American Airlines 2001 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

MANAGEMENT’S DISCUSSION AND ANALYSIS

AMR Corporation (AMR or the Company) was incorporated in October 1982. AMR’s principal subsidiary, American

Airlines, Inc., was founded in 1934. On April 9, 2001, American Airlines, Inc. purchased substantially all of the assets and

assumed certain liabilities of Trans World Airlines, Inc. (TWA). Accordingly, the operating results of TWA since the date of

acquisition have been included in the accompanying consolidated financial statements for the year ended December 31, 2001

(see Note 3 to the consolidated financial statements). American Airlines, Inc., including TWA (collectively, American), is the

largest scheduled passenger airline in the world. AMR’s operations fall almost entirely in the airline industry.

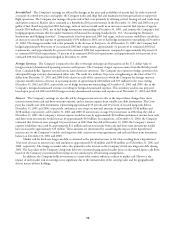

RESULTS OF OPERATIONS

AMR’s net loss in 2001 was $1.8 billion, or $11.43 loss per share. AMR’s net earnings in 2000 were $813 million, or

$5.43 per share ($5.03 diluted). On September 11, 2001, two American Airlines aircraft were hijacked and destroyed in terrorist

attacks on The World Trade Center in New York City and the Pentagon in northern Virginia. On the same day, two United Air

Lines aircraft were also hijacked and used in terrorist attacks. In response to the terrorist attacks, the Federal Aviation Adminis-

tration (FAA) issued a federal ground stop order on September 11, 2001, prohibiting all flights to, from and within the United

States. Airports did not reopen until September 13, 2001 (except for Washington Reagan Airport, which was partially reopened

on October 4, 2001). The Company was able to operate only a portion of its scheduled flights for several days thereafter. When

flights were permitted to resume, passenger traffic and yields on the Company’s flights were significantly lower than prior to the

attacks. As a result, the Company reduced its operating schedule to approximately 80 percent of the schedule it flew prior to

September 11, 2001. Somewhat offsetting the impact of the September 11 events, the Company recorded $856 million in

reimbursement from the U.S. Government under the Air Transportation Safety and System Stabilization Act (the Act) (see

Note 2 to the consolidated financial statements).

REVENUES

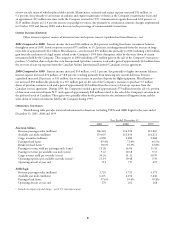

2001 Compared to 2000 The Company’s 2001 revenues, yield, revenue passenger miles (RPMs) and available seat miles

(ASMs) were severely impacted by the September 11, 2001 terrorist attacks, the Company’s reduced operating schedule, a

worsening of the U.S. economy that had already been dampening the demand for travel both domestically and internationally

prior to the September 11, 2001 events, business travel declines as a result of the September 11, 2001 attacks, and increased fare

sale activity occurring subsequent to the September 11 attacks to encourage passengers to resume flying. The Company’s revenues

decreased approximately $740 million, or 3.8 percent, versus 2000. However, excluding TWA’s revenues for the period April 10,

2001 through December 31, 2001, the Company’s revenues would have decreased approximately $2.6 billion versus 2000.

For comparability purposes, the following discussion does not combine American’s and TWA’s results of operations or

related statistics for 2001. American’s passenger revenues decreased by 14 percent, or $2.3 billion. In 2001, American derived

approximately 68 percent of its passenger revenues from domestic operations and approximately 32 percent from international

operations. American’s domestic revenue per available seat mile (RASM) decreased 11.3 percent, to 9.28 cents, on a capacity

decrease of 5 percent, or 104 billion ASMs. International RASM decreased to 9.07 cents, or 5.2 percent, on a capacity decrease

of 4.9 percent. The decrease in international RASM was led by an 11.8 percent and 10.8 percent decrease in Pacific and European

RASM, respectively, slightly offset by a 0.9 percent increase in Latin American RASM. The decrease in international capacity was

driven by a 6.5 percent and 4.7 percent reduction in Latin American and European ASMs, respectively, partially offset by an

increase in Pacific capacity of 2.8 percent.

TWA’s passenger revenues were approximately $1.7 billion for the period April 10, 2001 through December 31, 2001.

TWA’s RASM was 7.74 cents on capacity of 21.7 billion ASMs.

AMR Eagle’s passenger revenues decreased $74 million, or 5.1 percent. AMR Eagle’s traffic remained flat compared to

2000, at 3.7 billion RPMs, while capacity increased to 6.5 billion ASMs, or 3.4 percent. Similar to American, the decrease in

AMR Eagle’s revenues was due primarily to the September 11, 2001 terrorist attacks and a worsening of the U.S. economy that

had already been dampening the demand for air travel prior to that date.

Cargo revenues decreased 8.2 percent, or $59 million, for the same reasons as noted above.

2000 Compared to 1999 The Company’s revenues increased approximately $2.0 billion, or 11.1 percent, versus 1999.

American’s passenger revenues increased by 11.3 percent, or $1.7 billion. The increase in revenues was due primarily to a strong

U.S. economy, which led to strong demand for air travel both domestically and internationally, a favorable pricing climate, the

impact of a domestic fuel surcharge implemented in January 2000 and increased in September 2000, a labor disruption at one of

the Company’s competitors which positively impacted the Company’s revenues by approximately $80 to $100 million, and a

schedule disruption which negatively impacted the Company’s operations in 1999. In 2000, American derived approximately

70 percent of its passenger revenues from domestic operations and approximately 30 percent from international operations.