CVS 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

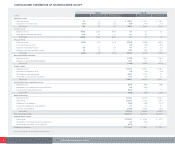

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

5Leases

The Company leases most of its retail locations and eight of its distribution centers under non-cancelable

operating leases, whose initial terms typically range from 15 to 25 years, along with options that permit renewals

for additional periods. The Company also leases certain equipment and other assets under non-cancelable

operating leases, whose initial terms typically range from 3 to 10 years. During 2004, the Company conformed its

accounting for operating leases and leasehold improvements to the views expressed by the Office of the Chief

Accountant of the Securities and Exchange Commission to the American Institute of Certified Public Accountants

on February 7, 2005. As a result, the Company recorded a $65.9 million non-cash pre-tax ($40.5 million after-

tax) adjustment to total operating expenses, which represents the cumulative effect of the adjustment for a

period of approximately 20 years (the “Lease Adjustment”). Since the effect of the Lease Adjustment was not

material to 2004 or any previously reported fiscal year, the cumulative effect was recorded in the fourth quarter

of 2004. Minimum rent is expensed on a straight-line basis over the term of the lease. In addition to minimum

rental payments, certain leases require additional payments based on sales volume, as well as reimbursement

for real estate taxes, common area maintenance and insurance, which are expensed when incurred.

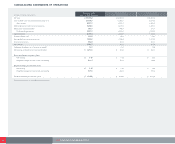

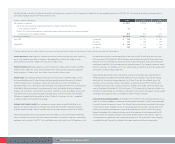

Following is a summary of the Company’s net rental expense for operating leases for the respective years:

In millions 2005 2004 2003

Minimum rentals $ 1,213.2 $ 1,020.6 $ 838.4

Contingent rentals 63.3 61.7 62.0

1,276.5 1,082.3 900.4

Less: sublease income (18.8) (14.0) (10.1)

$ 1,257.7 $ 1,068.3 $ 890.3

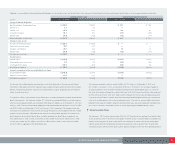

Following is a summary of the future minimum lease payments under capital and operating leases as of

December 31, 2005:

In millions Capital Leases Operating Leases

2006 $ 0.2 $1,233.0

2007 0.2 1,178.6

2008 0.2 1,127.5

2009 0.2 1,090.4

2010 0.1 1,205.4

Thereafter 0.0 10,492.8

0.9 $ 16,327.7

Less: imputed interest (0.2)

Present value of capital lease obligations $ 0.7

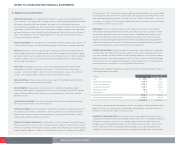

The Company finances a portion of its store development program through sale-leaseback transactions.

The properties are sold and the resulting leases qualify and are accounted for as operating leases. The

Company does not have any retained or contingent interests in the stores, nor does the Company provide

any guarantees, other than a guarantee of lease payments, in connection with the sale-leasebacks. Proceeds

from sale-leaseback transactions totaled $539.9 million in 2005, $496.6 million in 2004 and $487.8 million

in 2003. The operating leases that resulted from these transactions are included in the above table.

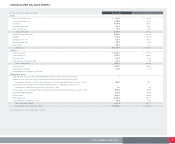

6Pension Plans and Other Postretirement Benefits

Defined Contribution Plans

The Company sponsors a voluntary 401(k) Savings Plan that covers substantially all employees who meet

plan eligibility requirements. The Company makes matching contributions consistent with the provisions

of the plan. At the participant’s option, account balances, including the Company’s matching contribution,

can be moved without restriction among various investment options, including the Company’s common

stock. The Company also maintains a nonqualified, unfunded Deferred Compensation Plan for certain key

employees. This plan provides participants the opportunity to defer portions of their compensation and

receive matching contributions that they would have otherwise received under the 401(k) Savings Plan if not

for certain restrictions and limitations under the Internal Revenue Code. The Company’s contributions under

the above defined contribution plans totaled $64.9 million in 2005, $52.1 million in 2004 and $46.9 million in

2003. The Company also sponsors an Employee Stock Ownership Plan. See Note 8 for further information

about this plan.

Other Postretirement Benefits

The Company provides postretirement healthcare and life insurance benefits to certain retirees who meet

eligibility requirements. The Company’s funding policy is generally to pay covered expenses as they are

incurred. For retiree medical plan accounting, the Company reviews external data and its own historical

trends for healthcare costs to determine the healthcare cost trend rates.

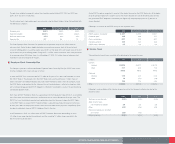

For measurement purposes, future healthcare costs are assumed to increase at an annual rate of 10.0%,

decreasing to an annual growth rate of 5.0% in 2011 and thereafter. A one percent change in the assumed

healthcare cost trend rate would change the accumulated postretirement benefit obligation by $0.6 million

and the total service and interest costs by $0.1 million.

During 2004, the Company adopted FAS 106-2, “Accounting and Disclosure Requirements Related to

the Medicare Prescription Drug, Improvement and Modernization Act of 2003.” This statement requires

disclosure of the effects of the Medicare Prescription Drug, Improvement and Modernization Act and an

assessment of the impact of the federal subsidy on the accumulated postretirement benefit obligation and

net periodic postretirement benefit cost. The adoption of this statement did not have a material impact on

the Company’s consolidated results of operations, financial position or related disclosures.

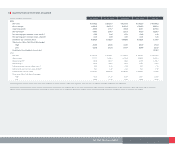

Pension Plans

The Company sponsors a non-contributory defined benefit pension plan that covers certain full-time

employees of Revco, D.S., Inc. who were not covered by collective bargaining agreements. On September

20, 1997, the Company suspended future benefit accruals under this plan. Benefits paid to retirees are

based upon age at retirement, years of credited service and average compensation during the five-year

period ended September 20, 1997. The plan is funded based on actuarial calculations and applicable

federal regulations.