Cincinnati Bell 2004 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2004 Cincinnati Bell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The credit facilities and other indebtedness impose significant restrictions on the Company.

The Company’s debt instruments impose, and the terms of any future debt may impose, operating and

other restrictions on the Company. These restrictions affect, and in many respects limit or prohibit, among

other things, the Company’s and its subsidiaries’ ability to:

•incur additional indebtedness;

•create liens;

•make investments;

•enter into transactions with affiliates;

•sell assets;

•guarantee indebtedness;

•declare or pay dividends or other distributions to shareholders;

•repurchase equity interests;

•redeem debt that is junior in right of payment to such indebtedness;

•enter into agreements that restrict dividends or other payments from subsidiaries;

•issue or sell capital stock of certain of its subsidiaries; and

•consolidate, merge or transfer all or substantially all of its assets and the assets of its subsidiaries on

a consolidated basis.

In addition, the Company’s credit facilities and debt instruments include restrictive covenants that may

materially limit the Company’s ability to prepay debt and preferred stock. The agreements governing the credit

facilities also require the Company to achieve specified financial results and maintain compliance with

specified financial ratios.

The restrictions contained in the terms of the credit facilities and its other debt instruments could:

•limit the Company’s ability to plan for or react to market conditions or meet capital needs or otherwise

restrict the Company’s activities or business plans; and

•adversely affect the Company’s ability to finance its operations, strategic acquisitions, investments or

alliances or other capital needs or to engage in other business activities that would be in its interest.

A breach of any of these restrictive covenants or the Company’s inability to comply with the required

financial ratios and financial results could result in a default under the credit facilities. During the occurrence

and continuance of a default under the credit facilities, the lenders may elect not to provide loans until such

default is cured or waived. Additionally, if certain defaults occur, the lenders may elect to declare all

outstanding borrowings, together with accrued interest and other fees, to be immediately due and payable. The

lenders will also have the right in these circumstances to terminate any commitments they have to provide

further borrowings. Additionally, the Company’s debt instruments contain cross-acceleration provisions, which

generally cause each instrument to accelerate upon a qualifying acceleration of any other debt instrument.

The Company’s future cash flows could be adversely affected if it is unable to realize fully its deferred

tax assets.

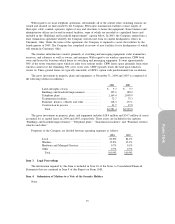

As of December 31, 2004, the Company had a net deferred tax asset of $707.8 million, which includes

U.S. federal net operating loss carryforwards of approximately $635.6 million and state and local net

operating loss carryforwards of approximately $225.0 million. Valuation allowances of approximately $144.2

million have been provided against certain state and local net operating losses and other state deferred taxes

due to the uncertainty of the Company’s ability to utilize the assets within statutory expiration period. For

more information concerning the Company’s net operating loss carryforwards, deferred tax assets and

10