American Airlines 2001 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

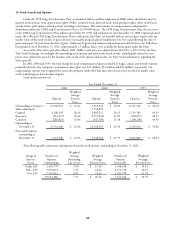

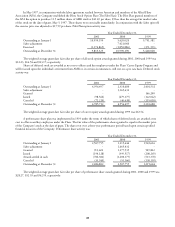

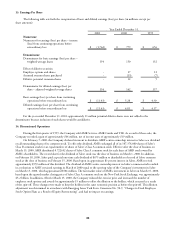

The Company has adopted the pro forma disclosure features of Statement of Financial Accounting Standards No. 123,

“Accounting for Stock-Based Compensation” (SFAS 123). As required by SFAS 123, pro forma information regarding income

(loss) from continuing operations before extraordinary loss and earnings (loss) per share from continuing operations before

extraordinary loss have been determined as if the Company had accounted for its employee stock options and awards granted

subsequent to December 31, 1994 using the fair value method prescribed by SFAS 123. The fair value for the stock options was

estimated at the date of grant using a Black-Scholes option pricing model with the following weighted-average assumptions for

2001, 2000 and 1999: risk-free interest rates ranging from 4.58% to 6.15%; dividend yields of 0%; expected stock volatility

ranging from 31.3% to 45.2%; and expected life of the options of 4.5 years for the Plans and 1.5 years for The Pilot Plan.

The Black-Scholes option valuation model was developed for use in estimating the fair value of traded options that

have no vesting restrictions and are fully transferable. In addition, option valuation models require the input of highly subjective

assumptions, including the expected stock price volatility. Because the Company’s employee stock options have characteristics

significantly different from those of traded options, and because changes in the subjective input assumptions can materially affect

the fair value estimate, in management’s opinion, the existing models do not necessarily provide a reliable single measure of the

fair value of its employee stock options.

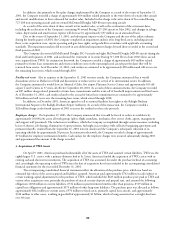

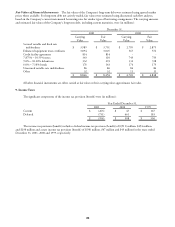

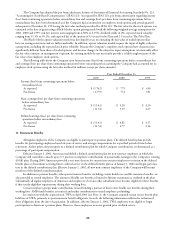

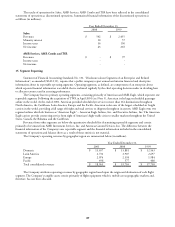

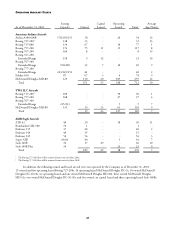

The following table shows the Company’s pro forma income (loss) from continuing operations before extraordinary loss

and earnings (loss) per share from continuing operations before extraordinary loss assuming the Company had accounted for its

employee stock options using the fair value method (in millions, except per share amounts):

Year Ended December 31,

2001 2000 1999

Income (loss) from continuing operations before

extraordinary loss:

As reported $ (1,762) $ 779 $ 656

Pro forma (1,779) 772 651

Basic earnings (loss) per share from continuing operations

before extraordinary loss:

As reported $ (11.43) $ 5.20 $ 4.30

Pro forma (11.54) 5.15 4.27

Diluted earnings (loss) per share from continuing

operations before extraordinary loss:

As reported $ (11.43) $ 4.81 $ 4.17

Pro forma (11.54) 4.77 4.14

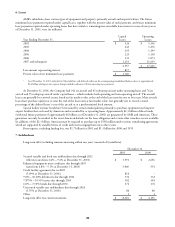

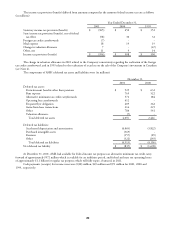

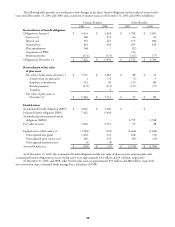

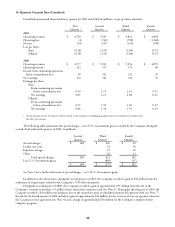

11. Retirement Benefits

All regular employees of the Company are eligible to participate in pension plans. The defined benefit plans provide

benefits for participating employees based on years of service and average compensation for a specified period of time before

retirement. Airline pilots also participate in a defined contribution plan for which Company contributions are determined as a

percentage of participant compensation.

Effective January 1, 2001, American established a defined contribution plan for non-contract employees in which the

Company will contribute a match up to 5.5 percent on employee contributions of pensionable earnings to the Company’s existing

401(k) plan. During 2000, American provided a one-time election for current non-contract employees to remain in the defined

benefit plan or discontinue accruing future credited service in the defined benefit plan as of January 1, 2001 and begin participa-

tion in the defined contribution plan. Effective January 1, 2002, all new non-contract employees of the Company will become

members of the defined contribution plan.

In addition to pension benefits, other postretirement benefits, including certain health care and life insurance benefits, are

also provided to retired employees. The amount of health care benefits is limited to lifetime maximums as outlined in the plan.

Substantially all regular employees of American and employees of certain other subsidiaries may become eligible for these benefits

if they satisfy eligibility requirements during their working lives.

Certain employee groups make contributions toward funding a portion of their retiree health care benefits during their

working lives. AMR funds benefits as incurred and makes contributions to match employee prefunding.

In connection with the acquisition of TWA in April 2001 (see Note 3), the Company assumed certain retiree benefit plan

liabilities of TWA, primarily its postretirement benefit obligation. As such, the following information reflects the inclusion of

these obligations from the date of acquisition. In addition, effective January 1, 2002, TWA employees were eligible to begin

participation in American’s pension plans. However, these employees were not granted prior credited service.