CVS 2005 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2005 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 CVS CORPORATION 2005 ANNUAL REPORT

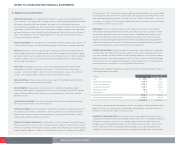

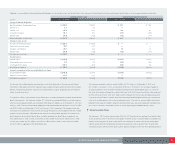

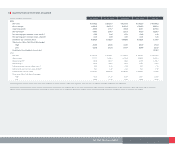

Following is a summary of the significant components of the Company’s deferred tax assets and liabilities

as of the respective balance sheet dates:

In millions Dec. 31, 2005 Jan. 1, 2005

Deferred tax assets:

Lease and rents $ 258.3 $ 298.7

Inventory124.0 111.3

Employee benefits 60.8 51.8

Accumulated other comprehensive items 53.5 33.4

Retirement benefits 11.0 15.0

Allowance for bad debt 22.1 20.8

Amortization method 16.9 19.9

Other 43.4 61.3

Total deferred tax assets 590.0 612.2

Deferred tax liabilities:

Accelerated depreciation (226.3) (231.5)

Total deferred tax liabilities (226.3) (231.5)

Net deferred tax assets $ 363.7 $ 380.7

During the fourth quarter of 2005, an assessment of tax reserves resulted in a reduction that was principally

based on resolving certain state tax matters. As a result, the Company reversed $52.6 million of previously

recorded tax reserves through the income tax provision. During the fourth quarter of 2004, an assessment

of tax reserves resulted in a reduction that was principally based on finalizing certain tax return years and

on a 2004 court decision that was relevant to the industry. As a result, the Company reversed $60.0 million

of previously recorded tax reserves through the income tax provision. The Company believes it is more

likely than not that the deferred tax assets included in the above table will be realized during future periods.

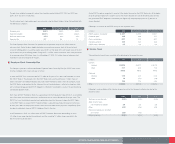

10 Commitments & Contingencies

Between 1991and 1997, the Company sold or spun off a number of subsidiaries, including Bob’s Stores,

Linens ’n Things, Marshalls, Kay-Bee Toys, Wilsons, This End Up and Footstar. In many cases, when

a former subsidiary leased a store, the Company provided a guarantee of the store’s lease obligations.

When the subsidiaries were disposed of, the Company’s guarantees remained in place, although each

initial purchaser has indemnified the Company for any lease obligations the Company was required to

satisfy. If any of the purchasers or any of the former subsidiaries were to become insolvent and failed

to make the required payments under a store lease, the Company could be required to satisfy these

obligations. As of December 31, 2005, the Company guaranteed approximately 360 such store leases,

with the maximum remaining lease term extending through 2018. Assuming that each respective purchaser

became insolvent, and the Company was required to assume all of these lease obligations, management

estimates that the Company could settle the obligations for approximately $400 to $450 million as of

December 31, 2005.

Management believes the ultimate disposition of any of the guarantees will not have a material adverse

effect on the Company’s consolidated financial condition, results of operations or future cash flows.

As of December 31, 2005, the Company had outstanding commitments to purchase $70.5 million of

merchandise inventory for use in the normal course of business. The Company currently expects to satisfy

these purchase commitments by 2008.

The Rhode Island Attorney General’s Office, the Rhode Island Ethics Commission and the United States

Attorney’s Office for the District of Rhode Island have been investigating the business relationships between

certain former members of the Rhode Island General Assembly and various Rhode Island companies,

including the Company. In connection with the investigation of these business relationships, a former state

senator has been criminally charged by state and federal authorities, and has pled guilty to the federal

charges. The Company will continue to cooperate fully with these investigations.

The United States Department of Justice and several state attorneys general are investigating whether any

civil or criminal violations resulted from certain practices engaged in by CVS and others in the pharmacy

industry with regard to dispensing one of two different dosage forms of a generic drug under circumstances

in which some state Medicaid programs at various times reimbursed one dosage form at a different rate

from the other. The Company is in discussions with various governmental agencies involved and believes

its conduct was lawful and justified.

The enforcement staff of the United States Securities and Exchange Commission (the “SEC”) has

commenced an informal inquiry into matters related to the accounting for a transaction that occurred in

2000 (the “2000 Transaction”). Pursuant to the 2000 Transaction, the Company (i) made accounting entries

reflecting the conveyance of certain excess plush toy collectible inventory to a third party; (ii) received a total

of $42.5 million in barter credits; and (iii) made a cash payment of $12.5 million to the same third party.

The inquiry is ongoing and the Company is continuing to respond to the SEC staff’s requests. In December

2005, the Audit Committee of the Company’s Board of Directors engaged independent outside counsel

to undertake an internal review of the matter (the “Internal Review”). In March 2006, based on the findings

from the Internal Review, the Audit Committee reached certain conclusions regarding the 2000 Transaction.

The Audit Committee concluded that various aspects of the Company’s accounting for the 2000 Transaction

were incorrect, although the Internal Review did not result in any adjustments to the financial statements

included in this Annual Report. On March 10, 2006, the Audit Committee reported its findings to the

Company’s Board of Directors, which adopted those findings. Subsequent to the Audit Committee

reaching these conclusions, the Company’s Controller (who was also the Principal Accounting Officer)

and the Company’s Treasurer resigned their positions. David B. Rickard, the Company’s Executive Vice

President, Chief Financial Officer and Chief Administrative Officer, will be acting as Principal Accounting

Officer on an interim basis. The Company cannot predict the outcome or timing of the SEC inquiry, or of

any related proceedings, although the Company does not believe that any of the above matters will have

any material effect on the Company’s results of operations or financial condition.

The Company is also a party to other litigation arising in the normal course of its business, none of which

is expected to be material to the Company.