CVS 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 CVS annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

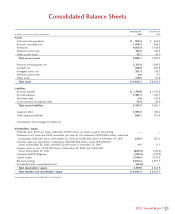

Consolidated Balance Sheets

23

2002 Annual Report

December 28, December 29,

In millions, except shares and per share amounts 2002 2001

Assets:

Cash and cash equivalents $ 700.4 $236.3

Accounts receivable, net 1,019.3 966.2

Inventories 4,013.9 3,918.6

Deferred income taxes 216.4 242.6

Other current assets 32.1 46.2

Total current assets 5,982.1 5,409.9

Property and equipment, net 2,215.8 1,847.3

Goodwill, net 878.9 874.9

Intangible assets, net 351.4 318 . 3

Deferred income taxes 6.6 8.1

Other assets 210.5 177. 8

Total assets $ 9,645.3 $ 8,636.3

Liabilities:

Accounts payable $ 1,707.9 $ 1,535.8

Accrued expenses 1,361.2 1,267.1

Short-term debt 4.8 235.8

Current portion of long-term debt 32.0 26.4

Total current liabilities 3,105.9 3,065.1

Long-term debt 1,076.3 810 . 4

Other long-term liabilities 266.1 193 . 9

Commitments and contingencies (Note 9)

Shareholders’ equity:

Preferred stock, $0.01 par value: authorized 120,619 shares; no shares issued or outstanding ——

Preference stock, series one ESOP convertible, par value $1.00: authorized 50,000,000 shares; issued and

outstanding 4,685,000 shares at December 28, 2002 and 4,887,000 shares at December 29, 2001 250.4 261.2

Common stock, par value $0.01: authorized 1,000,000,000 shares; issued 409,286,000

shares at December 28, 2002 and 408,532,000 shares at December 29, 2001 4.1 4.1

Treasury stock, at cost: 16,215,000 shares at December 28, 2002 and 17,645,000

shares at December 29, 2001 (469.5) (510.8)

Guaranteed ESOP obligation (194.4) (219.9)

Capital surplus 1,546.6 1,539.6

Retained earnings 4,104.4 3,492.7

Accumulated other comprehensive loss (44.6) —

Total shareholders’ equity 5,197.0 4,566.9

Total liabilities and shareholders’ equity $ 9,645.3 $ 8,636.3

See accompanying notes to consolidated financial statements.