CVS 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

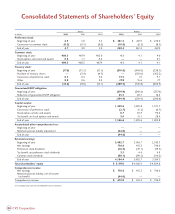

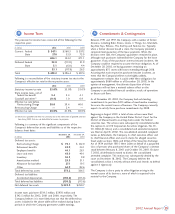

Employee Stock Ownership Plan

The Company sponsors a defined contribution Employee Stock

Ownership Plan (the “ESOP”) that covers full-time employees with

at least one year of service.

In 1989, the ESOP Trust issued and sold $357.5 million of 20-

year, 8.52% notes due December 31, 2008 (the “ESOP Notes”).

The proceeds from the ESOP Notes were used to purchase 6.7

million shares of Series One ESOP Convertible Preference Stock

(the “ESOP Preference Stock”) from the Company. Since the ESOP

Notes are guaranteed by the Company, the outstanding balance is

reflected as long-term debt and a corresponding guaranteed ESOP

obligation is reflected in shareholders’ equity in the accompanying

consolidated balance sheets.

Each share of ESOP Preference Stock has a guaranteed minimum

liquidation value of $53.45, is convertible into 2.314 shares of

common stock and is entitled to receive an annual dividend of

$3.90 per share. The ESOP Trust uses the dividends received and

contributions from the Company to repay the ESOP Notes. As the

ESOP Notes are repaid, ESOP Preference Stock is allocated to

participants based on: (i) the ratio of each year’s debt service

payment to total current and future debt service payments

multiplied by (ii) the number of unallocated shares of ESOP

Preference Stock in the plan. As of December 28, 2002, 4.7

million shares of ESOP Preference Stock were outstanding, of

which 2.5 million shares were allocated to participants and the

remaining 2.2 million shares were held in the ESOP Trust for future

allocations.

Annual ESOP expense recognized is equal to (i) the interest

incurred on the ESOP Notes plus (ii) the higher of (a) the

principal repayments or (b) the cost of the shares allocated, less

(iii) the dividends paid. Similarly, the guaranteed ESOP obligation

is reduced by the higher of (i) the principal payments or (ii) the

cost of shares allocated.

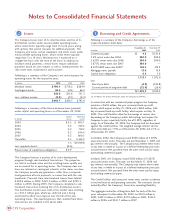

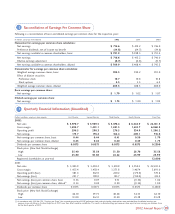

Following is a summary of the ESOP activity for the respective

years:

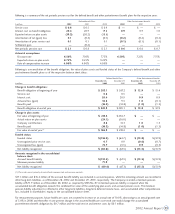

Pension Plans and Other

Postretirement Benefits

The Company sponsors a noncontributory defined benefit pension

plan that covers certain full-time employees of Revco, D.S., Inc.

who were not covered by collective bargaining agreements. On

September 20, 1997, the Company suspended future benefit

accruals under this plan. Benefits paid to retirees are based upon

age at retirement, years of credited service and average

compensation during the five year period ending September 20,

1997. The plan is funded based on actuarial calculations and

applicable federal regulations.

Pursuant to various labor agreements, the Company is also

required to make contributions to certain union-administered

pension and health and welfare plans that totaled $12.1 million in

2002, $11.1 million in 2001and $9.3 million in 2000. The

Company also has nonqualified supplemental executive retirement

plans in place for certain key employees for whom it has purchased

cost recovery variable life insurance.

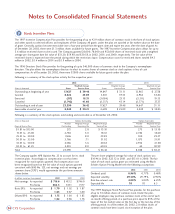

Defined Contribution Plans

The Company sponsors a voluntary 401(k) Savings Plan that

covers substantially all employees who meet plan eligibility

requirements. The Company makes matching contributions

consistent with the provisions of the plan. At the participant’s

option, account balances, including the Company’s matching

contribution, can be moved without restriction among various

investment options, including the Company’s common stock. The

Company also maintains a nonqualified, unfunded Deferred

Compensation Plan for certain key employees. This plan provides

participants the opportunity to defer portions of their

compensation and receive matching contributions that they would

have otherwise received under the 401(k) Savings Plan if not for

certain restrictions and limitations under the Internal Revenue

Code. The Company’s contributions under the above defined

contribution plans totaled $29.1 million in 2002, $26.7 million in

2001and $23.0 million in 2000. The Company also sponsors an

Employee Stock Ownership Plan. See Note 5 for further

information about this plan.

Other Postretirement Benefits

The Company provides postretirement healthcare and life

insurance benefits to certain retirees who meet eligibility

requirements. The Company’s funding policy is generally to pay

covered expenses as they are incurred. For retiree medical plan

accounting, the Company reviews external data and its own

historical trends for healthcare costs to determine the healthcare

cost trend rates.

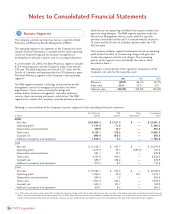

Notes to Consolidated Financial Statements

32 CVS Corporation

5

In millions 2002 2001 2000

ESOP expense recognized $26.0 $22.1 $ 18.8

Dividends paid 18 . 3 19 . 1 19 . 5

Cash contributions 26.0 22.1 18.8

Interest payments 18 . 7 20.5 21.9

ESOP shares allocated 0.4 0.4 0.3

6