American Airlines 2001 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

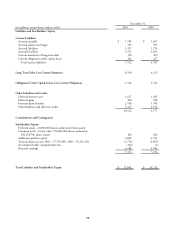

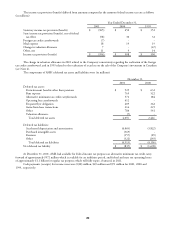

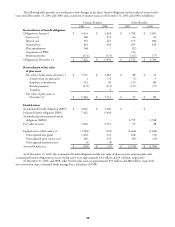

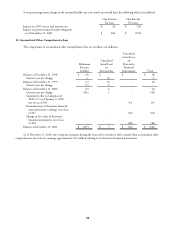

6. Leases

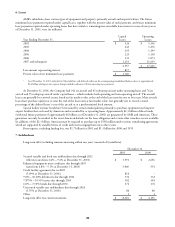

AMR’s subsidiaries lease various types of equipment and property, primarily aircraft and airport facilities. The future

minimum lease payments required under capital leases, together with the present value of such payments, and future minimum

lease payments required under operating leases that have initial or remaining non-cancelable lease terms in excess of one year as

of December 31, 2001, were (in millions):

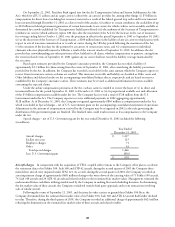

Year Ending December 31,

Capital

Leases

Operating

Leases

2002 $ 326 $ 1,336

2003 243 1,276

2004 295 1,199

2005 229 1,138

2006 231 1,073

2007 and subsequent 1,233 11,639

2,557 $ 17,661 1

Less amount representing interest 817

Present value of net minimum lease payments $ 1,740

1As of December 31, 2001, included in Other liabilities and deferred credits on the accompanying consolidated balance sheets is approximately

$1.6 billion relating to rent expense being recorded in advance of future operating lease payments.

At December 31, 2001, the Company had 342 jet aircraft and 41 turboprop aircraft under operating leases and 76 jet

aircraft and 55 turboprop aircraft under capital leases – which includes both operating and non-operating aircraft. The aircraft

leases can generally be renewed at rates based on fair market value at the end of the lease term for one to five years. Most aircraft

leases have purchase options at or near the end of the lease term at fair market value, but generally not to exceed a stated

percentage of the defined lessor’s cost of the aircraft or at a predetermined fixed amount.

Special facility revenue bonds have been issued by certain municipalities primarily to purchase equipment and improve

airport facilities that are leased by American and accounted for as operating leases. Approximately $2.3 billion of these bonds

(with total future payments of approximately $6 billion as of December 31, 2001) are guaranteed by AMR and American. These

guarantees can only be invoked in the event American defaults on the lease obligation and certain other remedies are not available.

In addition, of the $2.3 billion, American may be required to purchase up to $558 million under various remarketing agreements

which are supported by standby letters of credit with terms ranging from one to three years.

Rent expense, excluding landing fees, was $1.7 billion for 2001 and $1.3 billion for 2000 and 1999.

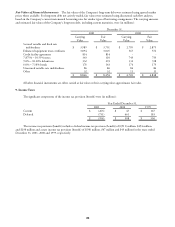

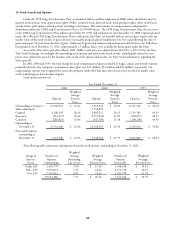

7. Indebtedness

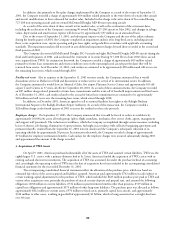

Long-term debt (excluding amounts maturing within one year) consisted of (in millions):

December 31,

2001 2000

Secured variable and fixed rate indebtedness due through 2021

(effective rates from 2.4% – 9.6% at December 31, 2001) $ 3,591 $ 2,656

Enhanced equipment trust certificates due through 2019

(rates from 6.8% – 9.1% at December 31, 2001) 3,006 553

Credit facility agreement due in 2005

(5.09% at December 31, 2001) 814 -

9.0% – 10.20% debentures due through 2021 332 332

7.875% – 10.55% notes due through 2039 302 345

6.0% – 7.10% bonds due through 2031 176 176

Unsecured variable rate indebtedness due through 2024

(3.55% at December 31, 2001) 86 86

Other 3 3

Long-term debt, less current maturities $ 8,310 $ 4,151