CVS 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

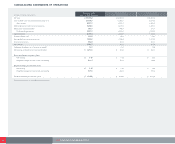

34 CVS CORPORATION 2005 ANNUAL REPORT

Intangible assets other than goodwill are required to be separated into two categories: finite-lived and

indefinite-lived. Intangible assets with finite useful lives are amortized over their estimated useful life, while

intangible assets with indefinite useful lives are not amortized. The Company currently has no intangible

assets with indefinite lives.

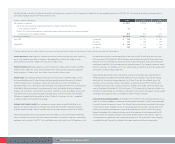

Following is a summary of the Company’s amortizable intangible assets as of the respective balance sheet dates:

Dec. 31, 2005 Jan. 1, 2005

In millions Gross Carrying Amount Accumulated Amortization Gross Carrying Amount Accumulated Amortization

Customer lists and Covenants not to compete $ 1,152.4 $ (435.9) $ 1,102.8 $ (321.8)

Favorable leases and Other 185.5 (99.8) 173.8 (86.9)

$ 1,337.9 $ (535.7) $ 1,276.6 $ (408.7)

The amortization expense for these intangible assets totaled $128.6 million in 2005, $95.9 million in

2004 and $63.2 million in 2003. The anticipated annual amortization expense for these intangible assets

is $126.1 million in 2006, $119.7 million in 2007, $111.0 million in 2008, $102.7 million in 2009 and

$93.3 million in 2010.

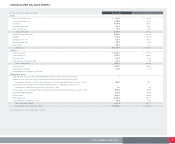

4Borrowing and Credit Agreements

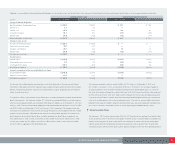

Following is a summary of the Company’s borrowings as of the respective balance sheet dates:

In millions Dec. 31, 2005 Jan. 1, 2005

Commercial paper $253.4 $885.6

5.625% senior notes due 2006 300.0 300.0

3.875% senior notes due 2007 300.0 300.0

4.0% senior notes due 2009 650.0 650.0

4.875% senior notes due 2014 550.0 550.0

8.52% ESOP notes due 2008(1) 114.0 140.9

Mortgage notes payable 21.0 14.8

Capital lease obligations 0.7 0.8

2,189.1 2,842.1

Less:

Short-term debt (253.4) (885.6)

Current portion of long-term debt (341.6) (30.6)

$ 1,594.1 $ 1,925.9

(1) See Note 8 for further information about the Company’s ESOP Plan.

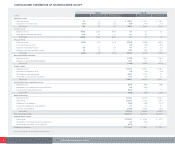

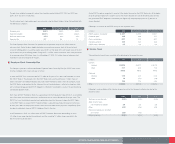

In connection with our commercial paper program, we maintain a $650 million, five-year unsecured back-up

credit facility, which expires on May 21, 2006, and a $675 million, five-year unsecured back-up credit facility,

which expires on June 2, 2010. In addition, we maintain a $675 million, five-year unsecured back-up credit

facility, which expires on June 11, 2009. The credit facilities allow for borrowings at various rates depending

on the Company’s public debt ratings and require the Company to pay a quarterly facility fee of 0.1%,

regardless of usage. As of December 31, 2005, the Company had no outstanding borrowings against the

credit facilities. The weighted average interest rate for short-term debt was 3.3% and 1.8% as of December

31, 2005 and January 1, 2005, respectively.

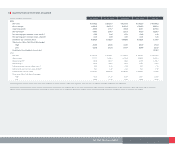

In September 2004, the Company issued $650 million of 4.0% unsecured senior notes due September 15,

2009 and $550 million of 4.875% unsecured senior notes due September 15, 2014 (collectively the

“Notes”). The Notes pay interest semi-annually and may be redeemed at any time, in whole or in part at a

defined redemption price plus accrued interest. Net proceeds from the Notes were used to repay a portion

of the outstanding commercial paper issued to finance the acquisition of the Acquired Businesses.

To manage a portion of the risk associated with potential changes in market interest rates between the

Company entering into a definitive agreement to purchase the Acquired Businesses and the placement

of the long-term financing, the Company entered into Treasury-Lock Contracts (the “Contracts”) with total

notional amounts of $600 million. The Company settled these Contracts at a loss of $32.8 million during the

third quarter of 2004 in conjunction with the placement of the long-term financing. The Company accounts

for the above derivatives in accordance with SFAS No. 133, “Accounting for Derivative Instruments and

Hedging Activities,” as modified by SFAS No. 138, “Accounting for Derivative Instruments and Certain

Hedging Activities,” which requires the resulting loss to be recorded in shareholders’ equity as a component

of accumulated other comprehensive loss. This unrealized loss will be amortized as a component of interest

expense over the life of the related long-term financing. As of December 31, 2005, the Company had no

freestanding derivatives in place.

The credit facilities and unsecured senior notes contain customary restrictive financial and operating

covenants. The covenants do not materially affect the Company’s financial or operating flexibility.

The aggregate maturities of long-term debt for each of the five years subsequent to December 31, 2005 are

$341.6 million in 2006, $341.9 million in 2007, $45.7 million in 2008, $651.3 million in 2009 and $1.4 million

in 2010.