Cincinnati Bell 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(g) Mr. Callaghan’s bonus amount consisted of an annual bonus in the amount of $119,306 and a “success

bonus” in the amount of $181,250, which was paid in connection with the sale by the Company of the

broadband business of BCSI Inc. (f/k/a Broadwing Communications Services Inc.).

(h) Mr. Wilson’s base salary reflected a blend of his starting annual salary rate of $140,000 and, following

his appointment as Vice President and General Counsel, an ending annual salary rate of $225,000.

(i) Mr. Keating’s base salary reflected a blend of his starting annual salary rate of $154,020 and, following

his appointment as Vice President Human Resources and Administration of Cincinnati Bell Inc., an

ending annual salary rate of $205,000.

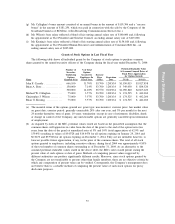

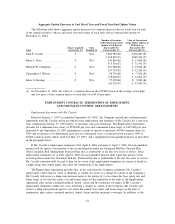

Grants of Stock Options in Last Fiscal Year

The following table shows all individual grants by the Company of stock options to purchase common

shares granted to the named executive officers of the Company during the fiscal year ended December 31, 2004:

Potential Realizable Value

At Assumed Annual Rates of

Stock Price Appreciation

for Option Term(b)

Name

Number of

Securities

Underlying

Options

Granted (#)(a)

% of Total

Options

Granted to

Employees In

Fiscal Year

Exercise

Price

($/Sh)

Expiration

Date 5%($) 10%($)

John F. Cassidy ................ 666,100 31.70% $3.700 12/03/14 $1,550,015 $3,927,858

Brian A. Ross .................. 150,000 7.14% $3.700 12/03/14 $ 349,050 $ 884,520

300,000 14.28% $5.570 01/29/14 $1,050,840 $2,663,220

Michael W. Callaghan ......... 75,000 3.57% $3.700 12/03/14 $ 174,525 $ 442,260

Christopher J. Wilson .......... 75,000 3.57% $3.700 12/03/14 $ 174,525 $ 442,260

Brian G. Keating .............. 75,000 3.57% $3.700 12/03/14 $ 174,525 $ 442,260

(a) The material terms of the options granted are: grant type: non-incentive; exercise price: fair market value

on grant date; exercise period: generally exercisable 28% after one year, and 3% per month for the next

24 months thereafter; term of grant: 10 years; termination: except in case of retirement, disability, death

or change in control of the Company, any unexercisable options are generally cancelled upon termination

of employment.

(b) As required by rules of the SEC, potential values stated are based on the prescribed assumption that the

common shares will appreciate in value from the date of the grant to the end of the option term (ten

years from the date of the grant) at annualized rates of 5% and 10% (total appreciation of 62.9% and

159.4%) resulting in values of $9.0728 and $14.4474 for all options expiring on January 29, 2014 and

$6.0270 and $9.5968 for all options expiring on December 3, 2014. They are not intended, however, to

forecast possible future appreciation, if any, in the price of the common shares. The total of all stock

options granted to employees, including executive officers, during fiscal 2004 was approximately 0.85%

of the total number of common shares outstanding as of December 31, 2004. As an alternative to the

assumed potential realizable values stated in the above table, the SEC’s rules would permit stating the

present value of such options at date of grant. Methods of computing present values suggested by

different authorities can produce significantly different results. Moreover, since stock options granted by

the Company are not transferable to persons other than family members, there are no objective criteria by

which any computation of present value can be verified. Consequently, the Company’s management does

not believe there is a reliable method of computing the present value of such stock options for proxy

disclosure purposes.

33

Proxy Statement