CVS 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

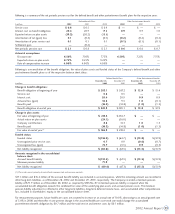

Restructuring & Asset Impairment

Charge

During the fourth quarter of 2001, management approved a

strategic restructuring, which resulted from a comprehensive

business review designed to streamline operations and enhance

operating efficiencies.

Following is a summary of the specific initiatives contained in the

2001 strategic restructuring:

1. 229 CVS/pharmacy and CVS ProCare store locations (the

“Stores”) would be closed by no later than March 2002. Since

these locations were leased facilities, management planned to

either return the premises to the respective landlords at the

conclusion of the current lease term or negotiate an early

termination of the contractual obligations. As of March 31,

2002, all of the Stores had been closed.

2. The Henderson, North Carolina distribution center (the “D.C.”)

would be closed and its operations would be transferred to the

Company’s remaining distribution centers by no later than May

2002. Since this location was owned, management planned to

sell the property upon closure. The D.C. was closed in April

2002 and sold in May 2002.

3. The Columbus, Ohio mail order facility (the “Mail Facility”)

would be closed and its operations would be transferred to the

Company’s Pittsburgh, Pennsylvania mail order facility by no

later than April 2002. Since this location was a leased facility,

management planned to either return the premises to the

landlord at the conclusion of the lease or negotiate an early

termination of the contractual obligation. The Mail Facility was

closed in March 2002.

4. Two satellite office facilities (the “Satellite Facilities”) would be

closed and their operations would be consolidated into the

Company’s Woonsocket, Rhode Island corporate headquarters

by no later than December 2001. Since these locations were

leased facilities, management planned to either return the

premises to the landlords at the conclusion of the leases or

negotiate an early termination of the contractual obligations.

The Satellite Facilities were closed in December 2001.

5. Approximately 1,500 managerial, administrative and store

employees in the Company’s Woonsocket, Rhode Island

corporate headquarters; Columbus Mail Facility; Henderson D.C.

and the Stores would be terminated. As of April 30, 2002, all

of these employees had been terminated.

37

2002 Annual Report

11

In accordance with, Emerging Issues Task Force (“EITF”) Issue 94-

3, “Liability Recognition for Certain Employee Termination Benefits

and Other Costs to Exit an Activity (Including Certain Costs

Incurred in a Restructuring),” SFAS No. 121, and Staff Accounting

Bulletin No. 100, “Restructuring and Impairment Charges,” the

Company recorded a $346.8 million pre-tax charge ($226.9

million after-tax) to operating expenses during the fourth quarter

of 2001 for restructuring and asset impairment costs associated

with the Action Plan. In accordance with Accounting Research

Bulletin No. 43, “Restatement and Revision of Accounting

Research Bulletins,” the Company also recorded a $5.7 million

pre-tax charge ($3.6 million after-tax) to cost of goods sold

during the fourth quarter of 2001 to reflect the markdown of

certain inventory contained in the Stores to its net realizable value.

In total, the restructuring and asset impairment charge was $352.5

million pre-tax ($230.5 million after-tax), or $0.56 per diluted

share in 2001 (the “Restructuring Charge”). The aggregate impact

of the 229 stores on the Company’s consolidated financial

statements for the year ended December 29, 2001, totaled

$585.3 million in net sales and $13.7 million in operating losses,

which included depreciation and amortization of $12.4 million,

incremental markdowns incurred in connection with liquidating

inventory and incremental payroll and other store-related costs

incurred in connection with closing and/or preparing the 229

stores for closing. Whenever possible, the company attempts to

transfer the customer base of its closed stores to adjacent CVS

store locations. The Company’s success in retaining customers and

the related impact on the above revenue and operating income or

loss, however, cannot be precisely calculated.

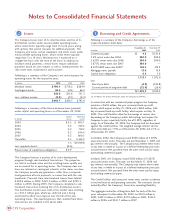

Following is a summary of the significant components of the

Restructuring Charge:

The Restructuring Charge will require total cash payments of

$246.9 million, which primarily consist of noncancelable lease

obligations extending through 2024. As of December 28, 2002,

the remaining future cash payments total $192.1 million.

Noncancelable lease obligations included $227.4 million for the

estimated continuing lease obligations of the Stores, the Mail

Facility and the Satellite Facilities. As required by EITF Issue 88-10,

“Costs Associated with Lease Modification or Termination,” the

estimated continuing lease obligations were reduced by estimated

probable sublease rental income.

In millions

Noncancelable lease obligations $ 227.4

Asset write-offs 105.6

Employee severance and benefits 19.5

Total (1) $ 352.5

(1) The Restructuring Charge is comprised of $5.7 million recorded in cost of goods sold

and $346.8 million recorded in selling, general and administrative expenses.