CVS 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

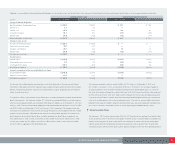

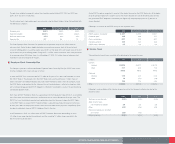

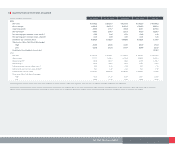

FIVE-YEAR FINANCIAL SUMMARY

14 Quarterly Financial Information (Unaudited)

In millions, except per share amounts First Quarter Second Quarter Third Quarter Fourth Quarter Fiscal Year

2005:

Net sales $ 9,182.2 $ 9,121.6 $ 8,970.4 $ 9,732.0 $ 37,006.2

Gross margin 2,380.8 2,417.4 2,401.0 2,702.0 9,901.2

Operating profit 499.8 477.7 438.9 603.1 2,019.5

Net earnings(2) 289.7 275.9 252.7 406.4 1,224.7

Net earnings per common share, basic(2) 0.35 0.34 0.31 0.49 1.49

Net earnings per common share, diluted(2) 0.34 0.33 0.30 0.48 1.45

Dividends per common share 0.03625 0.03625 0.03625 0.03625 0.1450

Stock price: (New York Stock Exchange)

High 26.89 29.68 31.60 29.30 31.60

Low 22.02 25.02 27.67 23.89 22.02

Registered shareholders at year-end 12,067

2004:

Net sales $ 6,818.6 $ 6,943.1 $ 7,909.4 $ 8,923.2 $ 30,594.3

Gross margin 1,771.7 1,826.5 2,070.8 2,362.2 8,031.2

Operating profit(1) 405.6 387.2 316.0 345.9 1,454.7

Net earnings(2) 244.6 234.5 184.6 255.1 918.8

Net earnings per common share, basic(2) 0.30 0.29 0.23 0.31 1.13

Net earnings per common share, diluted(2) 0.30 0.28 0.22 0.30 1.10

Dividends per common share0.033125 0.033125 0.033125 0.033125 0.1325

Stock price: (New York Stock Exchange)

High 19.26 21.50 22.07 23.67 23.67

Low 16.98 17.85 19.31 20.86 16.98

(1) Operating profit for the fourth quarter and fiscal year 2004 includes the pre-tax effect of a $65.9 million Lease Adjustment. Please see Note 5 for additional information regarding the Lease Adjustment.

(2) Net earnings and net earnings per common share for the fourth quarter and fiscal year 2005 include the after-tax effect of the reversal of $52.6 million of previously recorded tax reserves as discussed in Note 9 above. Net earnings and net earnings per

common share for the fourth quarter and fiscal year 2004 include the after-tax effect of the Lease Adjustment discussed in (1) above, and the reversal of $60.0 million of previously recorded tax reserves as discussed in Note 9 above.