American Airlines 2001 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2001 American Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

In addition, American has available a $1 billion credit facility that expires September 30, 2002. Interest on this facility

is based upon LIBOR plus a spread. This facility is immediately available subject to the Company providing specified aircraft

collateral as security at the time of borrowing. At December 31, 2001, no borrowings were outstanding under this facility.

Following the September 11, 2001 events, Standard & Poor’s and Moody’s downgraded the credit ratings of AMR and

American, and the credit ratings of a number of other major airlines. The long-term corporate credit ratings of AMR and

American were initially retained on review for possible downgrade by Moody’s, and following subsequent downgrades, were given

a negative outlook. In addition, the long-term corporate credit ratings of AMR and American remain on Standard & Poor’s

CreditWatch with negative implications. Any additional reductions in AMR’s or American’s credit ratings could result in

increased borrowing costs to the Company and might limit the availability of future financing sources.

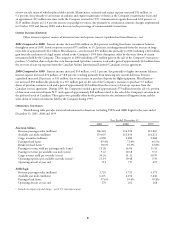

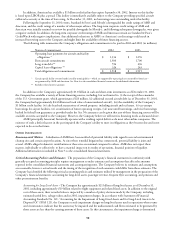

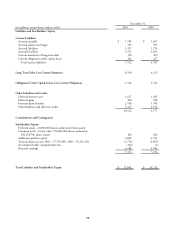

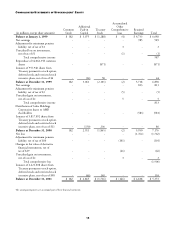

The following table summarizes the Company’s obligations and commitments to be paid in 2002 and 2003 (in millions):

Nature of commitment 2002 2003

Operating lease payments for aircraft and facility

obligations * $ 1,336 $ 1,276

Firm aircraft commitments 1,300 1,700

Long-term debt ** 556 296

Capital lease obligations ** 326 243

Total obligations and commitments $ 3,518 $ 3,515

* Certain special facility revenue bonds issued by municipalities – which are supported by operating leases executed by American –

are guaranteed by AMR and American. See Note 6 to the consolidated financial statements for additional information.

** Excludes related interest amounts

In addition to the Company’s approximately $3.0 billion in cash and short-term investments as of December 31, 2001,

the Company has available a variety of future financing sources, including, but not limited to: (i) the receipt of the remainder

of the U.S. Government grant, which approximates $128 million, (ii) additional secured aircraft debt (as of December 31, 2001,

the Company had approximately $4.4 billion net book value of unencumbered aircraft), (iii) the availability of the Company’s

$1 billion credit facility, (iv) sale-leaseback transactions of owned property, including aircraft and real estate, (v) tax-exempt

borrowings for airport facilities, (vi) securitization of future operating receipts, (vii) unsecured borrowings, and (viii) borrowings

backed by federal loan guarantees as provided under the Act. No assurance can be given that any of these financing sources will be

available on terms acceptable to the Company. However, the Company believes it will meet its financing needs as discussed above.

AMR (principally American) historically operates with a working capital deficit as do most other airline companies. The

existence of such a deficit has not in the past impaired the Company’s ability to meet its obligations as they become due and is not

expected to do so in the future.

OTHER INFORMATION

Environmental Matters Subsidiaries of AMR have been notified of potential liability with regard to several environmental

cleanup sites and certain airport locations. At sites where remedial litigation has commenced, potential liability is joint and

several. AMR’s alleged volumetric contributions at these sites are minimal compared to others. AMR does not expect these

matters, individually or collectively, to have a material impact on its results of operations, financial position or liquidity.

Additional information is included in Note 5 to the consolidated financial statements.

Critical Accounting Policies and Estimates The preparation of the Company’s financial statements in conformity with

generally accepted accounting principles requires management to make estimates and assumptions that affect the amounts

reported in the consolidated financial statements and accompanying notes. The Company believes its estimates and assumptions

are reasonable; however, actual results and the timing of the recognition of such amounts could differ from those estimates. The

Company has identified the following critical accounting policies and estimates utilized by management in the preparation of the

Company’s financial statements: accounting for long-lived assets, passenger revenue, frequent flyer accounting, and pensions and

other postretirement benefits.

Accounting for Long-Lived Assets – The Company has approximately $21 billion of long-lived assets as of December 31,

2001, including approximately $19 billion related to flight equipment and related fixed assets. In addition to the original

cost of these assets, their recorded value is impacted by a number of policy elections made by the Company, including

estimated useful lives, salvage values and in 2001, impairment charges. In accordance with Statement of Financial

Accounting Standards No. 121, “Accounting for the Impairment of Long-Lived Assets and for Long-Lived Assets to be

Disposed Of” (SFAS 121), the Company records impairment charges on long-lived assets used in operations when events

and circumstances indicate that the assets may be impaired and the undiscounted cash flows estimated to be generated by

those assets are less than the carrying amount of those assets. In this circumstance, the impairment charge is determined