American Airlines 2001 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.7

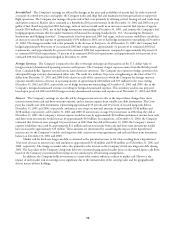

American’s domestic RASM increased 12.4 percent, to 10.42 cents, on a capacity decrease of 1.6 percent, or 109.5 billion

ASMs. The decrease in domestic capacity was due primarily to the Company’s More Room Throughout Coach program. Inter-

national RASM increased to 9.64 cents, or 10.7 percent, on a capacity increase of 3.2 percent. The increase in international

RASM was led by a 16.5 percent, 13.4 percent and 7.8 percent increase in Pacific, European and Latin American RASM,

respectively. The increase in international capacity was driven by a 6.6 percent, 2.7 percent and 0.5 percent increase in European,

Pacific and Latin American ASMs, respectively.

AMR Eagle’s passenger revenues increased $158 million, or 12.2 percent. AMR Eagle’s traffic increased to 3.7 billion

RPMs, up 10.7 percent, while capacity increased to 6.3 billion ASMs, or 10.9 percent. The increase in revenues was due primarily

to growth in AMR Eagle capacity aided by a strong U.S. economy, which led to strong demand for air travel, and a favorable

pricing environment.

Cargo revenues increased 12.1 percent, or $78 million, due primarily to a fuel surcharge implemented in February 2000

and increased in October 2000, and the increase in cargo capacity from the addition of 16 Boeing 777-200ER aircraft in 2000.

OPERATING EXPENSES

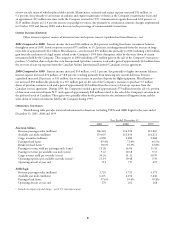

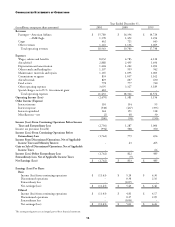

2001 Compared to 2000 The Company’s operating expenses increased 17 percent, or approximately $3.1 billion. However,

excluding TWA’s expenses for the period April 10, 2001 through December 31, 2001, the Company’s expenses would have

increased approximately $888 million versus 2000. In addition to the specific explanations provided below, the significant

decline in passenger traffic resulting from the terrorist acts of September 11, 2001 and resulting reduced operating schedule

caused a favorable impact on certain passenger-related operating expenses, including aircraft fuel, other rentals and landing fees,

commissions to agents and food service. American’s cost per ASM increased 6.3 percent to 11.14 cents, excluding TWA and

the impact of special charges – net of U.S. Government grant. The increase in American’s cost per ASM was driven partially by

a reduction in ASMs due to the Company’s More Room Throughout Coach program. Removing the impact of this program,

American’s cost per ASM grew approximately 3.3 percent, excluding TWA and the impact of special charges – net of U.S.

Government grant. TWA’s cost per ASM, excluding the impact of special charges – net of U.S. Government grant, was

10.58 cents. Wages, salaries and benefits increased 18.4 percent, or $1.3 billion, and included approximately $920 million

related to the addition of TWA. The remaining increase of approximately $329 million related primarily to an increase in the

average number of equivalent employees and contractual wage rate and seniority increases that are built into the Company’s

labor contracts. During 2001, the Company recorded approximately $300 million in additional wages, salaries and benefits

related primarily to the Company’s new contracts with its flight attendants and Transport Workers Union work groups. This

was mostly offset by a $328 million decrease in the provision for profit-sharing as compared to 2000. Aircraft fuel expense

increased 15.8 percent, or $393 million, and included approximately $322 million related to the addition of TWA. The

remaining increase in aircraft fuel expense was due to a 4.2 percent increase in the Company’s average price per gallon,

partially offset by a 3.7 percent decrease in the Company’s fuel consumption, excluding TWA. Depreciation and amortization

expense increased 16.8 percent, or $202 million, due primarily to the addition of new aircraft and an increase of approximately

$88 million related to TWA. Other rentals and landing fees increased $198 million, or 19.8 percent, and included approximately

$130 million related to the addition of TWA. The remaining increase of $68 million was due primarily to higher facilities rent

and landing fees across the Company’s system. Commissions to agents decreased 19.5 percent, or $202 million, and included

approximately $59 million related to TWA. The decrease in commissions to agents was due primarily to a 13.2 percent decrease

in passenger revenues, excluding TWA, and the benefit from commission structure changes implemented in 2000. Aircraft rentals

increased $222 million, or 36.6 percent, due primarily to the addition of TWA aircraft. Other operating expenses increased

11.1 percent, or $368 million, and included approximately $358 million related to TWA. Special charges – net of U.S. Govern-

ment grant included: (i) a $685 million asset impairment charge recorded in the second quarter of 2001 related to the write-down

of the carrying value of the Company’s Fokker 100, Saab 340 and ATR-42 aircraft and related rotables, (ii) charges resulting from

the September 11, 2001 terrorist events, including approximately $552 million related to aircraft charges, $115 million in facility

exit costs, $71 million in employee charges and $43 million in other charges, and (iii) an $856 million benefit recognized for the

reimbursement from the U.S. Government under the Act. See a further discussion of special charges – net of U.S. Government

grant in Note 2 to the consolidated financial statements.

2000 Compared to 1999 The Company’s operating expenses increased 10.5 percent, or approximately $1.7 billion. American’s

cost per ASM increased by 10.3 percent to 10.48 cents, partially driven by a reduction in ASMs due to the Company’s More

Room Throughout Coach program. Removing the impact of this program, American’s cost per ASM grew approximately

6.9 percent. Wages, salaries and benefits increased $663 million, or 10.8 percent, primarily due to an increase in the average

number of equivalent employees and contractual wage rate and seniority increases that are built into the Company’s labor

contracts, an increase of approximately $93 million in the provision for profit-sharing, and a charge of approximately $56 million

for the Company’s employee home computer program. Aircraft fuel expense increased $799 million, or 47.1 percent, due to an

increase of 42.0 percent in the Company’s average price per gallon and a 3.7 percent increase in the Company’s fuel consumption.

The increase in fuel expense is net of gains of approximately $545 million recognized during 2000 related to the Company’s fuel

hedging program. Depreciation and amortization expense increased $110 million, or 10.1 percent, due primarily to the addition