Cincinnati Bell 2004 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

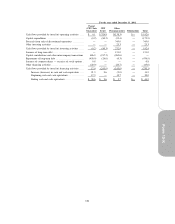

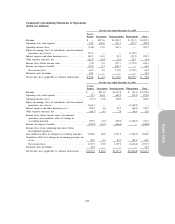

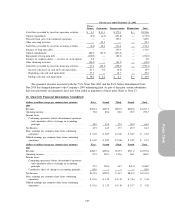

2004 Unusual Items

In the fourth quarter of 2004, the Company recorded a restructuring charge of $11.4 million intended to

improve operating efficiencies and reduce operating expenses. The net effect of the charge related to the

restructuring charge decreased diluted earnings per share by $0.03 in the fourth quarter.

In the first, second and third quarters of 2004, the Company recorded additional quarterly depreciation

expense of $5.2 million, and recorded $5.0 million in the fourth quarter of 2004 related to the shortening of

the economic useful life of its TDMA network assets to the final in-service date of December 31, 2006. The

net effect of the depreciation expense decreased diluted earnings per share by $0.01 in the first and second

quarters and $0.02 in the third quarter and fourth quarters.

In the third and fourth quarter of 2004, the Company recorded additional amortization expense of $5.6

million and $1.8 million, respectively, related to the roaming and trade name agreements which were no

longer operative as a result of the merger between Cingular Wireless and AT&T Wireless. The net effect of

the amortization expense decreased diluted earnings per share by $0.01 in the third quarter and had an

immaterial impact in the fourth quarter.

In the first, third and fourth quarter of 2004, the Company retired certain assets and recorded asset

impairment charges of $2.4 million, $1.7 million and $1.8 million, respectively. The net effect of the charge

related to the asset impairments decreased diluted earnings per share by $0.01 in the first quarter and had an

immaterial impact in the third and fourth quarter.

In the fourth quarter of 2004, the Company recorded a $3.2 million adjustment related to prior periods to

account for certain rent escalations associated with its tower site leases on a straight-line basis. These rent

escalations are associated with lease renewal options that were deemed to be reasonably assured of renewal,

thereby extending the initial term of the leases. The net effect of the adjustment decreased diluted earnings per

share by $0.01 in the fourth quarter. The adjustment was not considered material to the current year or to any

prior years’ earnings, earnings trends or individual financial statement line items.

In the fourth quarter of 2004, the Company recorded a non-cash income tax benefit of $12.6 million

resulting from a change in estimated future tax benefits. The net effect of the income related to the income tax

benefit increased diluted earnings per share by $0.05 in the fourth quarter.

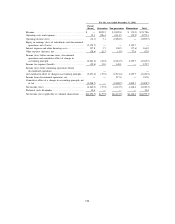

2003 Unusual Items

In the first quarter of 2003, the Company recorded a non-recurring increase to net income of $85.9

million, net of tax, associated with the adoption of SFAS 143 as a change in accounting principle (refer to

Note 1). The net effect of the income related to depreciation previously recorded increased diluted earnings

per share by $0.39 in the first quarter.

In the second, third and fourth quarter of 2003, the Company sold substantially all the assets of its

broadband business (refer to Note 2). The Company recorded a gain on sale of broadband assets of $299.0

million, $37.3 million and $0.4 million, which contributed $1.20 and $0.16 to diluted earnings per share in the

second and third quarter, respectively and had an immaterial effect on fourth quarter diluted earnings per share.

The Company reached a final settlement agreement regarding a construction contract that was in dispute in

February 2004. As part of the settlement, both parties agreed to drop their respective claims for monetary damages.

The Company recorded a $5.2 million charge in the fourth quarter of 2003 as a result of this settlement. The net

impact of this charge reduced the Company’s fourth quarter diluted earnings per share by $0.01.

In the third quarter of 2003, the Company recorded a $17.4 million non-cash charge on the exchange

of $46.0 million of 9% Senior Subordinated Notes of BRCOM for 11.1 million shares of common stock in

Cincinnati Bell Inc. The net impact of this charge reduced the Company’s diluted earnings per share by

$0.07. Additionally, the Company recorded a non-cash charge of $8.4 million to interest expense to write-off

deferred financing costs related to the Company’s credit facilities, which were reduced using the proceeds

from the issuance of the 7

1

⁄

4

% Senior Notes due 2013. The net impact of this charge reduced the Company’s

fourth quarter diluted earnings per share by $0.04.

108