American Airlines 2001 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.9

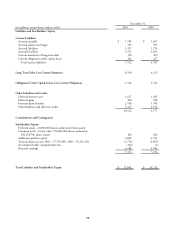

LIQUIDITY AND CAPITAL RESOURCES

The impact of the terrorist attacks of September 11, 2001 and their aftermath on the Company and the sufficiency of its

financial resources to absorb that impact will depend on a number of factors, including: (i) the magnitude and duration of the

adverse impact of the terrorist attacks on the economy in general, and the airline industry in particular; (ii) the Company’s ability

to reduce its operating costs and conserve its financial resources, taking into account the increased costs it will incur as a conse-

quence of the attacks, including those referred to below; (iii) the higher costs associated with new airline security directives,

including the impact of the Aviation and Transportation Security Act, and any other increased regulation of air carriers; (iv) the

significantly higher costs of aircraft insurance coverage for future claims caused by acts of war, terrorism, sabotage, hijacking and

other similar perils, and the extent to which such insurance will continue to be available; (v) the Company’s ability to raise

additional financing and the cost of such financing; (vi) the price and availability of jet fuel, and the availability to the Company

of fuel hedges in light of current industry conditions; and (vii) the extent of the benefits received by the Company under the Act,

taking into account any challenges to and interpretations or amendments of the Act or regulations issued pursuant thereto.

In response to the September 11, 2001 terrorist attacks, the Company initiated the following measures: reduced capacity

by approximately 20 percent, grounded aircraft and deferred certain aircraft deliveries to future years, significantly reduced capital

spending, closed facilities, reduced its workforce (see Note 2 to the consolidated financial statements for additional information)

and implemented numerous other cost reduction initiatives.

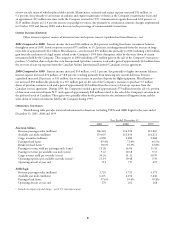

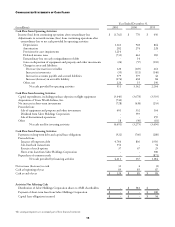

Operating activities provided net cash of $511 million in 2001, $3.1 billion in 2000 and $2.3 billion in 1999. The

$2.6 billion decrease from 2000 to 2001 resulted primarily from a decrease in income.

On April 9, 2001, American purchased substantially all of the assets and assumed certain liabilities of TWA for

approximately $742 million, which was funded from the Company’s existing cash and short-term investments.

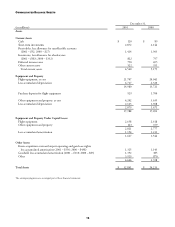

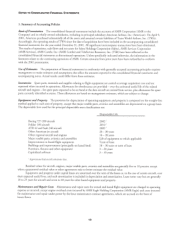

Capital expenditures in 2001 totaled $3.6 billion, compared to $3.7 billion in 2000 and $3.5 billion in 1999. In 2001,

American took delivery of 26 Boeing 737-800s, 13 Boeing 777-200ERs and 16 Boeing 757-200s. AMR Eagle took delivery

of 15 Embraer 140s, seven Embraer 135s, six Embraer 145s and one Bombardier CRJ-700 aircraft. These expenditures were

financed primarily through secured mortgage and debt agreements. Ten Boeing 737-800 aircraft were financed through sale-

leaseback transactions, resulting in cash of approximately $352 million being received by the Company. Proceeds from the sale

of equipment and property and other investments of $401 million included the proceeds received upon the delivery of five

McDonnell Douglas MD-11 aircraft to FedEx.

During the fourth quarter of 2001, the Company reached an agreement with Boeing that included a combination

of aircraft delivery deferrals, substitutions and limited additional aircraft orders. As a direct result of the agreement with

Boeing, the Company’s 2002 and 2003 aircraft commitment amounts have been reduced, in the aggregate, by approximately

$700 million. Following this agreement, at December 31, 2001, the Company had commitments to acquire the following aircraft:

47 Boeing 737-800s, 14 Boeing 777-200ERs, nine Boeing 767-300ERs, seven Boeing 757-200s, 124 Embraer regional jets and

24 Bombardier CRJ-700s. Deliveries of all aircraft extend through 2008. Future payments for all aircraft, including the estimated

amounts for price escalation, will approximate $1.3 billion in 2002, $1.7 billion in 2003, $1.2 billion in 2004 and an aggregate

of approximately $1.9 billion in 2005 through 2008. These future payments are net of approximately $470 million related to

deposits made for 2002 aircraft deliveries – which have been deferred as part of the agreement with Boeing – that will be applied

to future aircraft deliveries. In addition to these commitments for aircraft, the Company expects to spend approximately

$500 million in 2002 for modifications to aircraft, renovations of – and additions to – airport and off-airport facilities, and

the acquisition of various other equipment and assets.

During 2001, American issued approximately $2.6 billion of enhanced equipment trust certificates which has been

recorded as long-term debt. These enhanced equipment trust certificates are secured by aircraft, bear interest at 6.8 percent to

9.1 percent, and mature in 2006 to 2019. Also during 2001, as mentioned above, the Company entered into approximately

$1.1 billion of various debt agreements secured by aircraft. Effective rates on these agreements are fixed or variable (based upon

the London Interbank Offered Rate [LIBOR] plus a spread), ranging up to approximately 4.5 percent, and mature over various

periods of time, ranging from 2007 to 2021.

American has an $834 million credit facility that expires December 15, 2005. At American’s option, interest on this facility

can be calculated on one of several different bases. For most borrowings, American would anticipate choosing a floating rate based

upon LIBOR. During the fourth quarter of 2001, American amended this credit facility to include, among other items, a revision

of its financial covenants, including modifications to its fixed charge covenant and the addition of certain liquidity requirements.

The next test of the fixed charge covenant will occur on June 30, 2003 and will consider only the preceding six-month period.

American secured the facility with previously unencumbered aircraft. In addition, the facility requires that American maintain

at least $1.5 billion of liquidity, as defined in the facility, which consists primarily of cash and short-term investments, and

50 percent of the net book value of its unencumbered aircraft. As of December 31, 2001, $814 million was outstanding under

this credit facility, at an interest rate of 5.09 percent. The interest rate on the entire credit facility will be reset on March 18, 2002.