CVS 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

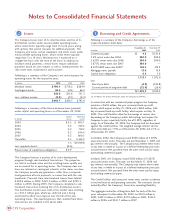

In June 2001, SFAS No. 143, "Accounting for Asset Retirement

Obligations" was issued. This statement applies to legal

obligations associated with the retirement of certain tangible

long-lived assets. As required, the Company will adopt this

statement effective in 2003. The Company does not expect

that the adoption of this statement will have a material impact

on its consolidated results of operations or financial position.

The Company adopted SFAS No. 144, "Accounting for the

Impairment or Disposal of Long-Lived Assets" effective

December 30, 2001. This statement addresses financial

accounting and reporting for the impairment or disposal of

long-lived assets. The adoption of this statement did not have a

material impact on the Company’s consolidated results of

operations or financial position.

In April 2002, SFAS No. 145, "Rescission of FASB Statements

No. 4, 44 and 64, Amendment of FASB Statement No. 13, and

Technical Corrections" was issued. This statement (i) eliminates

extraordinary accounting treatment for a gain or loss reported

on the extinguishment of debt, (ii) eliminates inconsistencies in

the accounting required for sale-leaseback transactions and

certain lease modifications with similar economic effects, and

(iii) amends other existing authoritative pronouncements to

make technical corrections, clarify meanings, or describe their

applicability under changed conditions. As required, the

Company will adopt SFAS No. 145 effective in 2003. The

Company does not expect that the adoption of this statement

will have a material impact on its consolidated results of

operations or financial position.

In June 2002, SFAS No. 146, "Accounting for Costs Associated

with Exit or Disposal Activities" was issued. This statement

nullifies existing guidance related to the accounting and

reporting for costs associated with exit or disposal activities

and requires that the fair value of a liability associated with an

exit or disposal activity be recognized when the liability is

incurred. Under previous guidance, certain exit costs were

permitted to be accrued upon management's commitment to an

exit plan, which is generally before an actual liability has been

incurred. The provisions of this statement are required to be

adopted for all exit or disposal activities initiated after

December 31, 2002. This statement will not impact any

liabilities recorded prior to adoption. As required, the Company

will adopt SFAS No. 146 effective in 2003. The Company does

not expect that the adoption of this statement will have a

material impact on its consolidated results of operations or

financial position.

In September 2002, the EITF Issue No. 02-16, “Accounting by

a Reseller for Cash Consideration Received from a Vendor” was

issued. The pronouncement addresses two issues. The first issue

requires that vendor allowances be categorized as a reduction

of cost of sales unless they are a reimbursement of costs

incurred to sell the vendor’s products, in which case, the cash

consideration should be characterized as a reduction of that

cost. Cash consideration received from a vendor in excess of the

fair value of the benefit received should be characterized as a

reduction of cost of sales. As required, the Company will adopt

this portion of the pronouncement in 2003. The second issue

requires that rebates or refunds payable only if the customer

completes a specified cumulative level of purchases should be

recognized as a reduction of cost of sales based on a systematic

and rational allocation over the purchase period. This portion of

the pronouncement is to be applied to all new arrangements

initiated after November 21, 2002. The Company does not

expect that the adoption of this pronouncement will have a

material impact on its consolidated results of operations or

financial position.

In November 2002, FASB Interpretation No. 45, “Guarantor’s

Accounting and Disclosure Requirements for Guarantees,

Including Indirect Guarantees of Indebtedness of Others” was

issued. This interpretation requires certain guarantees to be

recorded at fair value as opposed to the current practice of

recording a liability only when a loss is probable and reasonably

estimable. It also requires a guarantor to make enhanced

disclosures concerning guarantees, even when the likelihood of

making any payments under the guarantee is remote. The initial

recognition and initial measurement provisions are applicable on

a prospective basis to guarantees issued or modified after

December 31, 2002, while the enhanced disclosure

requirements are effective after December 15, 2002. The

Company does not expect the adoption of this interpretation

will have a material impact on its consolidated financial position

or results in operation.

In December 2002, SFAS No. 148, “Accounting for Stock-Based

Compensation–Transition and Disclosure” was issued. This

statement provides alternative methods of transition for a

voluntary change to the fair value based method of accounting

for stock-based employee compensation. This statement also

amends the disclosure requirements of SFAS No. 123 to require

prominent disclosures about the method of accounting for

stock-based compensation and the effect of the method used

on reported results. As required, the Company adopted this

statement effective in 2002. The adoption did not have a

material impact on the Company’s consolidated results of

operations or financial position.

In January 2003, FASB Interpretation No. 46, “Consolidation of

Variable Interest Entities” was issued. This interpretation requires

a company to consolidate variable interest entities (“VIE”) if the

enterprise is a primary beneficiary (holds a majority of the

variable interest) of the VIE and the VIE possesses specific

characteristics. It also requires additional disclosures for parties

involved with VIEs. The provisions of this interpretation are

effective in 2003. Accordingly, the Company will adopt FASB

Interpretation No. 46 effective fiscal 2003 and is evaluating the

effect such adoption may have on its consolidated results of

operations and financial position.

29

2002 Annual Report