CVS 2005 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2005 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AT CVS, ALL SIGNS POINT TO GROWTH

2

05

04

03

$22.54

$18.06

$26.42

Stock Price at Year End*

*Calendar year end

I’m happy to report that we surpassed our sales and profitability targets in all of them. We expect to open 250 to 275 new or

relocated stores in 2006, adding 100 to 125 net new locations.

Meanwhile, we’re delighted with the performance of the former Eckerd stores acquired in 2004. Concentrated largely in Florida and

Texas, they have met or exceeded expectations on every front. All operations have been fully integrated, from marketing,

distribution, and human resources to information systems and the successful combination of the acquired PBM operations under

the PharmaCare banner. Yet, as far and as fast as we’ve come, it’s important to note that we believe much of the acquisition’s

benefits still lie ahead of us. By employing our operational expertise and technology, we are taking advantage of a multi-year

opportunity to drive top-line growth, improve margins, and reduce inventory shrinkage. Furthermore, a new distribution center

similar to our Ennis, Texas, facility is set to open in Florida during the second half of 2006. Highly cost-effective, its storage and

retrieval systems will be capable of servicing the same volume and number of stores as a facility twice its size.

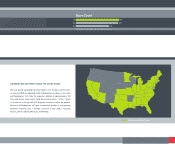

Our planned acquisition of 700 standalone Sav-on®and Osco®drugstores from Albertson’s, Inc., announced in January 2006, will

further strengthen our position as America’s No. 1 retail pharmacy. Upon completion of the transaction, which is expected to occur

mid-2006, we will operate approximately 6,100 stores across 42 states. Almost half the stores we are acquiring are located in

Southern California, which will make us the No. 1 drugstore in that fast-growing region. Most of the rest are high-volume stores in

states where we already have a presence, providing many No. 1 or No. 2 market positions. We will also acquire a distribution center

in La Habra, California. The transaction is expected to be accretive to both earnings and cash flow in its first full year.

Leveraging new opportunities in pharmacy

CVS now fills 14 percent of all U.S. retail drug prescriptions. Generics account for well over half of all the prescriptions we fill. With

several blockbuster drugs poised to lose patent protection over the next several years, the demand for generics should continue to

climb. While depressing top-line growth, the increasing adoption of generic pharmaceuticals is helping drive margin gains.

The Medicare Part D Prescription Drug Plan, launched in January 2006, should increase usage of pharmaceuticals over time by

making them more affordable for seniors. Some 42 million Medicare beneficiaries are eligible for the new plan, and we’ve worked

As far and as fast as we’ve come, it’s

important to note that we believe

much of the 2004 acquisition’s

benefits still lie ahead of us.