Cincinnati Bell 2004 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

are hedges that eliminate the risk of changes in the fair value of underlying assets and liabilities. The interest

rate swaps are recorded at their fair value and the carrying value of the 8

3

⁄

8

% Senior subordinated notes due

2014 is adjusted by the same corresponding value in accordance with the shortcut method of Statement of

Financial Accounting Standard No. 133, “Accounting for Derivative Instruments and Hedging Activities”

(“SFAS 133”). As of December 31, 2004, the fair value of interest rate swap contracts was $3.9 million.

Prior to 2004, the Company entered into interest rate swaps in order to hedge against movements in the

LIBOR rate, which determines the rate of interest paid by the Company on debt obligations under its credit

facilities (refer to Note 7). These interest rate swap agreements expired throughout 2003. Realized gains and

losses from the interest rate swaps are recognized as an adjustment to interest expense in each period. The

Company recorded $6.8 million and $13.3 million in interest expense related to interest rate swap agreements

for the years ended December 31, 2003 and 2002, respectively. During 2003, the fair value of the interest rate

swaps increased resulting in a year-to-date, after-tax net gain of $4.5 million, which was recognized in OCI.

As a result of the implementation of the first stage of the Company’s 2005 refinancing plan, whereby

$350 million in fixed coupon debt was issued and used to repay bank debt, the Company executed an

additional $350 million in fixed-to-floating interest rate swaps in February 2005. Refer to Note 23.

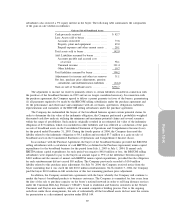

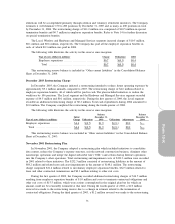

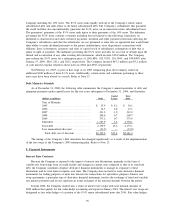

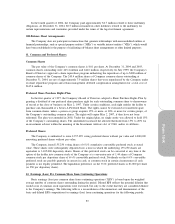

9. Minority Interest

December 31,

(dollars in millions) 2004 2003

Minority interest consists of:

Minority Interest in Cincinnati Bell

Wireless held by Cingular (“AWE”) .............. 38.4 39.0

Other ............................................... 0.8 0.7

Total ........................................... $39.2 $39.7

Cingular Wireless Corporation (“Cingular”), through its subsidiary AT&T PCS LLC (“AWE”), maintains

a 19.9% ownership in the Company’s Wireless subsidiary, Cincinnati Bell Wireless LLC (“CBW”). The

minority interest balance is adjusted as a function of AWE’s 19.9% share of the net income (or loss) of CBW,

with an offsetting amount being reflected in the Consolidated Statements of Operations and Comprehensive

Income (Loss) under the caption “Minority interest expense.” The operating agreement, which governs the

operations of CBW, provides for a three member committee. The Company has the right to appoint all three

representatives.

Under the operating agreement the Company can purchase the 19.9% minority interest in CBW prior to

January 31, 2006, at any time for $85.0 million plus interest at an annual rate of 5%, compounded monthly,

from the date of the agreement. Thereafter the price reduces to $83.0 million, plus 5% annual interest,

compounded monthly. Cingular also can sell the minority interest in CBW to the Company for $83.0 million

effective January 31, 2006 (or earlier, if the member committee calls for additional capital contributions which

call has not been approved by AWE of Cingular), plus 5% annual interest, compounded monthly or at any

time if there is a capital call by CBW. In addition, Cingular and CBW are parties to various commercial

agreements, including spectrum leases and reciprocal roaming agreements. These roaming agreements provide

for a term of five years and a reduction in rates as compared to CBW’s previous roaming agreements with

Cingular and AWE.

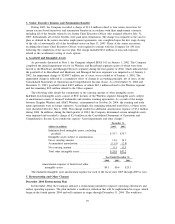

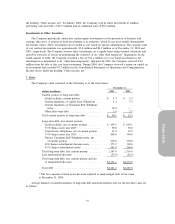

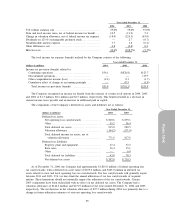

10. Commitments and Contingencies

Lease Commitments and Contractual Obligations

The Company leases certain circuits, facilities and equipment used in its operations. Total operating lease

rental expenses were approximately $24.8 million, $19.8 million and $41 million in 2004, 2003 and 2002,

respectively. Operating leases include tower site leases that provide for renewal options with fixed rent

escalations beyond the initial lease term. In the fourth quarter of 2004, the Company recorded a $3.2 million

79

Form 10-K