Cincinnati Bell 2004 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in the midwestern and southern United States. In the fourth quarter of 2004, the Company sold its payphone

assets located at correctional institutions and those outside of the Company’s operating area for $1.4 million.

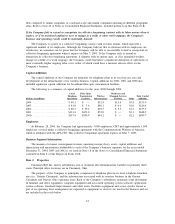

The Other segment produced revenue of $78.6 million, $81.1 million and $82.8 million in 2004, 2003

and 2002, respectively. The Other segment revenue constituted approximately 7%, 5% and 4% of consolidated

revenue in 2004, 2003 and 2002, respectively. The Other segment produced operating income of $18.0

million, $6.5 million and $1.7 million in 2004, 2003 and 2002, respectively.

Cincinnati Bell Any Distance

CBAD primarily resells long distance services to businesses and residential customers in the Greater

Cincinnati and Dayton, Ohio areas. At December 31, 2004, CBAD had approximately 562,000 subscribers

compared to 539,000 and 555,000 long distance subscribers at December 31, 2003 and 2002, respectively. With

regard to Local segment access lines for which a long distance carrier is chosen, CBAD’s market share within

the Greater Cincinnati area increased in 2004, with residential and business market share growing to

approximately 76% and 48%, respectively, from 71% and 45%, respectively, at the end of 2003. Of CBT’s

970,000 access lines, approximately 403,000 residential access lines and 118,000 business access lines

subscribed to “Any Distance” as of December 31, 2004. In 2004, CBAD produced $62.8 million in revenue for

the Other segment, representing approximately 5% of consolidated revenue, compared to $68.2 million or 4% of

consolidated revenue in 2003 and $68.8 million or 3% of consolidated revenue in 2002.

Cincinnati Bell Complete Protection Inc.

CBCP provides surveillance hardware and monitoring services to residential and business customers in

the Greater Cincinnati and Dayton, Ohio areas. At December 31, 2004, CBCP had approximately 7,000

monitoring subscribers in comparison to 6,000 and 5,000 monitoring subscribers at December 31, 2003 and

2002, respectively. In 2004, CBCP produced $3.9 million in revenue for the Other segment. As of the end of

2004, CBCP has decided to focus its operations on providing monitoring services in which it can leverage

operating synergies with the Company’s local operation. CBCP will discontinue sales of surveillance

equipment to business customers which do not also have an on-going monitoring service relationship. These

sales comprise approximately $2 million of CBCP’s 2004 revenue; however, these sales only contributed

modestly to the Other segment’s profitability.

Cincinnati Bell Public Communications Inc.

Public has provided public payphone services to customers in a seven state regional area. Subsequent to

the fourth quarter of 2004, when the Company sold substantially all its out-of-territory assets, services are

now provided in a four state regional area. Public had approximately 4,600, 8,100 and 7,700 stations in

service as of December 2004, 2003 and 2002, respectively, and generated approximately $10.6 million, $12.8

million and $13.7 million in revenue in 2004, 2003 and 2002, respectively, or less than 1% of consolidated

revenue in each year. The revenue decrease is a result of reduced calls per line caused by continued

penetration of wireless communications and a targeted reduction in unprofitable lines. The out-of-territory

assets sold contributed approximately $2.6 million to the Other segment’s total revenue with only marginal

contribution to the segment’s operating income.

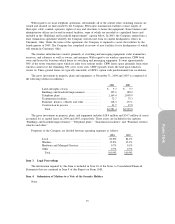

Broadband

The Broadband segment no longer has any substantive, on-going operations. As discussed above, on

February 22, 2003, certain of the Company’s subsidiaries entered into a definitive agreement to sell

substantially all of the operating assets of the Broadband segment for up to $129 million in cash and the

assumption of certain long-term operating contractual commitments. On June 6, 2003 and June 13, 2003, this

agreement was amended to, among other things, reduce the initial purchase price to $108.7 million (an

estimated $91.5 million in cash and a $17.2 million preliminary working capital promissory note, which was

ultimately reduced to zero based on the final working capital position of the broadband business). The buyer

paid the initial cash purchase price of $91.5 million, of which $29.3 million was placed into escrow to support

7

Form 10-K