Cincinnati Bell 2004 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

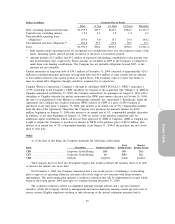

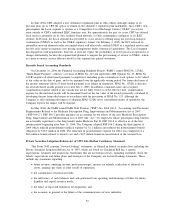

(dollars in millions) Payments Due by Period

Total < 1 Year 1–3 Years 4–5 Years Thereafter

Debt, excluding unamortized discount . . $2,159.5 $25.9 $225.5 $584.2 $1,323.9

Capital leases, excluding interest ........ 15.6 4.2 3.8 1.4 6.2

Noncancelable operating lease

obligations* .......................... 183.0 9.0 15.3 14.5 144.2

Unconditional purchase obligations** . . . 201.8 51.3 64.9 58.5 27.1

Total .................................... $2,559.9 $90.4 $309.5 $658.6 $1,501.4

* Rent expense under operating leases are recognized on a straight-line basis over the respective terms of the

leases, including option renewal periods if renewal of the lease is reasonably assured.

** Amount includes $2.5 million and $9.2 million of expected cash funding contributions to the pension trust

and postretirement trust, respectively. These amounts are included in 2005 as the Company is obligated to

make these cash funding contributions. The Company has not included obligations beyond 2005, as the

amounts are not estimable.

Current maturities of long-term debt of $30.1 million at December 31, 2004 consisted of approximately $24.3

million in scheduled principal payments on long-term debt and $1.6 million of other current debt in addition

to $4.2 million related to the current portion of capital leases. The Company expects to have the ability to

meet its current debt obligations through cash flows generated by its operations.

Cingular Wireless Corporation (“Cingular”), through its subsidiary AT&T PCS LLC (“AWE”), maintains a

19.9% ownership in the Company’s CBW subsidiary. In response to the acquisition (the “Merger”) of AWE by

Cingular announced on February 17, 2004, the Company entered into an agreement on August 4, 2004 with a

subsidiary of Cingular whereby the parties restructured the CBW joint venture effective on October 26, 2004,

the date of consummation of the Merger (as subsequently amended, the “Agreement”). Specifically, under the

Agreement, the Company has a right to purchase AWE’s interest in CBW at a price of $85.0 million if

purchased at any time prior to January 31, 2006, plus interest at an annual rate of 5%, compounded monthly,

from the date of the Agreement. Thereafter, the Company may purchase the minority interest for $83.0

million, beginning on January 31, 2006 plus interest at an annual rate of 5%, compounded monthly, thereafter.

In addition, at any time beginning on January 31, 2006 (or earlier, if the member committee calls for

additional capital contributions which call has not been approved by AWE or Cingular), AWE or Cingular has

a right to require the Company to purchase its interest in CBW at the purchase price of $83.0 million, plus

interest at an annual rate of 5%, compounded monthly, from January 31, 2006 if the purchase has not closed

prior to such date.

Other

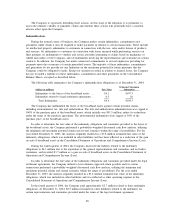

As of the date of this filing, the Company maintains the following credit ratings:

Entity Description Standard and Poor’s

Fitch

Rating Service

Moody’s

Investor Service

CBB .............................. Corporate Credit Rating BB- BB- Ba3

CBT .............................. Corporate Credit Rating B+ BB+ Ba2

CBB .............................. Outlook negative stable positive

The Company does not have any downgrade triggers that would accelerate the maturity dates of its debt

or increase the interest rate on its debt.

On November 3, 2004, the Company announced that it was in the process of finalizing a restructuring

plan to improve its operating efficiency and more effectively align its cost structure with future business

opportunities. The restructuring plan includes a workforce reduction that will be implemented in stages which

began in the fourth quarter 2004 and expect to continue through December 31, 2006.

The workforce reduction will be accomplished primarily through attrition and a special retirement

incentive, which the Company offered to management and union employees meeting certain age and years of

service criteria. Eligible employees wishing to take advantage of the special retirement incentive had to

45

Form 10-K