Cincinnati Bell 2004 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

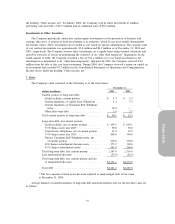

Security

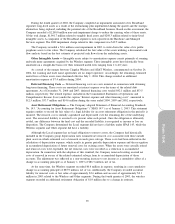

The Company’s obligations under the new credit facilities are collateralized by perfected first priority

pledges and security interests in the following:

(1) substantially all of the equity interests of the Company’s subsidiaries (other than CBT, CBET, certain

immaterial subsidiaries, and CBW, so long as it is not wholly owned) and

(2) certain personal property and intellectual property of the Company and its subsidiaries (other than

CBT, CBET, certain immaterial subsidiaries, and CBW, so long as it is not wholly owned). As of

December 31, 2004 and 2003 the carrying value of these pledged assets, excluding investment and

advances in subsidiaries, amounted to $1,891.1 million and $1,372.3 million, respectively. The value

of the assets pledged substantially relates to deferred tax assets and intercompany accounts

receivable.

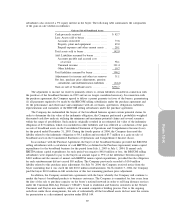

Covenants

The Company is subject to financial covenants in association with the credit facilities. These financial

covenants require the Company to maintain certain debt to EBITDA (as defined in the credit facility

agreement), senior secured debt to EBITDA, interest coverage ratios and fixed charge ratio. The facilities also

contain certain covenants which, among other things, may restrict the Company’s ability to incur additional

debt or liens, pay dividends, repurchase Company common stock, sell, transfer, lease, or dispose of assets and

make investments or merge with another company. If the Company were to violate any of its covenants and

was unable to obtain a waiver, it would be considered a default and no additional borrowings under the credit

facilities would be available until the default was waived or cured. The Company was in compliance with all

covenants set forth in its credit facilities and the indentures governing its other debt as of December 31, 2004.

Events of Default

The credit facilities provide for events of default customary to facilities of this type, including non-

payment of principal, interest or other amounts; incorrectness of representations and warranties in any material

respect; violation of covenants; cross-default and cross-acceleration; certain events of bankruptcy or

insolvency; certain material judgments; invalidity of any loan or security document; change of control and

certain ERISA events.

7

1

⁄

4

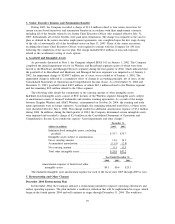

% Senior Notes Due 2023

In July 1993, the Company issued $50.0 million of 7

1

⁄

4

% Senior notes due 2023 (the “7

1

⁄

4

% Senior notes

due 2023”). The indenture related to these 7

1

⁄

4

% Senior notes due 2023 does not subject the Company to

restrictive financial covenants. However, the indenture governing the 7

1

⁄

4

% Senior notes due 2023 contains a

covenant that provides that if the Company incurs certain liens on its property or assets, the Company must

secure the outstanding notes equally and ratably with the indebtedness or obligations secured by such liens. The

7

1

⁄

4

% Senior notes due 2023 are collateralized with assets of the Company (but not its subsidiaries) by virtue of

the lien granted under the Company’s credit facilities. As of December 31, 2004, $50.0 million in aggregate

principal amount of the 7

1

⁄

4

% Senior notes due 2023 remains outstanding. Interest on the 7

1

⁄

4

% Senior notes due

2023 is payable semi-annually on June 15 and December 15. The 7

1

⁄

4

% Senior notes due 2023 may not be

redeemed by the Company prior to maturity. The indenture governing 7

1

⁄

4

% Senior notes due 2023 provides for

an event of default upon the default and acceleration of any other existing debt instrument indebtedness which

exceeds $20.0 million. For each of the years ended December 31, 2004, 2003 and 2002 the Company recorded

$3.6 million of cash interest expense related to the 7

1

⁄

4

% Senior notes due 2023.

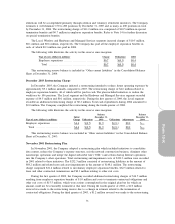

Capital Lease Obligations

The Company leases facilities and equipment used in its operations, some of which are required to be

capitalized in accordance with Statement of Financial Accounting Standards No. 13, “Accounting for Leases”

(“SFAS 13”). SFAS 13 requires the capitalization of leases meeting certain criteria, with the related asset being

75

Form 10-K