CVS 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

CVS CORPORATION 2005 ANNUAL REPORT

1Significant Accounting Policies

DESCRIPTION OF BUSINESS– CVS Corporation (the “Company”) is a leader in the retail drugstore industry

in the United States. The Company sells prescription drugs and a wide assortment of general merchandise,

including over-the-counter drugs, beauty products and cosmetics, film and photofinishing services,

seasonal merchandise, greeting cards and convenience foods, through its CVS/pharmacy®retail stores and

online through CVS.com.

®The Company also provides pharmacy benefit management, mail order services

and specialty pharmacy services through PharmaCare Management Services and PharmaCare Pharmacy®

stores. As of December 31, 2005, the Company operated 5,471 retail and specialty pharmacy stores in

37 states and the District of Columbia.

BASIS OF PRESENTATION– The consolidated financial statements include the accounts of the Company and

its wholly-owned subsidiaries. All material intercompany balances and transactions have been eliminated.

STOCK SPLIT–On May 12, 2005, the Company’s Board of Directors authorized a two-for-one stock split,

which was effected in the form of a dividend by the issuance of one additional share of common stock for

each share of common stock outstanding. These shares were distributed on June 6, 2005 to shareholders

of record as of May 23, 2005. All share and per share amounts presented herein have been restated to

reflect the effect of the stock split.

FISCAL YEAR–The Company’s fiscal year is a 52 or 53 week period ending on the Saturday nearest

to December 31. Fiscal 2005, which ended on December 31, 2005, and fiscal 2004, which ended

on January 1, 2005, each included 52 weeks. Fiscal 2003, which ended on January 3, 2004, included

53 weeks. Unless otherwise noted, all references to years relate to these fiscal years.

RECLASSIFICATIONS – Certain reclassifications have been made to the consolidated financial statements

of prior years to conform to the current year presentation.

USE OF ESTIMATES–The preparation of financial statements in conformity with generally accepted

accounting principles requires management to make estimates and assumptions that affect the reported

amounts in the consolidated financial statements and accompanying notes. Actual results could differ

from those estimates.

CASH AND CASH EQUIVALENTS– Cash and cash equivalents consist of cash and temporary investments

with maturities of three months or less when purchased.

ACCOUNTS RECEIVABLE– Accounts receivable are stated net of an allowance for uncollectible accounts of

$53.2 million and $57.3 million as of December 31, 2005 and January 1, 2005, respectively. The balance

primarily includes amounts due from third party providers (e.g., pharmacy benefit managers, insurance

companies and governmental agencies) and vendors.

FAIR VALUE OF FINANCIAL INSTRUMENTS– As of December 31, 2005, the Company’s financial instruments

include cash and cash equivalents, accounts receivable, accounts payable and short-term debt. Due to the

short-term nature of these instruments, the Company’s carrying value approximates fair value. The carrying

amount of long-term debt was $1.9 billion, and the estimated fair value was $1.9 billion as of December 31,

2005 and January 1, 2005. The fair value of long-term debt was estimated based on rates currently offered

to the Company for debt with similar terms and maturities. The Company had outstanding letters of credit,

which guaranteed foreign trade purchases, with a fair value of $9.5 million as of December 31, 2005, and

$7.8 million as of January 1, 2005. There were no outstanding investments in derivative financial instruments

as of December 31, 2005 or January 1, 2005.

INVENTORIES– Inventory is stated at the lower of cost or market on a first-in, first-out basis using the

retail method of accounting to determine cost of sales and inventory in our stores, and the cost method

of accounting to determine inventory in our distribution centers. Independent physical inventory counts

are taken on a regular basis in each store and distribution center location to ensure that the amounts

reflected in the accompanying consolidated financial statements are properly stated. During the interim

period between physical inventory counts, the Company accrues for anticipated physical inventory losses

on a location-by-location basis based on historical results and current trends.

PROPERTY AND EQUIPMENT– Property, equipment and improvements to leased premises are depreciated

using the straight-line method over the estimated useful lives of the assets, or when applicable, the term

of the lease, whichever is shorter. Estimated useful lives generally range from 10 to 40 years for buildings,

building improvements and leasehold improvements and 5 to 10 years for fixtures and equipment. Repair

and maintenance costs are charged directly to expense as incurred. Major renewals or replacements that

substantially extend the useful life of an asset are capitalized and depreciated.

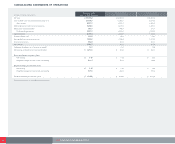

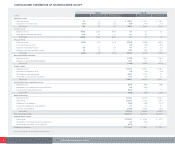

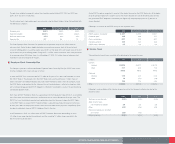

Following are the components of property and equipment included in the consolidated balance sheets as

of the respective balance sheet dates:

In millions Dec. 31, 2005 Jan. 1, 2005

Land $ 322.4 $ 262.6

Building and improvements 631.0 612.6

Fixtures and equipment 3,484.1 2,943.8

Leasehold improvements 1,496.7 1,286.5

Capitalized software198.6 168.2

Capital leases 1.3 1.3

6,134.1 5,275.0

Accumulated depreciation and amortization (2,181.5) (1,769.1)

$ 3,952.6 $ 3,505.9

The Company capitalizes application development stage costs for significant internally developed software

projects. These costs are amortized over a five-year period. Unamortized costs were $84.3 million as of

December 31, 2005 and $78.6 million as of January 1, 2005.

IMPAIRMENT OF LONG-LIVED ASSETS–The Company accounts for the impairment of long-lived assets in

accordance with Statement of Financial Accounting Standards (“SFAS”) No. 144, “Accounting for Impairment

or Disposal of Long-Lived Assets.” As such, the Company groups and evaluates fixed and finite-lived

intangible assets excluding goodwill, for impairment at the individual store level, which is the lowest level

at which individual cash flows can be identified. When evaluating assets for potential impairment, the

Company first compares the carrying amount of the asset group to the individual store’s estimated future