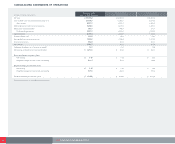

CVS 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ADVERTISING COSTS–Advertising costs are expensed when the related advertising takes place. Advertising

costs, net of vendor funding, which is included in selling, general and administrative expenses, were

$206.6 million in 2005, $205.7 million in 2004 and $178.2 million in 2003.

INTEREST EXPENSE, NET–Interest expense was $117.0 million, $64.0 million and $53.9 million, and interest

income was $6.5 million, $5.7 million and $5.8 million in 2005, 2004 and 2003, respectively. Capitalized

interest totaled $12.7 million in 2005, $10.4 million in 2004 and $11.0 million in 2003.

INCOME TAXES–The Company provides for federal and state income taxes currently payable, as well as

for those deferred because of timing differences between reporting income and expenses for financial

statement purposes versus tax purposes. Federal and state incentive tax credits are recorded as a

reduction of income taxes. Deferred tax assets and liabilities are recognized for the future tax consequences

attributable to differences between the carrying amount of assets and liabilities for financial reporting

purposes and the amounts used for income tax purposes. Deferred tax assets and liabilities are measured

using the enacted tax rates expected to apply to taxable income in the years in which those temporary

differences are expected to be recoverable or settled. The effect of a change in tax rates is recognized

as income or expense in the period of the change.

EARNINGS PER COMMON SHARE– Basic earnings per common share is computed by dividing: (i) net

earnings, after deducting the after-tax Employee Stock Ownership Plan (“ESOP”) preference dividends,

by (ii) the weighted average number of common shares outstanding during the year (the “Basic Shares”).

When computing diluted earnings per common share, the Company assumes that the ESOP preference

stock is converted into common stock and all dilutive stock options are exercised. After the assumed ESOP

preference stock conversion, the ESOP Trust would hold common stock rather than ESOP preference stock

and would receive common stock dividends ($0.145 per share in 2005, $0.1325 per share in 2004 and

$0.115 per share in 2003) rather than ESOP preference stock dividends (currently $3.90 per share). Since

the ESOP Trust uses the dividends it receives to service its debt, the Company would have to increase its

contribution to the ESOP Trust to compensate it for the lower dividends. This additional contribution would

reduce the Company’s net earnings, which in turn, would reduce the amounts that would be accrued under

the Company’s incentive compensation plans.

Diluted earnings per common share is computed by dividing: (i) net earnings, after accounting for the

difference between the dividends on the ESOP preference stock and common stock and after making

adjustments for the incentive compensation plans, by (ii) Basic Shares plus the additional shares that

would be issued assuming that all dilutive stock options are exercised and the ESOP preference stock

is converted into common stock. Options to purchase 6.9 million and 9.4 million shares of common stock

were outstanding as of December 31, 2005 and January 1, 2005, respectively, but were not included in the

calculation of diluted earnings per share because the options’ exercise prices were greater than the average

market price of the common shares and, therefore, the effect would be antidilutive.

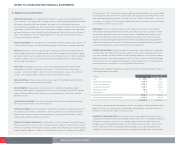

NEW ACCOUNTING PRONOUNCEMENTS– In December 2004, SFAS No. 123(R), “Share-Based Payment,” was

issued. This statement establishes standards for the accounting for transactions in which an entity exchanges

its equity instruments for goods or services. The statement focuses primarily on accounting for transactions

in which an entity obtains employee services in share-based payment transactions. The provisions of this

statement are required to be adopted for annual periods beginning after June 15, 2005. The Company

believes the adoption of this statement will decrease diluted earnings per share by approximately $0.05

in 2006, however, the Company continues to evaluate the potential impact as the amount is subject to

variation based on the granting of stock compensation during 2006. Please see Note 7 to the Company’s

consolidated financial statements for additional information regarding stock-based compensation.

32 CVS CORPORATION 2005 ANNUAL REPORT

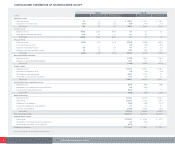

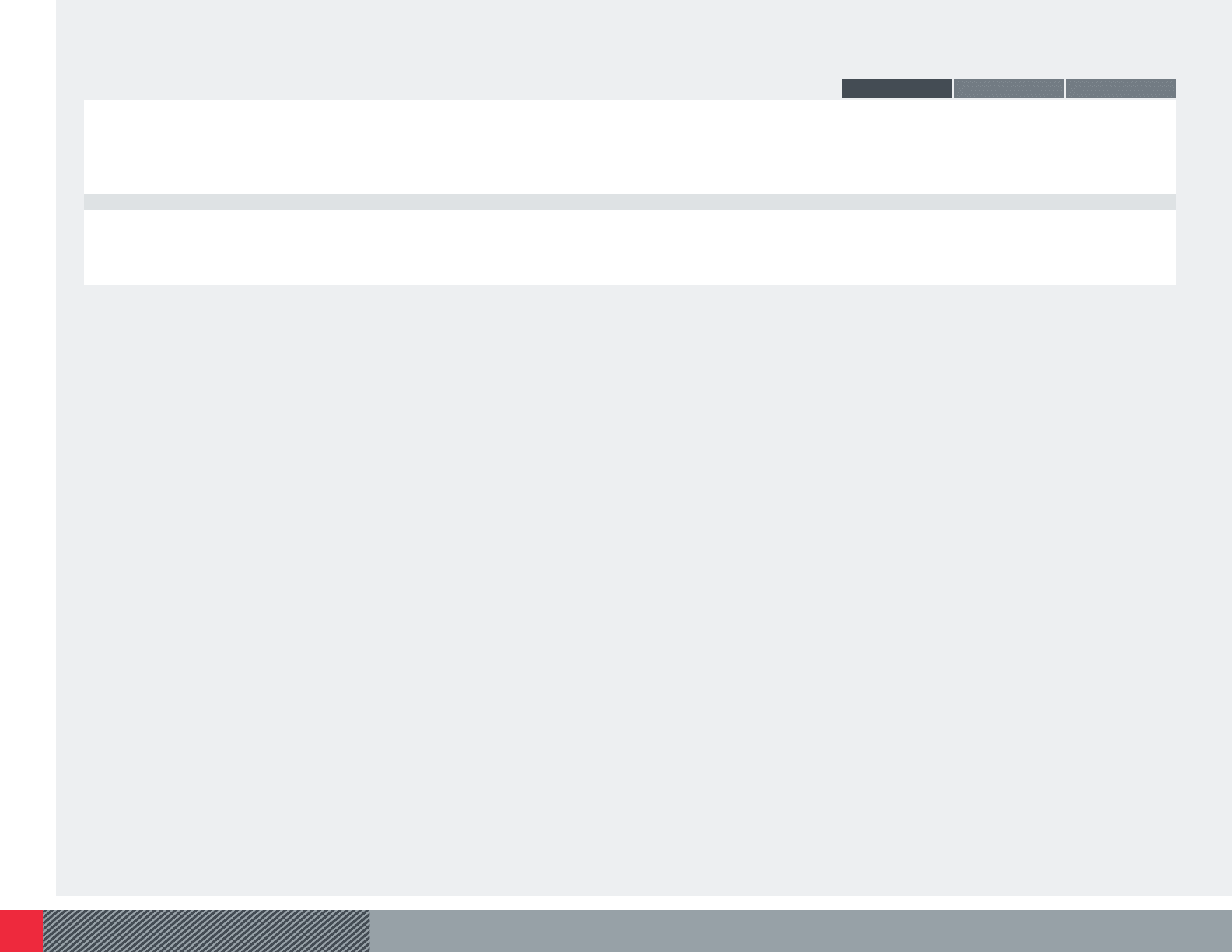

The following table summarizes the effect on net earnings and earnings per common share if the Company had applied the fair value recognition provisions of SFAS No. 123, “Accounting for Stock-Based Compensation,” to

stock-based employee compensation for the respective years:

In millions, except per share amounts 2005 2004 2003

Net earnings, as reported $ 1,224.7 $ 918.8 $ 847.3

Add: Stock-based employee compensation expense included in reported net earnings,

net of related tax effects(1) 4.8 1.5 2.2

Deduct: Total stock-based employee compensation expense determined under fair value based method

for all awards, net of related tax effects 48.6 40.2 52.4

Pro forma net earnings $ 1,180.9 $ 880.1 $ 797.1

Basic EPS: As reported $1.49 $ 1.13 $ 1.06

Pro forma 1.44 1.09 0.99

Diluted EPS: As reported $1.45 $ 1.10 $ 1.03

Pro forma 1.40 1.06 0.97

(1) Amounts represent the after-tax compensation costs for restricted stock grants and expense related to the acceleration of vesting of stock options on certain terminated employees.