CVS 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

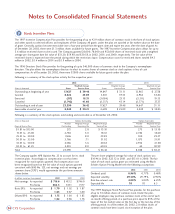

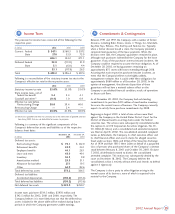

Intangible assets other than goodwill are required to be

separated into two categories: finite-lived and indefinite-lived.

Intangible assets with finite useful lives are amortized over their

estimated useful life, while intangible assets with indefinite

useful lives are not amortized. The Company currently has no

intangible assets with indefinite lives.

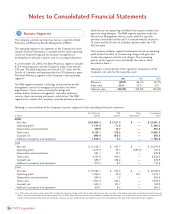

Following is a summary of the Company’s amortizable intangible

assets as of the respective balance sheet dates:

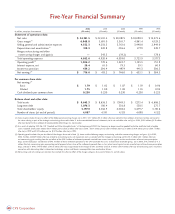

The amortization expense for these intangible assets totaled

$53.3 million in 2002, $52.7 million in 2001 and $48.2 million in

2000. The anticipated annual amortization expense for these

intangible assets is $57.2 million in 2003, $49.5 million in 2004,

$43.3 million in 2005, $40.2 million in 2006, and $38.0 million

in 2007.

Goodwill and Other Intangibles

Goodwill represents the excess of the purchase price over the

fair value of net assets acquired. Effective December 30, 2001,

the Company adopted SFAS No. 142, “Goodwill and Other

Intangible Assets.” As a result of the adoption, goodwill is no

longer being amortized, but is subject to annual impairment

reviews, or more frequent reviews if events or circumstances

indicate there may be an impairment. The Company groups and

evaluates goodwill for impairment at the reporting unit level

annually, or whenever events or circumstances indicate there

may be an impairment. When evaluating goodwill for potential

impairment, the Company first compares the fair value of the

reporting unit, based on estimated future discounted cash flows,

with its carrying amount. If the estimated fair value of the

reporting unit is less than its carrying amount, an impairment

loss calculation is prepared. The impairment loss calculation

compares the implied fair value of reporting unit goodwill with

the carrying amount of that goodwill. If the carrying amount of

reporting unit goodwill exceeds the implied fair value of that

goodwill, an impairment loss is recognized in an amount equal

to that excess. Upon adoption, the Company performed the

required implementation impairment review, which resulted in no

impairment of goodwill. During 2002, the Company also

performed its required annual goodwill impairment test, which

concluded there was no impairment of goodwill.

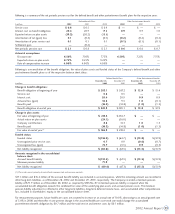

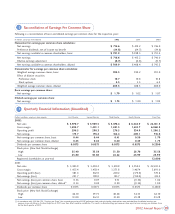

The following summary details the after-tax impact, on a pro

forma basis, of discontinuing the amortization of goodwill on

net earnings and earnings per common share (“EPS”) for the

respective years:

The carrying amount of goodwill as of December 28, 2002 was

$878.9 million. During 2002, gross goodwill increased $4.0

million, primarily due to store acquisitions. There was no

impairment of goodwill during 2002.

31

2002 Annual Report

4

In millions 2002 2001 2000

Net earnings:

As reported $716.6 $ 413.2 $ 746.0

Goodwill amortization —28.2 31.9

As adjusted 716.6 441.4 777.9

Basic EPS:

As reported $1.79$1.02 $1.87

Goodwill amortization —0.07 0.08

As adjusted 1.79 1.09 1.95

Diluted EPS:

As reported $1.75$1.00 $1.83

Goodwill amortization —0.07 0.08

As adjusted 1.75 1.07 1.91

December 28, 2002 December 29, 2001

Gross Gross

Carrying Accum. Carrying Accum.

In millions Amount Amort. Amount Amort.

Customer lists and

Covenants not to

compete(1) $ 464.5 $(194.1) $ 379.7 $(135.1)

Favorable leases and

Other(2) 153 . 1 ( 72 . 1 ) 134 . 7 ( 61 . 0 )

$ 617.6 $(266.2) $ 514.4 $(196.1)

(1) The increase in the gross carrying amount during 2002 was primarily due to the acquisi-

tion of customer lists.

(2) The increase in the gross carrying amount during 2002 was primarily due to the acquisi-

tion of leases with rents below market rates.