Cincinnati Bell 2004 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

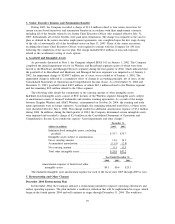

During the fourth quarter of 2002, the Company completed an impairment assessment of its Broadband

segment’s long-lived assets as a result of the restructuring plan implemented during the quarter and the strategic

alternatives being explored, including the potential sale of the Broadband business. Based on this assessment, the

Company recorded a $2,200.0 million non-cash impairment charge to reduce the carrying value of these assets.

Of the total charge, $1,901.7 million related to tangible fixed assets and $298.3 million related to finite-lived

intangible assets. A component of the Broadband segment is now reported in the Hardware and Managed

Services segment. The 2002 impairment charge related to this component was $19.5 million.

The Company recorded a $3.6 million asset impairment in 2003 to write-down the value of its public

payphone assets to fair value. The Company calculated the fair value of the assets utilizing a discounted cash

flow analysis based on the best estimate of projected cash flows from the underlying assets.

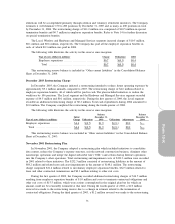

Other Intangible Assets — Intangible assets subject to amortization expense consist primarily of roaming

and trade name agreements acquired by the Wireless segment. These intangible assets have historically been

amortized on a straight-line basis over their estimated useful lives ranging from 2 to 40 years.

As a result of the merger between Cingular Wireless and AT&T Wireless, consummated on October 26,

2004, the roaming and trade name agreements are no longer operative. Accordingly, the remaining estimated

useful lives of these assets were shortened effective July 1, 2004. This change resulted in additional

amortization expense of $7.4 million during 2004.

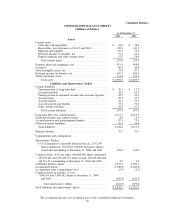

Deferred Financing Costs — Deferred financing costs are costs incurred in connection with obtaining

long-term financing. These costs are amortized as interest expense over the terms of the related debt

agreements. As of December 31, 2004 and 2003, deferred financing costs totaled $42.1 million and $53.5

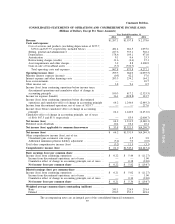

million, respectively. The related expense, included in the Consolidated Statements of Operations and

Comprehensive Income (Loss) under the caption “Interest expense and other financing costs”, amounted to

$12.5 million, $33.7 million and $14.6 million during the years ended 2004, 2003 and 2002, respectively.

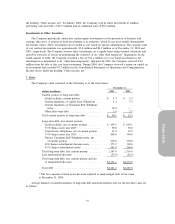

Asset Retirement Obligations — The Company adopted Statement of Financial Accounting Standards

No. 143, “Accounting for Asset Retirement Obligations” (“SFAS 143”) as of January 1, 2003. This statement

requires entities to record the fair value of a legal liability for an asset retirement obligation in the period it is

incurred. The removal cost is initially capitalized and depreciated over the remaining life of the underlying

asset. The associated liability is accreted to its present value each period. Once the obligation is ultimately

settled, any difference between the final cost and the recorded liability is recognized as income or loss on

disposition. The Company determined the Local segment did not have a liability under SFAS 143, while the

Wireless segment and Other segment did have a liability.

Although the Local segment has no legal obligation to remove assets, the Company had historically

included in the Company group depreciation rates estimated net removal cost associated with these outside

plant assets in which estimated cost of removal exceeds gross salvage. These costs had been reflected in the

calculation of depreciation expense, which results in greater periodic depreciation expense and the recognition

in accumulated depreciation of future removal costs for existing assets. When the assets were actually retired

and removal costs were expended, the net removal costs were recorded as a reduction to accumulated

depreciation. In connection with the adoption of this standard, the Company removed existing accrued net

costs of removal in excess of the related estimated salvage from its accumulated depreciation of those

accounts. The adjustment was reflected as a non-recurring increase to net income as a cumulative effect of a

change in accounting principle as of January 1, 2003 of $86.3 million, net of tax.

At the same time, the Wireless segment recorded $0.4 million in expense, resulting in a net cumulative

change in accounting principle of $85.9 million, net of tax. Additionally, the Company recorded an initial

liability for removal costs at fair value of approximately $2.6 million and an asset of approximately $2.3

million in 2003 related to the Wireless and Other segments. During the fourth quarter of 2003, the wireless

segment recorded an additional retirement obligation of $1.9 million due to a change in estimate.

65

Form 10-K