CVS 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

2002 Annual Report

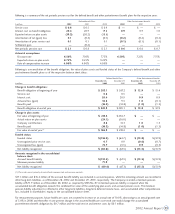

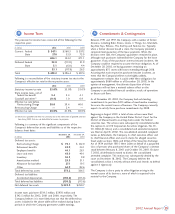

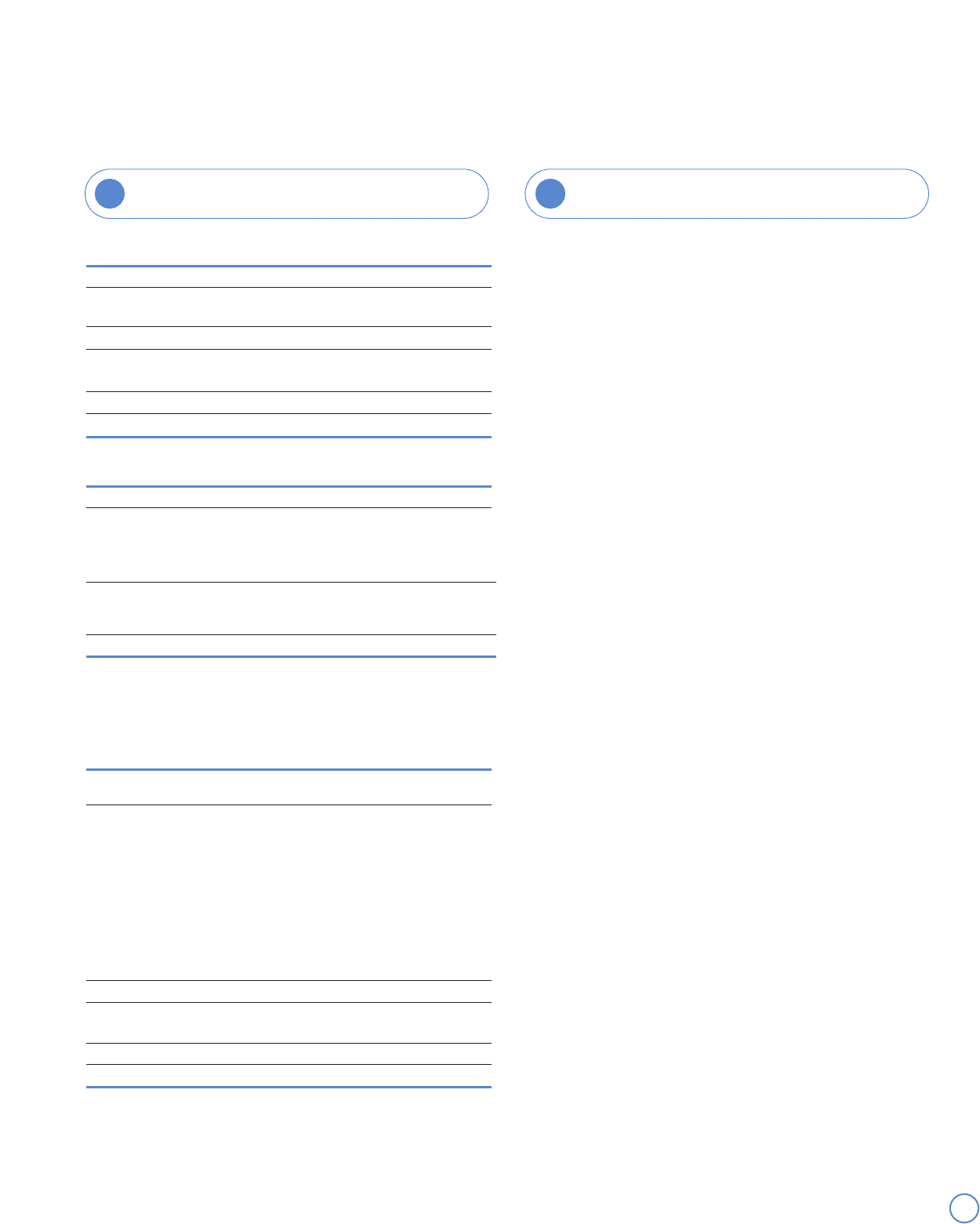

Income Taxes

The provision for income taxes consisted of the following for the

respective years:

Following is a reconciliation of the statutory income tax rate to the

Company’s effective tax rate for the respective years:

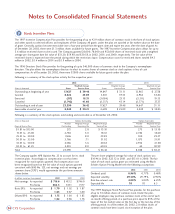

Following is a summary of the significant components of the

Company’s deferred tax assets and liabilities as of the respective

balance sheet dates:

Income taxes paid were $319.5 million, $397.0 million and

$342.5 million for 2002, 2001 and 2000, respectively. The

Company believes it is more likely than not that the deferred tax

assets included in the above table will be realized during future

periods in which the Company generates taxable earnings.

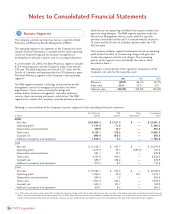

Commitments & Contingencies

Between 1991 and 1997, the Company sold a number of former

divisions, including Bob’s Stores, Linens ‘n Things, Inc., Marshalls,

Kay-Bee Toys, Wilsons, This End Up and Footstar, Inc. Typically,

when a former division leased a store, the Company provided a

corporate level guarantee of the lease payments. When the

divisions were sold, the Company’s guarantees remained in place,

although each purchaser indemnified the Company for the lease

guarantee. If any of the purchasers were to become insolvent, the

Company could be required to assume the lease obligation. As of

December 28, 2002, we had guarantees remaining on

approximately 875 stores with leases extending through 2018.

Assuming that each respective purchaser became insolvent, an

event that the Company believes to be highly unlikely,

management estimates that it could settle these obligations for

approximately $660 million as of December 28, 2002. In the

opinion of management, the ultimate disposition of these

guarantees will not have a material adverse effect on the

Company’s consolidated financial condition, results of operations

or future cash flows.

As of December 28, 2002, the Company had outstanding

commitments to purchase $215 million of merchandise inventory

for use in the normal course of business. The Company currently

expects to satisfy these purchase commitments by 2008.

Beginning in August 2001, a total of nine actions were filed

against the Company in the United States District Court for the

District of Massachusetts asserting claims under the federal

securities laws. The actions were subsequently consolidated under

the caption In re CVS Corporation Securities Litigation, No. 01-

CV-11464 (D. Mass.) and a consolidated and amended complaint

was filed on April 8, 2002. The consolidated amended complaint

names as defendants the Company, its chief executive officer and

its chief financial officer and asserts claims for alleged securities

fraud under sections 10(b) and 20(a) of the Securities Exchange

Act of 1934 and Rule 10b-5 there under on behalf of a purported

class of persons who purchased shares of the Company's common

stock between February 6, 2001 and October 30, 2001. On June

7, 2002, all defendants moved to dismiss the consolidated

amended complaint. This motion was subsequently denied by the

court on December 18, 2002. The Company believes the

consolidated action is entirely without merit and intends to defend

against it vigorously.

The Company is also a party to other litigation arising in the

normal course of its business, none of which is expected to be

material to the Company.

In millions 2002 2001 2000

Current: Federal $347.1 $360.3 $ 397.2

State 57.0 53.9 73.9

404.1 414 . 2 471 . 1

Deferred: Federal 32.0 (111.8) 21.9

State 3.1 (6.0) 4.4

35.1 (117.8) 26.3

Total $439.2 $ 296.4 $ 497.4

2002 2001 2000

Statutory income tax rate 35.0% 35.0% 35.0%

State income taxes, net of

federal tax benefit 3.4 3.4 4.1

Goodwill and other(1) (0.4) 1.0 0.9

Effective tax rate before

Restructuring Charge 38.0 39.4 40.0

Restructuring Charge —2.4 —

Effective tax rate 38.0% 41.8% 40.0%

(1) Decrease in goodwill and other was primarily due to the elimination of goodwill amortiza-

tion during 2002 that was not deductible for income tax purposes.

December 28, December 29,

In millions 2002 2001

Deferred tax assets:

Restructuring Charge $73.1 $122.0

Retirement benefits 53.9 24.1

Employee benefits 44.1 28.1

Lease and rents 43.9 49.1

Inventory 36.3 9.8

Amortization method 29.9 31 . 1

Allowance for bad debt 27.1 19 . 5

Other 64.9 82.6

Total deferred tax assets 373.2 366.3

Deferred tax liabilities:

Accelerated depreciation (150.2) (115.6)

Total deferred tax liabilities (150.2) (115.6)

Net deferred tax assets $223.0 $250.7

8 9