Cincinnati Bell 2004 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

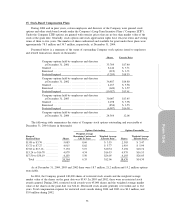

15. Stock-Based Compensation Plans

During 2004 and in prior years, certain employees and directors of the Company were granted stock

options and other stock-based awards under the Company’s Long-Term Incentive Plans (“Company LTIP”).

Under the Company LTIP, options are granted with exercise prices that are no less than market value of the

stock at the grant date. Generally, stock options and stock appreciation rights have ten-year terms and vesting

terms of three to five years. The number of shares authorized and available for grant under these plans were

approximately 78.3 million and 34.7 million, respectively, at December 31, 2004.

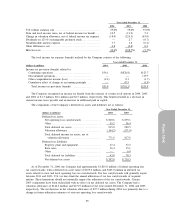

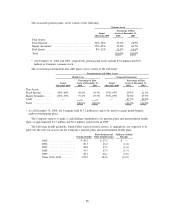

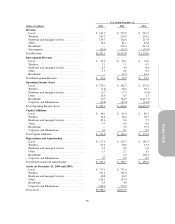

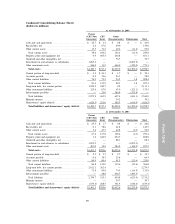

Presented below is a summary of the status of outstanding Company stock options issued to employees

and related transactions (shares in thousands):

Shares Exercise Price

Company options held by employees and directors

at December 31, 2001 ............................ 33,769 $17.40

Granted ............................................. 8,142 $ 3.71

Exercised ........................................... (219) $ 3.71

Forfeited/expired .................................... (5,205) $18.55

Company options held by employees and directors

at December 31, 2002 ............................ 36,487 $14.80

Granted ............................................. 4,167 $ 5.58

Exercised ........................................... (620) $ 3.57

Forfeited/expired .................................... (10,027) $15.61

Company options held by employees and directors

at December 31, 2003 ............................ 30,007 $13.45

Granted ............................................. 2,198 $ 3.98

Exercised ........................................... (854) $ 3.55

Forfeited/expired .................................... (6,987) $16.58

Company options held by employees and directors

at December 31, 2004 ............................ 24,364 12.06

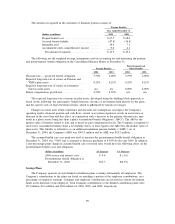

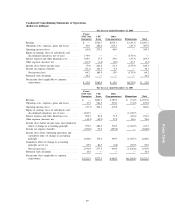

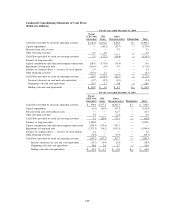

The following table summarizes the status of Company stock options outstanding and exercisable at

December 31, 2004 (shares in thousands):

Options Outstanding Options Exercisable

Range of

Exercise Prices Shares

Weighted Average

Remaining Contractual

Life in Years

Weighted Average

Exercise Price Shares

Weighted Average

Exercise Price

$1.88 to $3.70 .............. 5,083 8.60 $ 3.55 2,385 $ 3.47

$3.72 to $7.27 .............. 4,915 8.02 $ 5.77 1,919 $ 5.99

$7.68 to $13.16 ............. 5,194 5.19 $10.74 5,194 $10.74

$13.24 to $16.78 ............ 4,979 4.34 $16.53 4,979 $16.53

$17.50 to $38.19 ............ 4,193 5.50 $26.05 4,193 $26.05

Total ..................... 24,364 6.35 $12.06 18,670 $14.30

As of December 31, 2004, 2003 and 2002 there were 18.7 million, 21.2 million and 19.2 million options

exercisable.

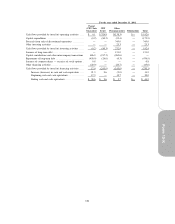

In 2004, the Company granted 140,000 shares of restricted stock awards and the weighted average

market value of the shares on the grant date was $5.43. In 2003 and 2002, there were no restricted stock

awards granted. During 2001, restricted stock awards were 65,000 shares and the weighted average market

value of the shares on the grant date was $24.41. Restricted stock awards generally vest within one to five

years. Total compensation expense for restricted stock awards during 2004 and 2003 was $0.3 million, and

$3.8 million during 2002.

91

Form 10-K