Cincinnati Bell 2004 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

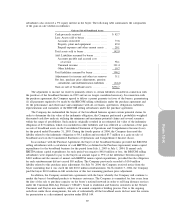

3. Senior Executive Bonuses and Termination Benefits

During 2003, the Company recorded a charge of $11.2 million related to four senior executives for

certain success-based incentives and termination benefits in accordance with their employment contracts,

including all of the benefits related to its former Chief Executive Officer who resigned effective July 31,

2003. Substantially all of these benefits were paid upon termination. The charge was required as the success

plan, as defined in the senior executive employment agreements, was completed upon the first stage closing

of the sale of substantially all of the broadband assets on June 13, 2003. Three of the senior executives,

excluding the former Chief Executive Officer, were required to remain with the Company for 180 days

following the completion of the success plan. The charge included $0.8 million of non-cash expenses

related to the accelerated vesting of stock options.

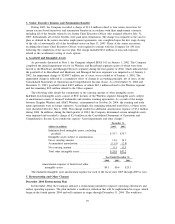

4. Goodwill and Intangible Assets

As previously discussed in Note 1, the Company adopted SFAS 142 on January 1, 2002. The Company

completed the initial impairment test for its Wireless and Broadband segments (parts of which were later

moved to the Hardware and Managed Services segment) during the first quarter of 2002, which indicated that

the goodwill of its Broadband and Hardware and Managed Services segments was impaired as of January 1,

2002. An impairment charge of $2,008.7 million, net of taxes, was recorded as of January 1, 2002. The

impairment charge is reflected as a cumulative effect of change in accounting principle, net of taxes, in the

Consolidated Statements of Operations and Comprehensive Income (Loss). As of December 31, 2004 and

December 31, 2003, goodwill totaled $40.9 million, of which $40.1 million related to the Wireless segment

and the remaining $0.8 million related to the Other segment.

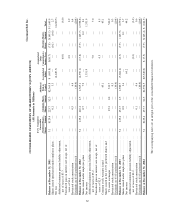

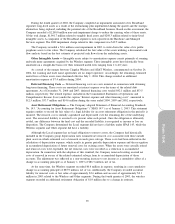

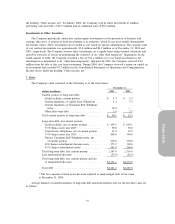

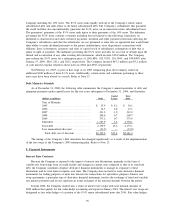

The following table details the components of the carrying amount of other intangible assets.

Indefinite-lived intangible assets consist of FCC licenses of the Wireless segment. Intangible assets subject

to amortization consist of licensed trademarks and wireless roaming agreements. As a result of the merger

between Cingular Wireless and AT&T Wireless, consummated on October 26, 2004, the roaming and trade

name agreements were no longer operative. Accordingly, the remaining estimated useful lives of these assets

were shortened effective July 1, 2004. This change resulted in additional amortization expense of $7.4 million

during 2004. In addition, during the third quarter of 2004, the Company determined certain intangible assets

were impaired and recorded a charge of $2.4 million in the Consolidated Statements of Operations and

Comprehensive Income (Loss) under the caption “Asset impairments and other charges”:

December 31,

(dollars in millions) 2004 2003

Indefinite-lived intangible assets, excluding

goodwill .......................................... $ 35.7 $35.7

Intangible assets subject to amortization:

Gross carrying amount .............................. 11.6 14.3

Accumulated amortization .......................... (11.5) (2.8)

Net carrying amount ................................ 0.1 11.5

Total other intangible assets ......................... $ 35.8 $47.2

Year Ended December 31,

2004 2003 2002

Amortization expense of finite-lived other

intangible assets .................................. $9.1 $0.6 $25.3

The estimated intangible asset amortization expense for each of the fiscal years 2005 through 2009 is zero.

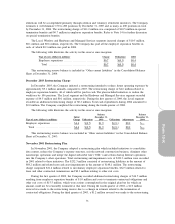

5. Restructuring and Other Charges

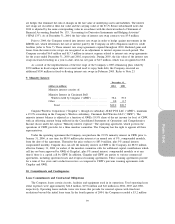

December 2004 Restructuring Plan

In December 2004, the Company initiated a restructuring intended to improve operating efficiencies and

reduce operating expenses. The plan includes a workforce reduction that will be implemented in stages, which

began in the fourth quarter 2004 and will continue in stages through December 31, 2006. The workforce

70