American Airlines 2001 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

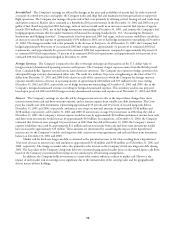

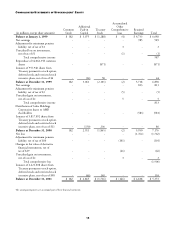

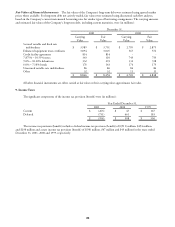

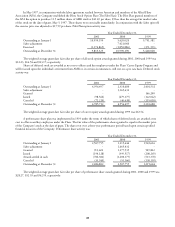

The following table provides unaudited pro forma consolidated results of operations, assuming the acquisition had

occurred as of January 1, 2000 (in millions, except per share amounts):

(Unaudited)

Year Ended December 31,

2001 2000

Operating revenues $ 19,830 $ 23,265

Income (loss) from continuing operations (1,769) 687

Net earnings (loss) (1,769) 730

Earnings (loss) per share – diluted $ $ 4.51

The unaudited pro forma consolidated results of operations have been prepared for comparative purposes only. These

amounts are not indicative of the combined results which would have occurred had the transaction actually been consummated

on the date indicated above and are not indicative of the consolidated results of operations which may occur in the future.

4. Investments

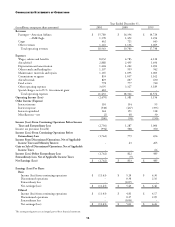

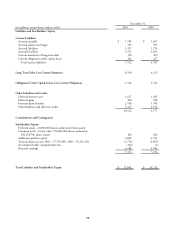

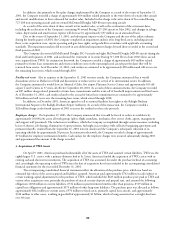

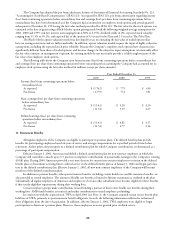

Short-term investments consisted of (in millions):

December 31,

2001 2000

Overnight investments and time deposits $ 460 $ 361

U. S. Government agency notes 722 -

Corporate and bank notes 649 906

U. S. Treasury notes 500 -

Asset backed securities 333 361

U. S. Government agency mortgages 130 442

Other 78 74

$ 2,872 $ 2,144

Short-term investments at December 31, 2001, by contractual maturity included (in millions):

Due in one year or less $ 1,950

Due between one year and three years 692

Due after three years 230

$ 2,872

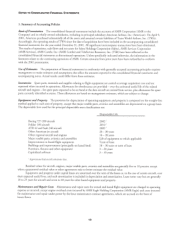

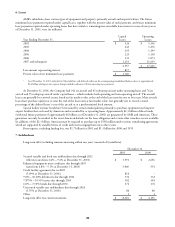

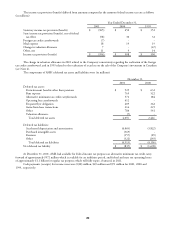

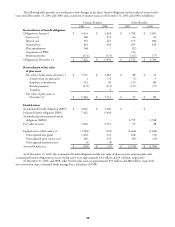

All short-term investments are classified as available-for-sale and stated at fair value. Unrealized gains and losses, net of

deferred taxes, are reflected as an adjustment to stockholders’ equity.

American has standby letter of credit agreements (see Note 6) which are secured by approximately $490 million of short-

term investments.

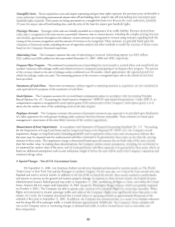

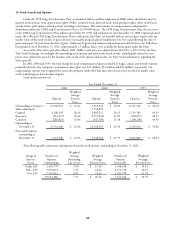

During 1999, the Company entered into an agreement with priceline.com Incorporated (priceline) whereby ticket

inventory provided by the Company may be sold through priceline’s e-commerce system. In conjunction with this agreement,

the Company received warrants to purchase approximately 5.5 million shares of priceline common stock. In the second quarter

of 2000, the Company sold these warrants for proceeds of approximately $94 million, and recorded a gain of $57 million which

is included in Miscellaneous – net on the accompanying consolidated statements of operations.

Also during 1999, the Company sold approximately 2.7 million depository certificates which were convertible, subject

to certain restrictions, into the common stock of Equant N.V. (Equant), a public company, for a net gain of approximately

$118 million, after taxes and minority interest. Of this amount, approximately $75 million is included in Miscellaneous – net and

approximately $71 million, net of taxes and minority interest, related to depository certificates held by the Company on behalf of

Sabre is included in income from discontinued operations on the accompanying consolidated statements of operations. During

2001, as a result of the merger between France Telecom and Equant, the Company converted its remaining depository certificates

into France Telecom common stock and subsequently sold those shares for a net gain of approximately $5 million which is

included in Miscellaneous – net on the accompanying consolidated statements of operations.

(11.48)