CVS 2002 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2002 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•

Total operating expenses as a percentage of net sales increased

during 2001 primarily due to higher store payroll expense

resulting from market wage pressures and the shortage of

pharmacists previously discussed, as well as increased benefit

costs due to rising healthcare costs and higher advertising

expense as we implemented a customer reactivation program

aimed at attracting lost customers and in response to the

increasingly competitive environment.

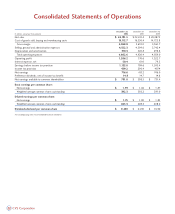

Operating profit increased $435.6 million in 2002 to $1,206.2

million. This compares to $770.6 million in 2001 and $1,322.7

million in 2000. Operating profit as a percentage of net sales was

5.0% in 2002, 3.5% in 2001 and 6.6% in 2000. If you exclude the

effect of the Restructuring Charge and the $3.5 million net

nonrecurring gain in 2001 and the $19.2 million nonrecurring

litigation gain in 2000, operating profit increased $86.6 million in

2002 to $1,206.2 million. This compares to $1,119.6 million in

2001 and $1,303.5 million in 2000. Excluding the above

nonrecurring items, operating profit as a percentage of net sales was

5.0% in 2002, 5.0% in 2001, and 6.5% in 2000.

Interest expense, net consisted of the following:

Interest expense declined in 2001 and 2002 due to a combination

of lower interest rates and lower average debt balances.

Income tax provision ~Our effective income tax rate was 38.0% in

2002, 41.8% in 2001 and 40.0% in 2000. The decrease in our

effective income tax rate in 2002 was primarily due to the

elimination of goodwill amortization that was not deductible for

income tax purposes. Our effective income tax rate was higher in

2001 because certain components of the Restructuring Charge were

not deductible for income tax purposes. Excluding the impact of the

strategic restructuring, our effective tax rate was 39.4% in 2001.

The decrease in our effective income tax rate in 2001 was primarily

due to lower state income taxes.

Net earnings increased $303.4 million to $716.6 million (or $1.75

per diluted share) in 2002. This compares to $413.2 million (or

$1.00 per diluted share) in 2001 and $746.0 million (or $1.83 per

diluted share) in 2000. If you exclude the effect of the Restructuring

Charge and the $2.1 million net nonrecurring gain (or $0.56 per

diluted share) in 2001 and the $11.5 million after-tax litigation gain

(or $0.03 per diluted share) in 2000, our net earnings increased

$75.0 million to $716.6 million (or $1.75 per diluted share) in

2002. This compares to $641.6 million (or $1.56 per diluted share)

in 2001 and $734.5 million (or $1.80 per diluted share) in 2000.

Liquidity & Capital Resources

We anticipate that cash flow from operations, supplemented by

commercial paper and long-term borrowings, will continue to fund

the growth of our business.

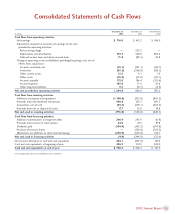

Net cash provided by operating activities increased to $1,204.8

million in 2002. This compares to $680.6 million in 2001 and

$780.2 million in 2000. The improvement in net cash provided by

operations during 2002 was primarily the result of higher net

earnings and improved inventory management. Cash provided by

operating activities will continue to be negatively impacted by future

payments associated with the strategic restructuring. The timing of

future cash payments related to the strategic restructuring depends

on when, and if, early lease terminations can be reached. As of

December 28, 2002, the remaining payments, which primarily

consist of noncancelable lease obligations extending through 2024,

totaled $192.1 million.

Net cash used in investing activities increased to $735.8 million in

2002. This compares to $536.8 million in 2001 and $640.5 million

in 2000. The increase in net cash used in investing activities during

2002 was primarily due to higher capital expenditures. Capital

expenditures totaled $1,108.8 million during 2002, compared to

$713.6 million in 2001 and $695.3 million in 2000. Approximately

89% of total expenditures in 2002 were for new stores, store

expansions and/or remodels. During 2002, we opened 78 stores in

new markets, including: Chicago, Illinois; Las Vegas, Nevada; Phoenix,

Arizona; and several markets in Florida and Texas. During 2003, we

currently plan to invest over $1 billion in capital expenditures, which

includes spending for approximately 150 -175 new stores (80-100 in

new markets), 100 relocations and 50 closings. We also currently

expect to begin construction of a new distribution center in Texas

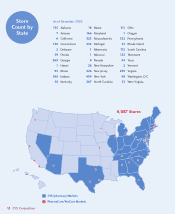

during 2003. As of December 28, 2002, we operated 4,087 retail

and specialty pharmacy stores in 32 states and the District of

Columbia.

Following is a summary of our store development activity for the

respective years:

We finance a portion of our new store development program through

sale-leaseback transactions. Proceeds from sale-leaseback

transactions totaled $448.8 million in 2002. This compares to

$323.3 million in 2001 and $299.3 million in 2000. The properties

are sold at net book value and the resulting leases qualify and are

accounted for as operating leases. During 2001, we also completed a

Management’s Discussion and Analysis of

16 CVS Corporation

In millions 2002 2001 2000

Interest expense $54.5 $65.2 $84.1

Interest income (4.1) (4.2) (4.8)

Interest expense, net $50.4 $61.0 $79.3

2002 2001 2000

Total stores (beginning of year) 4,191 4,133 4,098

New stores 174 126 158

Closed stores (278) (68) (123)

Total stores (end of year) 4,087 4,191 4,133

Relocated stores(1) 92 122 23 0

(1) Relocated stores are not included in new or closed store totals.