American Airlines 2001 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

On September 22, 2001, President Bush signed into law the Air Transportation Safety and System Stabilization Act (the

Act), which for all U.S. airlines and air cargo carriers (collectively, air carriers) provides for, among other things: (i) $5 billion in

compensation for direct losses (including lost revenues) incurred as a result of the federal ground stop order and for incremental

losses incurred through December 31, 2001 as a direct result of the attacks; (ii) subject to certain conditions, the availability of up

to $10 billion in federal government guarantees of certain loans made to air carriers for which credit is not reasonably available as

determined by a newly established Air Transportation Stabilization Board; (iii) the authority of the Secretary of Transportation to

reimburse air carriers (which authority expires 180 days after the enactment of the Act) for the increase in the cost of insurance,

for coverage ending before October 1, 2002, over the premium in effect for the period September 4, 2001 to September 10, 2001;

(iv) at the discretion of the Secretary of Transportation, a $100 million limit on the liability of any air carrier to third parties with

respect to acts of terrorism committed on or to such air carrier during the 180-day period following the enactment of the Act;

(v) the extension of the due date for the payment by air carriers of certain excise taxes; and (vi) compensation to individual

claimants who were physically injured or killed as a result of the terrorist attacks of September 11, 2001. In addition, the Act

provides that, notwithstanding any other provision of law, liability for all claims, whether compensatory or punitive, arising from

the terrorist-related events of September 11, 2001 against any air carrier shall not exceed the liability coverage maintained by

the air carrier.

Based upon estimates provided by the Company’s insurance providers, the Company has recorded a liability of

approximately $2.3 billion for claims arising from the events of September 11, 2001, after considering the liability protections

provided for by the Act. In addition, the Company has recorded a receivable for the same amount which the Company expects to

recover from its insurance carriers as claims are resolved. This insurance receivable and liability are classified as Other assets and

Other liabilities and deferred credits on the accompanying consolidated balance sheets, respectively, and are based on reserves

established by the Company’s insurance carriers. These estimates may be revised as additional information becomes available

concerning the expected claims.

Under the airline compensation provisions of the Act, each air carrier is entitled to receive the lesser of: (i) its direct and

incremental losses for the period September 11, 2001 to December 31, 2001 or (ii) its proportional available seat mile allocation

of the $5 billion compensation available under the Act. The Company has received a total of $728 million from the U.S.

Government under the Act. The Company expects to receive additional payments in 2002 aggregating approximately

$128 million. As of December 31, 2001, the Company recognized approximately $856 million as compensation under the Act,

which is included in Special charges – net of U.S. Government grant on the accompanying consolidated statements of operations.

Adjustments to the amount of compensation received by the Company may be recognized in 2002 as the rules governing the

distribution of the government grant are finalized. The finalized rules could result in more or less compensation to the Company

under the Act.

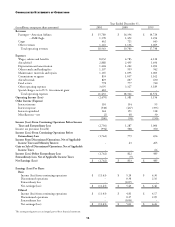

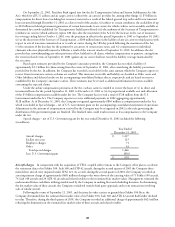

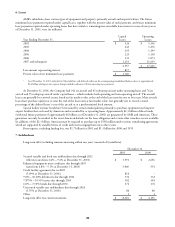

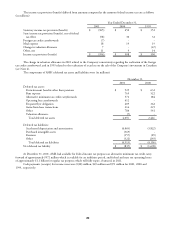

Special charges – net of U.S. Government grant for the year ended December 31, 2001 included the following

(in millions):

Year Ended

December 31, 2001

Aircraft charges $ 1,237

Facility exit costs 115

Employee charges 71

Other 43

Total special charges 1,466

Less: U.S. Government grant (856)

$ 610

Aircraft charges In conjunction with the acquisition of TWA, coupled with revisions to the Company’s fleet plan to accelerate

the retirement dates of its Fokker 100, Saab 340 and ATR 42 aircraft, during the second quarter of 2001 the Company deter-

mined these aircraft were impaired under SFAS 121. As a result, during the second quarter of 2001, the Company recorded an

asset impairment charge of approximately $685 million relating to the write-down of the carrying value of 71 Fokker 100 aircraft,

74 Saab 340 aircraft and 20 ATR 42 aircraft and related rotables to their estimated fair market values. Management estimated the

undiscounted future cash flows utilizing models used by the Company in making fleet and scheduling decisions. In determining

the fair market value of these aircraft, the Company considered outside third party appraisals and recent transactions involving

sales of similar aircraft.

Following the events of September 11, 2001, and decisions by other carriers to ground their Fokker 100 fleets, the

Company determined that the estimated fair market value of its Fokker 100, Saab 340 and ATR 42 aircraft had further declined

in value. Therefore, during the third quarter of 2001, the Company recorded an additional charge of approximately $423 million

reflecting the diminution in the estimated fair market value of these aircraft and related rotables.