American Airlines 2001 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

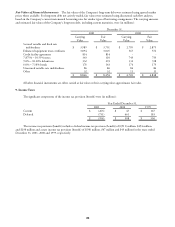

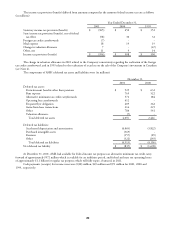

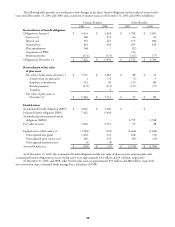

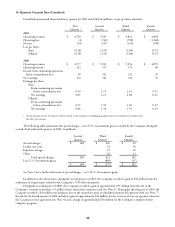

The income tax provision (benefit) differed from amounts computed at the statutory federal income tax rate as follows

(in millions):

Year Ended December 31,

2001 2000 1999

Statutory income tax provision (benefit) $ (965) $ 450 $ 352

State income tax provision (benefit), net of federal

tax effect (58) 30 32

Foreign tax credit carryforwards (7) - -

Meal expense 18 19 19

Change in valuation allowance 7 - (67)

Other, net 11 9 14

Income tax provision (benefit) $ (994) $ 508 $ 350

The change in valuation allowance in 2001 related to the Company’s uncertainty regarding the realization of the foreign

tax credit carryforward, and in 1999 related to the realization of a tax loss on the sale of the Company’s investment in Canadian

(see Note 4).

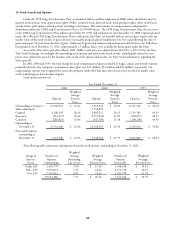

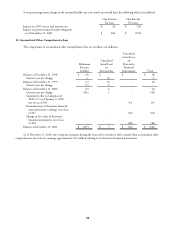

The components of AMR’s deferred tax assets and liabilities were (in millions):

December 31,

2001 2000

Deferred tax assets:

Postretirement benefits other than pensions $ 925 $ 632

Rent expense 765 522

Alternative minimum tax credit carryforwards 572 184

Operating loss carryforwards 412 -

Frequent flyer obligation 409 362

Gains from lease transactions 216 225

Other 784 541

Valuation allowance (7) -

Total deferred tax assets 4,076 2,466

Deferred tax liabilities:

Accelerated depreciation and amortization (4,065) (3,822)

Purchased intangible assets (369) -

Pensions (157) (89)

Other (322) (245)

Total deferred tax liabilities (4,913) (4,156)

Net deferred tax liability $ (837) $ (1,690)

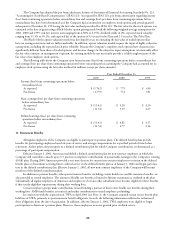

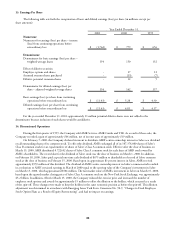

At December 31, 2001, AMR had available for federal income tax purposes an alternative minimum tax credit carry-

forward of approximately $572 million which is available for an indefinite period, and federal and state net operating losses

of approximately $1.1 billion for regular tax purposes which will fully expire, if unused, in 2021.

Cash payments (receipts) for income taxes were $(28) million, $49 million and $71 million for 2001, 2000 and

1999, respectively.