CVS 2005 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2005 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

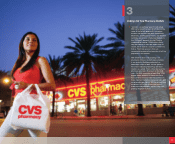

3

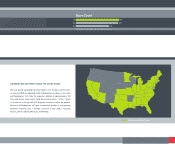

Staking Out New Pharmacy Markets

✛

11

“Location is everything,” goes the old adage.

Well, we’ve taken it to heart at CVS by entering

some of the fastest-growing U.S. drugstore

markets over the past five years. From Illinois,

Minnesota, and Nevada to Arizona and Southern

California, we’ve been introducing shoppers to

the “CVS easy” approach to retail. They’ve

responded by keeping CVS/pharmacy firmly

atop our industry in sales per square foot. Of

course, we’ve made it a snap for customers to

find us. That’s because our stores are

conveniently located within two miles of half the

population in our markets.

With 5,420 locations and counting, CVS

pharmacies fill one in every five prescriptions

in our markets. We dispensed more than

400 million scripts in 2005, and our growth in

this area is outpacing food, drug, and mass

retailers as a whole. That’s critical because the

pharmacy generates 70 percent of total CVS

sales. Our 2004 acquisition of more than 1,100

Eckerd stores, primarily in Florida and Texas,

has vaulted us into key leadership positions in

these important markets virtually overnight. And

our planned acquisition of 700 Sav-on and Osco

drugstores will further enhance our market

leadership and geographic reach in large and

growing drugstore markets.