American Airlines 2001 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

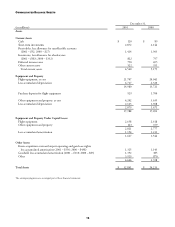

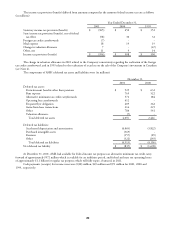

In addition, due primarily to fleet plan changes implemented by the Company as a result of the events of September 11,

2001, the Company recorded a charge of approximately $64 million related primarily to the write-down of certain other aircraft

and aircraft modifications to their estimated fair market value. Included in this charge is the write-down of five owned Boeing

727-200 non-operating aircraft and one owned McDonnell Douglas MD-80 non-operating aircraft.

As a result of the write-down of these aircraft to fair market value, as well as the acceleration of the retirement dates,

including the acceleration of the Company’s remaining 50 owned Boeing 727-200 aircraft to May 2002, and changes in salvage

values, depreciation and amortization expense will decrease by approximately $57 million on an annualized basis.

Due to the events of September 11, 2001, and subsequent impact on the Company and the rest of the airline industry,

during the fourth quarter of 2001, the Company completed an impairment analysis of its long-lived assets, including aircraft

fleets, route acquisition costs, airport operating and gate lease rights, and goodwill in accordance with applicable accounting

standards. The impairment analysis did not result in any additional impairment charges beyond those recorded in the second and

third quarters of 2001.

The Company also retired all McDonnell Douglas DC-9 aircraft and eight McDonnell Douglas MD-80 aircraft during the

third and fourth quarters of 2001, and accelerated the retirement of its entire Boeing 717-200 fleet to June 2002 (these aircraft

were acquired from TWA). In conjunction therewith, the Company recorded a charge of approximately $65 million related

primarily to future lease commitments and return condition costs on the operating leased aircraft past the dates they will be

removed from service. As of December 31, 2001, cash outlays are estimated to be approximately $58 million and will occur over

the remaining lease terms, which extend through 2010.

Facility exit costs Also in response to the September 11, 2001 terrorist attacks, the Company announced that it would

discontinue service at Dallas Love Field and discontinue or reduce service on several of its international routes. In addition,

the Company announced it would close six Admiral’s Clubs, five airport Platinum Service Centers and approximately 105 off-

airport Travel Centers in 37 cities, all effective September 28, 2001. As a result of these announcements, the Company recorded

an $87 million charge related primarily to future lease commitments and the write-off of leasehold improvements and fixed assets.

As of December 31, 2001, cash outlays related to the accrual of future lease commitments are estimated to be approximately

$20 million and will occur over the remaining lease terms, which extend through 2018.

In addition, in December 2001, American agreed to sell its terminal facilities lease rights at the Raleigh-Durham

International Airport to the Raleigh-Durham Airport Authority. As a result of this transaction, the Company recorded a

$28 million charge in the fourth quarter of 2001 to accrue the residual cost less sales proceeds.

Employee charges On September 19, 2001, the Company announced that it would be forced to reduce its workforce by

approximately 20,000 jobs across all work groups (pilots, flight attendants, mechanics, fleet service clerks, agents, management

and support staff personnel). The reduction in workforce, which the Company accomplished through various measures, including

leaves of absence, job sharing, elimination of open positions, furloughs in accordance with collective bargaining agreements and

permanent layoffs, resulted from the September 11, 2001 terrorist attacks and the Company’s subsequent reduction of its

operating schedule by approximately 20 percent. In connection therewith, the Company recorded a charge of approximately

$71 million for employee termination benefits. Cash outlays for the employee charges were incurred substantially during 2001

and approximated the amount of the charge recorded.

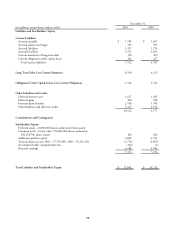

3. Acquisition of TWA Assets

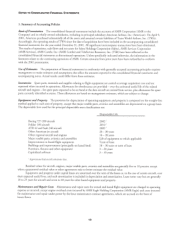

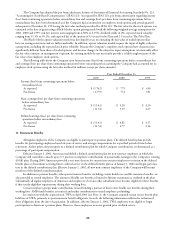

On April 9, 2001, American purchased substantially all of the assets of TWA and assumed certain liabilities. TWA was the

eighth largest U.S. carrier, with a primary domestic hub in St. Louis. American funded the acquisition of TWA’s assets with its

existing cash and short-term investments. The acquisition of TWA was accounted for under the purchase method of accounting

and, accordingly, the operating results of TWA since the date of acquisition have been included in the accompanying consolidated

financial statements for the year ended December 31, 2001.

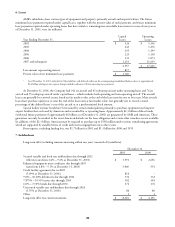

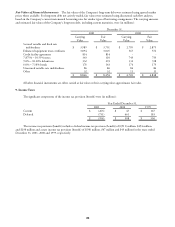

The accompanying consolidated financial statements reflect the allocation of the purchase price, which was based on

estimated fair values of the assets acquired and liabilities assumed. American paid approximately $742 million in cash (subject to

certain working capital adjustments) for the purchase of TWA, which included the $625 million purchase price paid to TWA and

various other acquisition costs, primarily the purchase of aircraft security deposits and prepaid rent, and assumed the following

obligations: $638 million in current liabilities, $734 million in postretirement benefits other than pensions, $519 million in

capital lease obligations and approximately $175 million of other long-term liabilities. The purchase price was allocated as follows:

approximately $812 million to current assets, $574 million to fixed assets, primarily capital lease aircraft, and approximately

$320 million to other assets, resulting in goodwill of approximately $1 billion, which is being amortized on a straight-line basis

over 40 years.