CVS 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 CVS CORPORATION 2005 ANNUAL REPORT

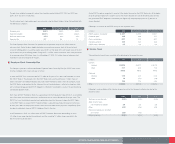

13 Subsequent Event

On January 22, 2006, the Company entered into a definitive agreement under which it will acquire

approximately 700 standalone Sav-on and Osco drugstores, as well as a distribution center located in

La Habra, California, from Albertson’s, Inc. (“Albertson’s”), for $2.93 billion in cash immediately preceding

the planned merger of Albertson’s and Supervalu, Inc. (“Supervalu”). Approximately half of the drugstores

are located in southern California, with others in the Company’s existing markets in numerous states across

the Midwest and Southwest. The Company will also acquire Albertson’s owned real estate interests in the

drugstores for $1.0 billion in cash. Closing of the transaction, which is expected to occur in mid-2006, is

subject to review under the Hart-Scott-Rodino Act, as well as other customary closing conditions. Further,

closing is also conditioned on consummation of the merger between Albertson’s and Supervalu, which

is also subject to review under the Hart-Scott-Rodino Act and other customary closing conditions, as

well as approval by the shareholders of Albertson’s and Supervalu. The Company expects to finance

the transaction through a combination of cash, short-term and long-term debt and proceeds from the

subsequent sale-leaseback of the owned real estate interests. Closing of the transaction is not subject

to such financing.

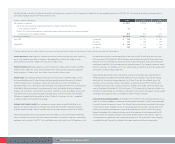

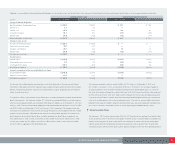

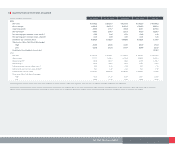

12 Reconciliation of Earnings Per Common Share

Following is a reconciliation of basic and diluted earnings per common share for the respective years:

In millions, except per share amounts 2005 2004 2003

Numerator for earnings per common share calculation:

Net earnings $ 1,224.7 $ 918.8 $ 847.3

Preference dividends, net of income tax benefit (14.1) (14.2) (14.6)

Net earnings available to common shareholders, basic $ 1,210.6 $ 904.6 $ 832.7

Net earnings $ 1,224.7 $ 918.8 $ 847.3

Dilutive earnings adjustment (4.4) (5.2) (6.3)

Net earnings available to common shareholders, diluted $ 1,220.3 $ 913.6 $ 841.0

Denominator for earnings per common share calculation:

Weighted average common shares, basic 811.4 797.2 788.8

Preference stock 19.5 20.4 21.2

Stock options 9.9 13.2 5.4

Restricted stock units 0.8 — —

Weighted average common shares, diluted 841.6 830.8 815.4

Basic earnings per common share:

Net earnings $1.49 $ 1.13 $ 1.06

Diluted earnings per common share:

Net earnings $1.45 $ 1.10 $ 1.03