CVS 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

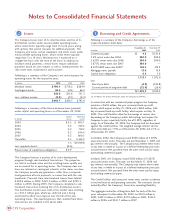

In accordance with Statement of Position No. 98-1,

“Accounting for the Costs of Computer Software Developed or

obtained for Internal Use,” the company capitalizes application

stage development costs for significant internally developed

software projects. These costs are amortized over a 5-year

period. Unamortized costs were $89.5 million as of December

28, 2002 and $87.8 million as of December 29, 2001.

Impairment of long-lived assets ~The Company groups and

evaluates fixed and intangible assets excluding goodwill, for

impairment at the individual store level, which is the lowest level

at which individual cash flows can be identified. When

evaluating assets for potential impairment, the Company first

compares the carrying amount of the asset to the asset’s

estimated future cash flows (undiscounted and without interest

charges). If the estimated future cash flows used in this analysis

are less than the carrying amount of the asset, an impairment

loss calculation is prepared. The impairment loss calculation

compares the carrying amount of the asset to the asset’s

estimated future cash flows (discounted and with interest

charges). If the carrying amount exceeds the asset’s estimated

future cash flows (discounted and with interest charges), then

the intangible assets are written down first, followed by the

other long-lived assets, to fair value.

Intangible assets ~Purchased customer lists are amortized on

a straight-line basis over their estimated useful lives of up to 10

years. Purchased leases are amortized on a straight-line basis

over the remaining life of the lease. See Note 4 for further

information on intangible assets.

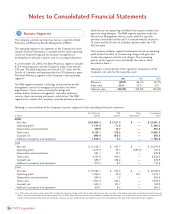

Revenue recognition ~The Company recognizes revenue from

the sale of merchandise at the time the merchandise is sold.

Service revenue from the Company’s pharmacy benefit

management segment, which is recognized using the net

method under Emerging Issues Task Force (“EITF”) No. 99-19

“Reporting Revenue Gross as a Principal Versus Net as an

Agent,” is recognized at the time the service is provided.

Service revenue totaled $84.9 million in 2002 and $82.1

million in 2001. Customer returns are immaterial.

Vendor allowances ~The total value of any upfront payments

received from vendors that are linked to purchase commitments

is initially deferred. The deferred amounts are then amortized to

reduce cost of goods sold over the life of the contract based

upon periodic purchase volume. The total value of any upfront

payments received from vendors that are not linked to purchase

commitments is also initially deferred. The deferred amounts

are then amortized to reduce cost of goods sold on a straight-

line basis over the life of the related contract. The total

amortization of these upfront payments was not material to the

accompanying consolidated financial statements. Funds that are

directly linked to advertising commitments are recognized as a

reduction of advertising expense in the selling, general and

administrative expenses line when the related advertising

commitment is satisfied.

Store opening and closing costs ~New store opening costs,

other than capital expenditures, are charged directly to expense

when incurred. When the Company closes a store, the present

value of estimated unrecoverable costs, including the remaining

lease obligation less estimated sublease income and the book

value of abandoned property and equipment, are charged to

expense.

Insurance ~The Company is self-insured for certain losses

related to general liability, workers’ compensation and

automobile liability. The Company obtains third party insurance

coverage to limit exposure from these claims. The Company’s

self-insurance accruals, which include reported claims and claims

incurred but not reported, are calculated using standard

insurance industry actuarial assumptions and the Company’s

historical claims experience.

Stock-based compensation ~The Company accounts for its

stock-based compensation plans under the recognition and

measurement principles of APB Opinion No. 25, “Accounting for

Stock Issued to Employees,” and related interpretations. As

such, no stock-based employee compensation cost is reflected

in net earnings for options granted under those plans since

they had an exercise price equal to the market value of the

underlying common stock on the date of grant. See Note 7 for

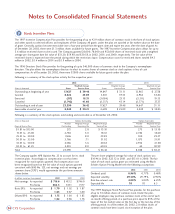

further information on stock-based compensation. The following

table summarizes the effect on net earnings and earnings per

common share if the company had applied the fair value

recognition provisions of Statement of Financial Accounting

Standards (“SFAS”) No. 123, “Accounting for Stock-Based

Compensation,” to stock-based employee compensation for the

respective years:

27

2002 Annual Report

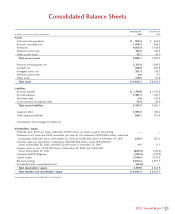

In millions, except per share amounts 2002 2001 2000

Net earnings, as reported $716.6 $ 413.2 $ 746.0

Add: Stock-based employee

compensation expense included

in reported net earnings, net of

related tax effects(1) 2.7 3.3 3.5

Deduct: Total stock-based

employee compensation expense

determined under fair value based

method for all awards, net of

related tax effects 56.8 59.4 31.8

Pro forma net earnings $662.5 $ 357.1 $ 717.7

Basic EPS: As reported $1.79$1.02 $1.87

Pro forma 1.65 0.87 1.80

Diluted EPS: As reported $1.75$1.00 $1.83

Pro forma 1.62 0.86 1.76

(1) Amounts represent the after-tax compensation costs for restricted stock grants.