CVS 2002 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2002 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Each day,

nearly 13,000

CVS pharmacists

help people live

longer, healthier

lives.

Capturing Pharmacy

Growth Opportunities

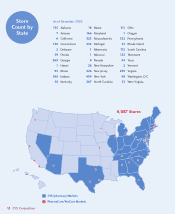

CVS fills one of every nine

retail prescriptions in the United

States. We currently operate in about

65 of the top 100 U.S. drugstore

markets, and we are the market leader in

approximately half of those. Pharmacy has always been

our core business and currently accounts for more than

two-thirds of our total sales.

Growth Drivers

According to IMS Health, pharmacy sales are

expected to continue to grow at an annual rate of 11%

to 14%. The aging population is an important driver of

pharmacy growth because it drives utilization. People

aged 65 and over use almost four times as many

prescriptions as the rest of the population. In the next

10 years, people aged 65 and over will spend $1.8

trillion on prescriptions, according to government

estimates. Remarkable as it sounds, two-thirds of all the

people who have lived beyond age 65 in the entire

history of the world are alive today; and by 2030, the

number of people aged 65 and over is expected to

nearly double.

Drug introductions slowed somewhat in the past

few years, creating a bulging pipeline of new drugs in

various stages of development. More than 100 of those

drugs are recognized as having blockbluster potential,

meaning they can generate at least $500 million in

sales for the industry. As they are approved by the Food

and Drug Administration and enter the market, we will

see increased demand.

We are seeing a growing rate of patent expirations,

which allows branded drugs to convert to cost-effective

generic equivalents. Industry projections suggest that

branded drugs with more than $40 billion in U.S. sales

in 2001 will lose patent or exclusivity protection in the

United States by 2006. Generics soften the top line

because they generate less revenue per prescription, but

they are good for profit margins and drive utilization.

In 2003, customers may be able to select generics

for such brand names as Tiazac®for hypertension,

Wellbutrin®and Zyban®for depression, and Nolvadex®

for breast cancer. Despite this shift from higher-priced

brand-name drugs to more cost-effective generics, our

pharmacy sales are growing at a healthy pace.

Capitalizing on Opportunities

To capitalize on these growth trends, we plan to

make CVS the easiest pharmacy for customers to use.

It sounds simple enough, but in fact it’s a complex