American Airlines 2001 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

was approximately $3.6 billion, and we expect it to be just

$1.8 billion in 2002.

Our capital controls have been complemented by our

myriad expense-reduction efforts, which include: trimming

in-flight amenities, closing most of our city ticket offices and

some lesser-used airport lounges and cutting back on advertis-

ing and promotions, information technology and corporate

overhead. We have also been able to negotiate some meaning-

ful cost reductions with many of our suppliers.

None of these initiatives were particularly pleasant,

but worst of all, in the face of staggering losses we took the

painful step of reducing our workforce by the equivalent of

20,000 jobs. Fortunately, through creative and collaborative

work on the part of our management team and union leaders,

we were able to mitigate at least some of the effect on our

people through initiatives like voluntary leaves, job sharing,

military leaves and reductions in overtime.

Controlling both capital spending and operating costs was,

and is, a critically important part of our efforts to rebuild our

Company. Moreover, our determination to prudently manage

our balance sheet in recent years paid off in a big way as we

sought a cash cushion to help weather the storm of late 2001.

For some time, AMR had a sizeable undrawn bank line,

which we drew down shortly after September 11. In the days

following, we were also able to complete a deal that provided

$1.9 billion in secured financing. And, during 2001, we

received $730 million from the government as part of the

Airline Stabilization Act passed in September. We expect to

receive another $130 million in 2002.

All that leaves us with a balance sheet which, relative to

the rest of the industry, remains strong. We ended 2001 with

about $3 billion in cash and a large stockpile of unencum-

bered aircraft assets we can draw upon, if necessary. Nonethe-

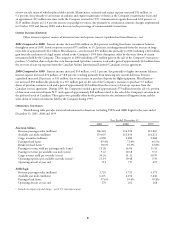

less, the losses we incurred for the year were staggering. The

net loss of about $1.8 billion in 2001, which includes a loss

of $800 million for the fourth quarter alone, dwarfed any

previous year’s loss.

2001 was a painful year for all three of our major con-

stituency groups. We lost many valued customers, friends and

colleagues on both September 11 and November 12. For

many others, the joy of flight has been dampened, at least

temporarily. Thousands of AMR employees lost their jobs,

and all of us were deeply troubled by the attacks on our coun-

try. Customers and employees alike have had to make some

dramatic adjustments to deal with the new security require-

ments of the post-9/11 world. And of course, our shareholders

have taken a tremendous hit, as AMR shares fell significantly

in the aftermath of the September attacks.

And yet, despite all the bad news, 2001 – which, among

other things, marked our Company’s 75th anniversary – did

contain a number of important highlights and milestones.

2