American Airlines 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

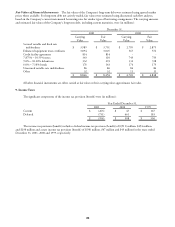

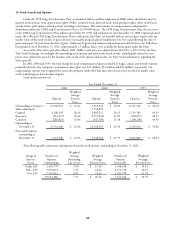

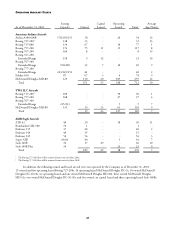

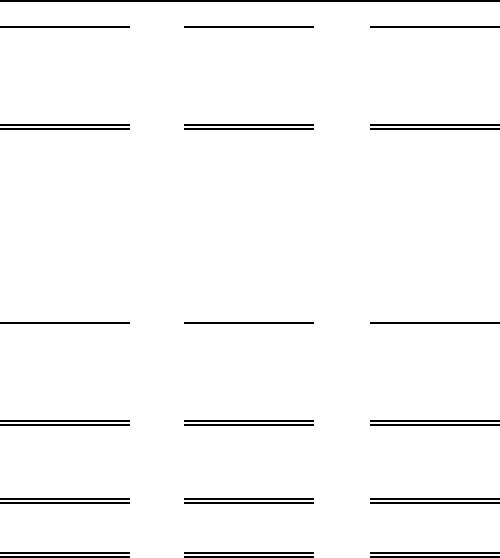

13. Earnings Per Share

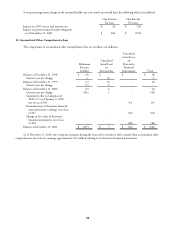

The following table sets forth the computation of basic and diluted earnings (loss) per share (in millions, except per

share amounts):

Year Ended December 31,

2001 2000 1999

Numerator:

Numerator for earnings (loss) per share – income

(loss) from continuing operations before

extraordinary loss $ (1,762) $ 779 $ 656

Denominator:

Denominator for basic earnings (loss) per share –

weighted-average shares 154 150 152

Effect of dilutive securities:

Employee options and shares - 27 12

Assumed treasury shares purchased - (15) (7)

Dilutive potential common shares - 12 5

Denominator for diluted earnings (loss) per

share – adjusted weighted-average shares 154 162 157

Basic earnings (loss) per share from continuing

operations before extraordinary loss $ (11.43) $ 5.20 $ 4.30

Diluted earnings (loss) per share from continuing

operations before extraordinary loss $ (11.43) $ 4.81 $ 4.17

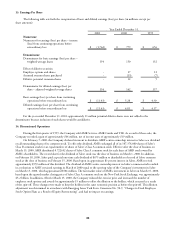

For the year ended December 31, 2001, approximately 11 million potential dilutive shares were not added to the

denominator because inclusion of such shares would be antidilutive.

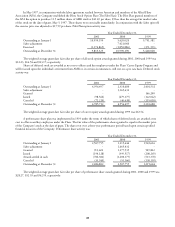

14. Discontinued Operations

During the first quarter of 1999, the Company sold AMR Services, AMR Combs and TSR. As a result of these sales, the

Company recorded a gain of approximately $64 million, net of income taxes of approximately $19 million.

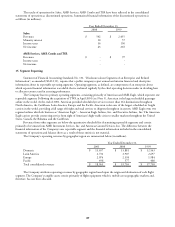

On February 7, 2000, the Company declared its intent to distribute AMR’s entire ownership interest in Sabre as a dividend

on all outstanding shares of its common stock. To effect the dividend, AMR exchanged all of its 107,374,000 shares of Sabre’s

Class B common stock for an equal number of shares of Sabre’s Class A common stock. Effective after the close of business on

March 15, 2000, AMR distributed 0.722652 shares of Sabre Class A common stock for each share of AMR stock owned by

AMR’s shareholders. The record date for the dividend of Sabre stock was the close of business on March 1, 2000. In addition,

on February 18, 2000, Sabre paid a special one-time cash dividend of $675 million to shareholders of record of Sabre common

stock at the close of business on February 15, 2000. Based upon its approximate 83 percent interest in Sabre, AMR received

approximately $559 million of this dividend. The dividend of AMR’s entire ownership interest in Sabre’s common stock resulted

in a reduction to AMR’s retained earnings in March of 2000 equal to the carrying value of the Company’s investment in Sabre

on March 15, 2000, which approximated $581 million. The fair market value of AMR’s investment in Sabre on March 15, 2000,

based upon the quoted market closing price of Sabre Class A common stock on the New York Stock Exchange, was approximately

$5.2 billion. In addition, effective March 15, 2000, the Company reduced the exercise price and increased the number of

employee stock options and awards by approximately 19 million to offset the dilution to the holders, which occurred as a result

of the spin-off. These changes were made to keep the holders in the same economic position as before the spin-off. This dilution

adjustment was determined in accordance with Emerging Issues Task Force Consensus No. 90-9, “Changes to Fixed Employee

Stock Option Plans as a Result of Equity Restructuring”, and had no impact on earnings.