American Airlines 2001 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.12

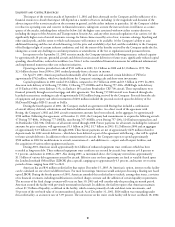

OUTLOOK

Due in part to the lack of predictability of future traffic, business mix and yields, the Company continues to have difficulty

in estimating the impact of the events of September 11, 2001. However, given the magnitude of these unprecedented events, the

Company expects that the adverse impact to the Company – and to the airline industry as a whole – will continue to be signifi-

cant in 2002. Because of the high degree of uncertainty, the Company is not currently able to provide an estimate for the full year

2002. However, the Company does expect to incur a sizable loss in the first quarter, and will likely incur a loss for 2002.

Capacity for American – which reflects TWA in the first quarter of 2002 but not in the first quarter of 2001 – is expected

to increase two to three percent in the first quarter of 2002 compared to last year’s first quarter levels. American Eagle’s capacity

will be down slightly. Capacity for the remainder of 2002 is less clear and depends on a number of factors, including, but not

limited to, how quickly demand returns and what levels of capacity the Company’s competitors deploy. Traffic continues to

remain challenging to predict. However, for the first quarter of 2002, the Company expects traffic to be up about three percent

from last year’s first quarter levels. In response to the September 11 terrorist attacks, the Company put in place numerous cost

reduction initiatives, including, but not limited to: cutting capacity, grounding aircraft and deferring certain aircraft deliveries to

future years, sharply reducing capital spending, closing facilities, trimming food service and reducing its workforce. In addition,

the Company expects to see lower fuel prices in the first quarter of 2002 compared to 2001. Somewhat offsetting these cost

savings, however, will be higher wages, salaries and benefit costs, higher security costs and insurance premiums, and greater

interest expense. American’s unit costs for the first quarter of 2002 are expected to be three to five percent higher than last year’s

first quarter.

FORWARD-LOOKING INFORMATION

The preceding Letter to Shareholders, Customers and Employees and Management’s Discussion and Analysis

contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended, which represent the Company’s expectations or beliefs

concerning future events. When used in this document and in documents incorporated herein by reference, the words “expects,”

“plans,” “anticipates,” “believes,” and similar expressions are intended to identify forward-looking statements. Forward-looking

statements include, without limitation, the Company’s expectations concerning operations and financial conditions, including

changes in capacity, revenues and costs, expectations as to future financing needs, overall economic conditions and plans and

objectives for future operations, the ability to continue to successfully integrate with its operations the assets acquired from TWA

and the former TWA workforce, and the impact of the events of September 11, 2001 on the Company and the sufficiency of the

Company’s financial resources to absorb that impact. Other forward-looking statements include statements which do not relate

solely to historical facts, such as, without limitation, statements which discuss the possible future effects of current known trends

or uncertainties, or which indicate that the future effects of known trends or uncertainties cannot be predicted, guaranteed or

assured. All forward-looking statements in this report are based upon information available to the Company on the date of this

report. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise. Forward-looking statements are subject to a number of factors that could cause

actual results to differ materially from our expectations. The following factors, in addition to other possible factors not listed,

could cause the Company’s actual results to differ materially from those expressed in forward-looking statements: uncertainty

of future collective bargaining agreements and events; economic and other conditions; fuel prices/supply; competition in the

airline industry; changing business strategy; government regulation; uncertainty in international operations; adverse impact of

the terrorist attacks; availability of future financing; and availability of the Act. Additional information concerning these and other

factors is contained in the Company’s Securities and Exchange Commission filings, including but not limited to Form 10-K for

2001, copies of which are available from the Company without charge.

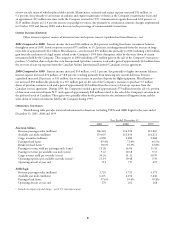

MARKET RISK SENSITIVE INSTRUMENTS AND POSITIONS

The risk inherent in the Company’s market risk sensitive instruments and positions is the potential loss arising from

adverse changes in the price of fuel, foreign currency exchange rates and interest rates as discussed below. The sensitivity analyses

presented do not consider the effects that such adverse changes may have on overall economic activity, nor do they consider

additional actions management may take to mitigate the Company’s exposure to such changes. Actual results may differ. See

Note 8 to the consolidated financial statements for accounting policies and additional information.