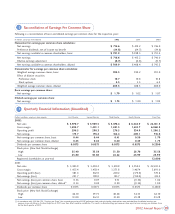

CVS 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

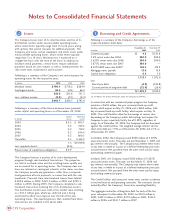

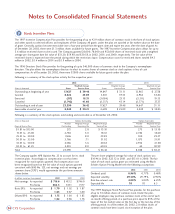

Borrowing and Credit Agreements

Following is a summary of the Company’s borrowings as of the

respective balance sheet dates:

In connection with our commercial paper program, the Company

maintains a $650 million, five-year unsecured back-up credit

facility, which expires on May 21, 2006 and a $650 million, 364-

day unsecured back-up credit facility, which expires on May 19,

2003. The credit facilities allow for borrowings at various rates

depending on the Company’s public debt ratings and require the

Company to pay a quarterly facility fee of 0.08%, regardless of

usage. As of December 28, 2002, the Company had not borrowed

against the credit facilities. The weighted average interest rate for

short-term debt was 1.9% as of December 28, 2002 and 2.1% as

of December 29, 2001.

In October 2002, the Company issued $300 million of 3.875%

unsecured senior notes. The notes are due November 1, 2007, and

pay interest semi-annually. The Company may redeem these notes

at any time, in whole or in part, at a defined redemption price plus

accrued interest. Net proceeds from the notes were used to repay

outstanding commercial paper.

In March 2001, the Company issued $300 million of 5.625%

unsecured senior notes. The notes are due March 15, 2006 and

pay interest semi-annually. The Company may redeem these notes

at any time, in whole or in part, at a defined redemption price plus

accrued interest. Net proceeds from the notes were used to repay

outstanding commercial paper.

The Credit Facilities and unsecured senior notes contain customary

restrictive financial and operating covenants. The covenants do not

materially affect the Company’s financial or operating flexibility.

The aggregate maturities of long-term debt for each of the five

years subsequent to December 28, 2002 are $32.0 million in

2003, $323.2 million in 2004, $27.9 million in 2005, $334.3

million in 2006, and $341.7 million in 2007.

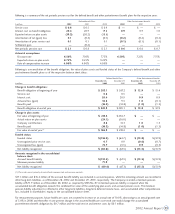

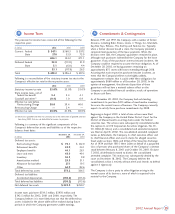

Leases

The Company leases most of its retail locations and five of its

distribution centers under noncancelable operating leases,

whose initial terms typically range from 15 to 22 years, along

with options that permit renewals for additional periods. The

Company also leases certain equipment and other assets under

noncancelable operating leases, whose initial terms typically

range from 3 to 10 years. Minimum rent is expensed on a

straight-line basis over the term of the lease. In addition to

minimum rental payments, certain leases require additional

payments based on sales volume, as well as reimbursements for

real estate taxes, maintenance and insurance.

Following is a summary of the Company’s net rental expense for

operating leases for the respective years:

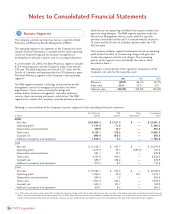

Following is a summary of the future minimum lease payments

under capital and operating leases as of December 28, 2002:

The Company finances a portion of its store development

program through sale-leaseback transactions. The properties

are sold at net book value and the resulting leases qualify and

are accounted for as operating leases. The Company does not

have any retained or contingent interests in the stores nor does

the Company provide any guarantees, other than a corporate

level guarantee of lease payments, in connection with the sale-

leasebacks. Proceeds from sale-leaseback transactions totaled

$448.8 million in 2002, $323.3 million in 2001 and $299.3

million in 2000. During 2001, the Company completed a sale-

leaseback transaction involving five of its distribution centers.

The distribution centers were sold at fair market value resulting

in a $35.5 million gain, which was deferred and is being

amortized to offset rent expense over the life of the new

operating leases. The operating leases that resulted from these

transactions are included in the above table.

Notes to Consolidated Financial Statements

Capital Operating

In millions Leases Leases

2003 $ 0.2 $ 805.1

2004 0.2 769.2

2005 0.2 718.2

2006 0.2 654.4

2007 0.2 600.5

Thereafter 0.5 6,162.4

1.5 $9,709.8

Less: imputed interest (0.6)

Present value of capital lease obligations $ 0.9

In millions 2002 2001 2000

Minimum rentals $ 790.4 $758.2 $684.9

Contingent rentals 65.6 67.6 66.3

856.0 825.8 751.2

Less: sublease income (9.3) (9.1) (9.2)

$846.7 $ 816.7 $742.0

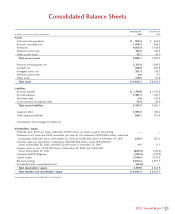

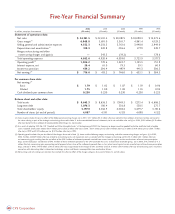

December 28, December 29,

In millions 2002 2001

Commercial paper $4.8 $235.8

5.5% senior notes due 2004 300.0 300.0

5.625% senior notes due 2006 300.0 300.0

3.875% senior notes due 2007 300.0 —

8.52% ESOP notes due 2008(1) 19 4 . 4 219 . 9

Mortgage notes payable 13. 0 15 . 9

Capital lease obligations 0.9 1.0

1,113.1 1,072.6

Less:

Short-term debt (4.8) (235.8)

Current portion of long-term debt (32.0) (26.4)

$ 1,076.3 $810.4

(1) See Note 5 for further information about the Company’s ESOP Plan.

30 CVS Corporation

2 3