American Airlines 2001 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.27

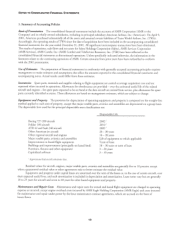

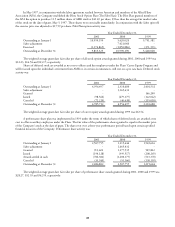

Fuel Price Risk Management American enters into jet fuel, heating oil and crude swap and option contracts to protect against

increases in jet fuel prices. These instruments generally have maturities of up to 36 months. In accordance with SFAS 133, the

Company accounts for its fuel swap and option contracts as cash flow hedges. Upon the adoption of SFAS 133, the Company

recorded the fair value of its fuel hedging contracts in Other assets and Accumulated other comprehensive loss on the consolidated

balance sheets. Effective gains or losses on fuel hedging agreements are deferred in Accumulated other comprehensive loss and are

recognized in earnings as a component of fuel expense when the underlying fuel being hedged is used. The ineffective portion of

the fuel hedge agreements is based on the change in the total value of the derivative relative to the change in the value of the fuel

being hedged and is recognized as a component of fuel expense on the accompanying consolidated statements of operations.

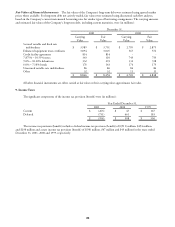

For the year ended December 31, 2001 and 2000, the Company recognized net gains of approximately $29 million and

$545 million, respectively, as a component of fuel expense on the accompanying consolidated statements of operations related

to its fuel hedging agreements. The net gains recognized in 2001 included approximately $72 million of ineffectiveness expense

relating to the Company’s fuel hedging agreements. At December 31, 2001, American had fuel hedging agreements with broker-

dealers on approximately 2.3 billion gallons of fuel products, which represented approximately 40 percent of its expected 2002

fuel needs, approximately 21 percent of its expected 2003 fuel needs, and approximately five percent of its expected 2004 fuel

needs. The fair value of the Company’s fuel hedging agreements at December 31, 2001 and 2000, representing the amount the

Company would receive to terminate the agreements, totaled $39 million and $223 million, respectively.

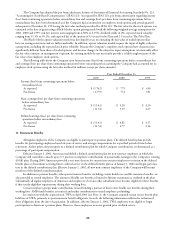

Interest Rate Risk Management American utilizes interest rate swap contracts to effectively convert a portion of its fixed-rate

obligations to floating-rate obligations. Under SFAS 133, the Company accounts for its interest rate swap contracts as fair value

hedges whereby the fair value of the related interest rate swap agreement is reflected in Other assets with the corresponding liabil-

ity being recorded as a component of Long-term debt on the consolidated balance sheets. The Company has no ineffectiveness

with regard to its interest rate swap contracts. The fair value of the Company’s interest rate swap agreements, representing the

amount the Company would receive if the agreements were terminated at December 31, 2001 and 2000, was approximately

$11 million and $4 million, respectively.

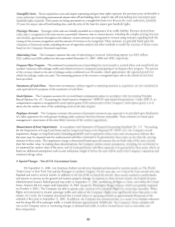

Foreign Exchange Risk Management To hedge against the risk of future exchange rate fluctuations on a portion of American’s

foreign cash flows, the Company enters into various currency put option agreements on a number of foreign currencies. These

instruments generally have maturities of up to 12 months. In accordance with SFAS 133, the Company accounts for its currency

put option agreements as cash flow hedges. Upon the adoption of SFAS 133, the Company recorded the fair value of its foreign

currency put option agreements in Other assets and Accumulated other comprehensive loss on the consolidated balance sheets.

Effective gains and losses on currency put option agreements are deferred in Accumulated other comprehensive loss and are

recognized in earnings as a component of passenger revenue when the underlying hedged revenues are recognized. The ineffective-

ness associated with the Company’s currency put option agreements was not material. For the year ended December 31, 2001,

the Company recognized net gains of approximately $14 million as a component of passenger revenue related to its foreign

currency put option agreements. The fair value of the Company’s foreign currency put option agreements totaled approximately

$12 million and $20 million as of December 31, 2001 and 2000, respectively, representing the amount the Company would

receive to terminate these agreements.

The Company has entered into Japanese yen currency exchange agreements to effectively convert certain yen-based lease

obligations into dollar-based obligations. Under SFAS 133, the Company accounts for its Japanese yen currency exchange agree-

ments as cash flow hedges whereby the fair value of the related Japanese yen currency exchange agreements is reflected in Other

liabilities and deferred credits and Accumulated other comprehensive loss on the consolidated balance sheets. The Company has

no ineffectiveness with regard to its Japanese yen currency exchange agreements. The fair value of the Company’s yen currency

exchange agreements, representing the amount the Company would pay to terminate the agreements, were $45 million and

$5 million as of December 31, 2001 and 2000, respectively. The exchange rates on the Japanese yen agreements range from

66.5 to 113.5 yen per U.S. dollar.