CVS 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

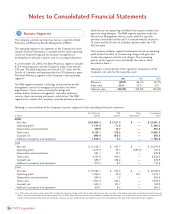

Notes to Consolidated Financial Statements

38 CVS Corporation

Asset write-offs included $59.0 million for fixed asset write-offs,

$40.9 million for intangible asset write-offs and $5.7 million for

the markdown of certain inventory to its net realizable value. The

fixed asset and intangible asset write-offs relate to the Stores, the

Mail Facility and the Satellite Facilities. Management’s decision to

close the above locations was considered to be an event or change

in circumstances as defined in SFAS No. 121. Since management

intended to use the Stores and the Mail Facility on a short-term

basis during the shutdown period, impairment was measured using

the “Assets to Be Held and Used” provisions of SFAS No. 121. The

analysis was prepared at the individual location level, which is the

lowest level at which individual cash flows can be identified. The

analysis first compared the carrying amount of the location’s

assets to the location’s estimated future cash flows (undiscounted

and without interest charges) through the anticipated closing date.

If the estimated future cash flows used in this analysis were less

than the carrying amount of the location’s assets, an impairment

loss calculation was prepared. The impairment loss calculation

compared the carrying value of the location’s assets to the

location’s estimated future cash flows (discounted and with

interest charges). Since these locations will continue to be

operated until closed, any remaining net book value after the

impairment write down was depreciated over their revised useful

lives. Impairment of the Satellite Facilities was measured using the

“Assets to Be Disposed Of” provisions of SFAS No. 121, since

management intended to vacate the locations immediately. The

entire $3.5 million net book value of the Satellite Facilities was

considered to be impaired since management intended to discard

the assets located in the facilities. The inventory markdown

resulted from the liquidation of certain front store inventory

contained in the Stores. Since management intended to liquidate

the inventory below its cost, an adjustment was made to reduce

the inventory’s cost to its net realizable value.

Employee severance and benefits included $19.5 million for

severance pay, healthcare continuation costs and outplacement

service costs related to approximately 1,500 managerial,

administrative and store employees in the Company’s Woonsocket,

Rhode Island corporate headquarters; Columbus, Mail Facility;

Henderson D.C. and the Stores. As of April 30, 2002, all these

employees had been terminated.

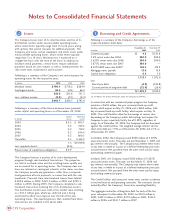

Following is a reconciliation of the beginning and ending liability balances as of December 28, 2002:

Noncancelable Lease Employee

In millions Obligations(1) Asset Write-Offs Severance & Benefits Total

Restructuring charge $ 227.4 $ 105.6 $ 19.5 $ 352.5

Utilized – Cash — — (2.1) (2.1)

Utilized – Non-cash — (105.6) — (105.6)

Balance at 12/29/01 $ 227.4 $ — $ 17.4 $ 244.8

Utilized – Cash (39.6) — (13.1) (52.7)

Balance at 12/28/02(2) $ 187.8 $ — $ 4.3 $ 192.1

(1) Noncancelable lease obligations extend through 2024.

(2) The Company believes that the reserve balances as of December 28, 2002 are adequate to cover the remaining liabilities associated with the Restructuring Charge.