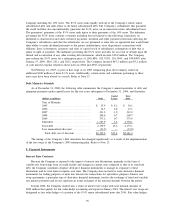

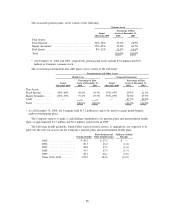

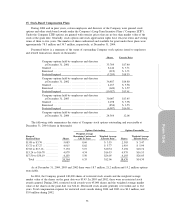

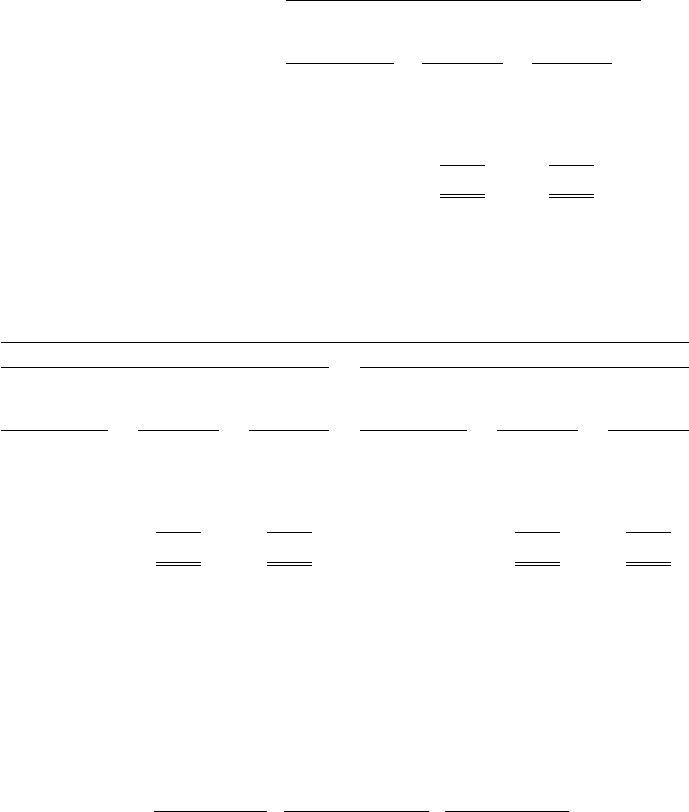

The associated pension plans’ assets consist of the following:

Pension Assets

Percentage of Plan

Assets at December 31,

Target

Allocation 2005 2004 2003

Plan Assets:

Fixed Income ....................................... 20%–38% 28.6% 28.9%

Equity Securities* .................................. 55%–65% 59.9% 60.5%

Real Estate .......................................... 8%–12% 11.5% 10.6%

Total ................................................ 100.0% 100.0%

* At December 31, 2004 and 2003, respectively, pension plan assets include $5.8 million and $7.0

million in Company common stock.

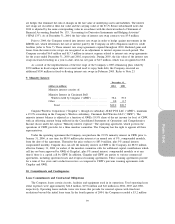

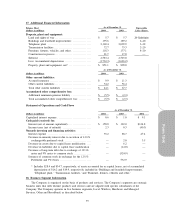

The associated postretirement and other plans’ assets consist of the following:

Postretirement and Other Assets

Health Care Group Life Insurance

Percentage of Plan

Assets at December 31,

Percentage of Plan

Assets at December 31,

Target

Allocation 2005 2004 2003

Target

Allocation 2004 2004 2003

Plan Assets:

Fixed Income ......... 30%–40% 42.8% 36.3% 35%–45% 20.3% 21.1%

Equity Securities ...... 60%–70% 57.2% 63.7% 55%–65% 32.0% 29.7%

Cash* ................. — — — — 47.7% 49.2%

Total .................. 100.0% 100.0% 100.0% 100.0%

* As of December 31, 2004, the Company held $13.2 million in cash to be used for group health benefits

under postretirement plans.

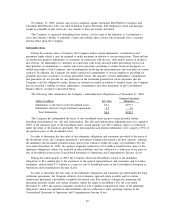

The Company expects to make a cash funding contribution to its pension plans and postretirement health

plans of approximately $2.5 million and $9.2 million, respectively in 2005.

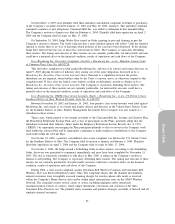

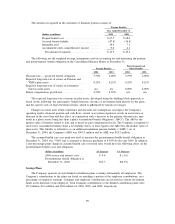

The following benefit payments, which reflect expected future service, as appropriate, are expected to be

paid over the next ten years from the Company’s pension plans and postretirement health plans:

Pension Benefits

Postretirement and

Other Benefits Gross

Medicare Subsidy

Receipts

2005 ........................ $ 49.2 $ 25.2 $ —

2006 ........................ 60.3 26.2 (1.4)

2007 ........................ 40.0 27.1 (1.6)

2008 ........................ 39.7 27.7 (1.7)

2009 ........................ 40.1 28.1 (1.8)

Years 2010–2014 ............ 199.2 144.6 (12.0)

88