CVS 2005 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2005 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

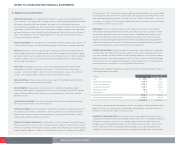

can be identified. When evaluating long-lived assets for potential impairment, we first compare the carrying

amount of the asset group to the individual store’s estimated future cash flows (undiscounted and without

interest charges). If the estimated future cash flows are less than the carrying amount of the asset group,

an impairment loss calculation is prepared. The impairment loss calculation compares the carrying amount

of the asset group to the individual store’s estimated future cash flows (discounted and with interest charges).

If required, an impairment loss is recorded for the portion of the asset group’s carrying value that exceeds

the individual store’s estimated future cash flows (discounted and with interest charges).

Our impairment loss calculation contains uncertainty since we must use judgment to estimate each store’s

future sales, profitability and cash flows. When preparing these estimates, we consider each store’s

historical results and current operating trends and our consolidated sales, profitability and cash flow results

and forecasts. These estimates can be affected by a number of factors including, but not limited to, general

economic conditions, the cost of real estate, the continued efforts of third party organizations to reduce

their prescription drug costs, the continued efforts of competitors to gain market share and consumer

spending patterns. We have not made any material changes to our impairment loss assessment

methodology during the past three years.

Closed Store Lease Liability

We account for closed store lease termination costs in accordance with SFAS No. 146, “Accounting for

Costs Associated with Exit or Disposal Activities.” As such, when a leased store is closed, we record a

liability for the estimated present value of the remaining obligation under the non-cancelable lease, which

includes future real estate taxes, common area maintenance and other charges, if applicable. The liability

is reduced by estimated future sublease income.

The initial calculation and subsequent evaluations of our closed store lease liability contains uncertainty

since we must use judgment to estimate the timing and duration of future vacancy periods, the amount

and timing of future lump sum settlement payments and the amount and timing of potential future sublease

income. When estimating these potential termination costs and their related timing, we consider a number

of factors, which include, but are not limited to, historical settlement experience, the owner of the property,

the location and condition of the property, the terms of the underlying lease, the specific marketplace

demand and general economic conditions. We have not made any material changes in the reserve

methodology used to record closed store lease reserves during the past three years.

Self-Insurance Liabilities

We are self-insured for certain losses related to general liability, workers’ compensation and auto liability

although we maintain stop loss coverage with third party insurers to limit our total liability exposure. We

are also self-insured for certain losses related to health and medical liabilities.

The estimate of our self-insurance liability contains uncertainty since we must use judgment to estimate

the ultimate cost that will be incurred to settle reported claims and unreported claims for incidents incurred

but not reported as of the balance sheet date. When estimating our self-insurance liability we consider a

number of factors, which include, but are not limited to, historical claim experience, demographic factors,

severity factors and valuations provided by independent third party actuaries.

On a quarterly basis, we review our assumptions with our independent third party actuaries to determine

that our self-insurance liability is adequate. We have not made any material changes in the accounting

methodology used to establish our self-insurance liability during the past three years.

Inventory

Our inventory is stated at the lower of cost or market on a first-in, first-out basis using the retail method

of accounting to determine cost of sales and inventory in our stores, and the cost method of accounting

to determine inventory in our distribution centers. Under the retail method, inventory is stated at cost, which

is determined by applying a cost-to-retail ratio to the ending retail value of our inventory. Since the retail

value of our inventory is adjusted on a regular basis to reflect current market conditions, our carrying value

should approximate the lower of cost or market. In addition, we reduce the value of our ending inventory for

estimated inventory losses that have occurred during the interim period between physical inventory counts.

Physical inventory counts are taken on a regular basis in each location to ensure that the amounts reflected

in the consolidated financial statements are properly stated.

The accounting for inventory contains uncertainty since we must use judgment to estimate the inventory

losses that have occurred during the interim period between physical inventory counts. When estimating

these losses, we consider a number of factors, which include but are not limited to, historical physical

inventory results on a location-by-location basis and current inventory loss trends. We have not made any

material changes in the accounting methodology used to establish our inventory loss reserves during the

past three years.

Although we believe that the estimates discussed above are reasonable and the related calculations

conform to generally accepted accounting principles, actual results could differ from our estimates,

and such differences could be material.

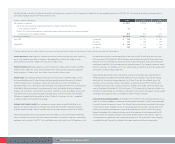

Recent Accounting Pronouncements

In December 2004, SFAS No. 123(R), “Share-Based Payment,” was issued. This statement establishes

standards for the accounting for transactions in which an entity exchanges its equity instruments for goods

or services. The statement focuses primarily on accounting for transactions in which an entity obtains

employee services in share-based payment transactions. The provisions of this statement are required to

be adopted for annual periods beginning after June 15, 2005. We believe the adoption of this statement will

decrease our diluted earnings per share by approximately $0.05 in 2006; however, we continue to evaluate

the potential impact as the amount is subject to variation based on the granting of stock compensation

during 2006. Please see Note 7 to our consolidated financial statements for additional information regarding

stock-based compensation.

In October 2005, the Financial Accounting Standards Board (“FASB”) issued FASB Staff Position (“FSP”)

No. FAS 13-1, “Accounting for Rental Costs Incurred during a Construction Period.” The FSP addresses the

accounting for rental costs associated with operating leases that are incurred during a construction period

and requires rental costs associated with ground or building operating leases that are incurred during a

construction period to be recognized as rental expense. The provisions of the FSP are required to be

applied to the first reporting period beginning after December 15, 2005. We do not expect that the adoption

of this position will have a material impact on our consolidated results of operations or financial position.

22 CVS CORPORATION 2005 ANNUAL REPORT